Seattle Condo Market Report – May 2024

Seattle’s condo market in May exhibited fairly typical seasonal activity. Condo inventory rose, selling prices improved, though sales activity stumbled a little.

Another Month, Another Record

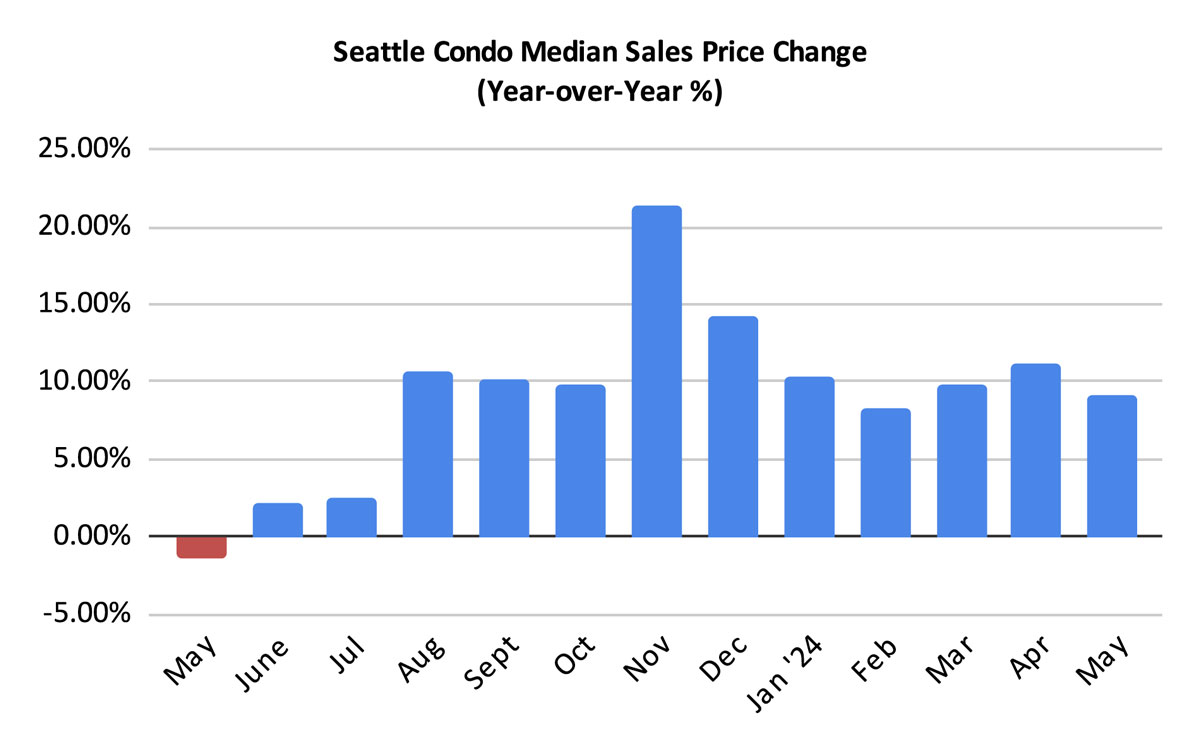

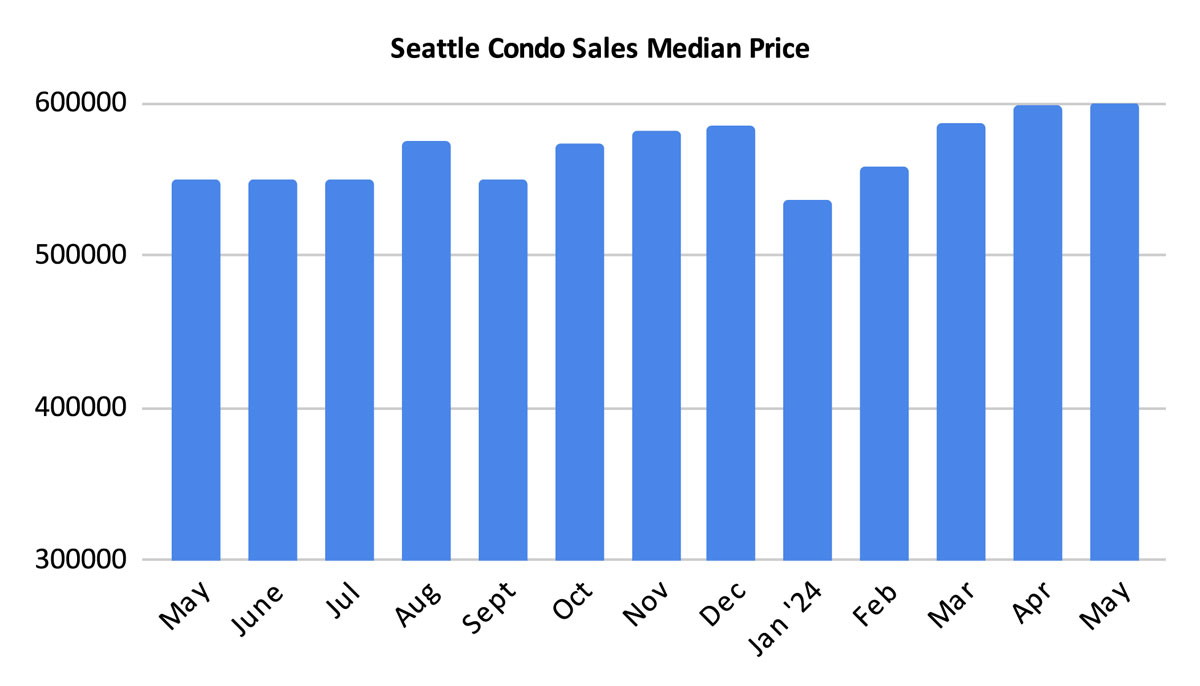

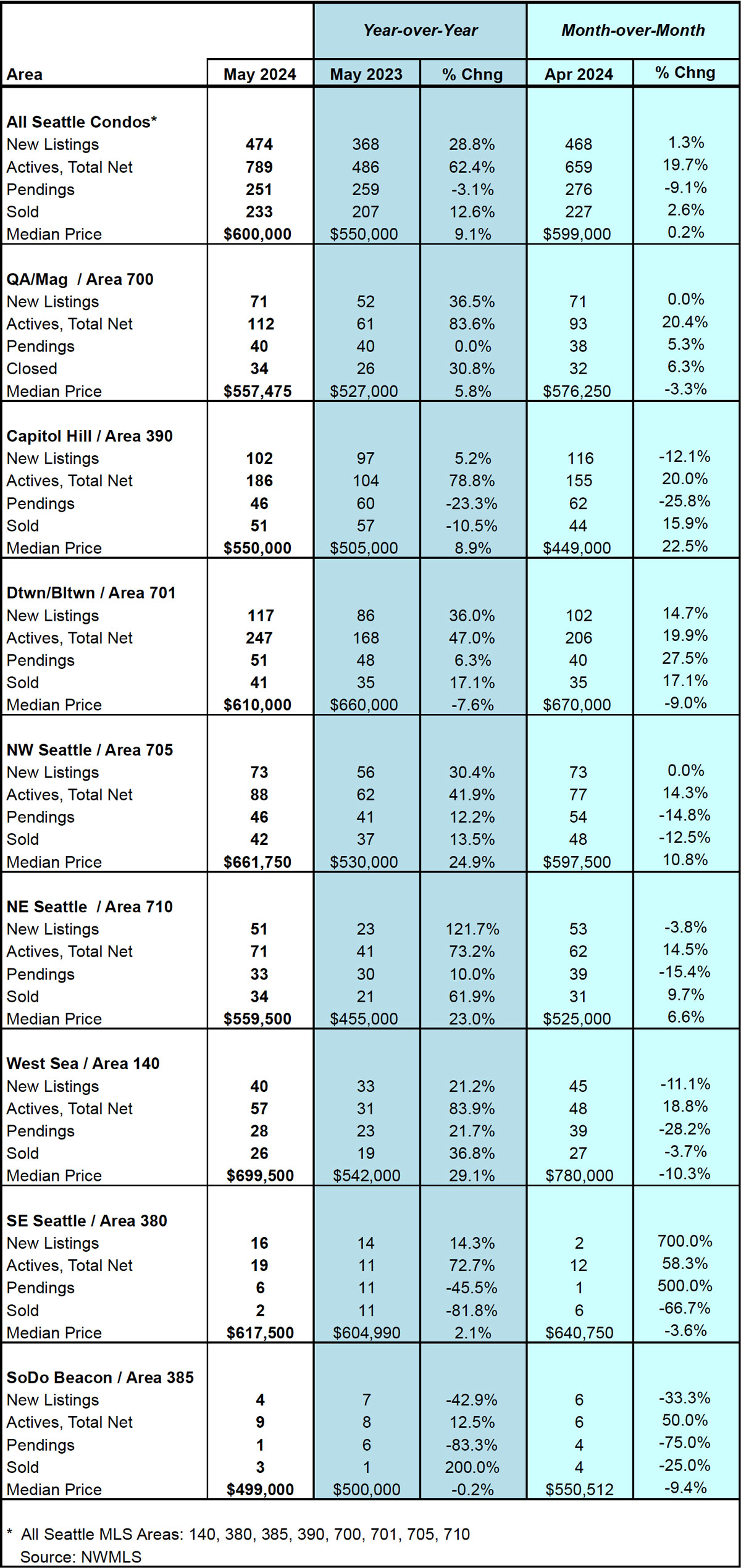

Overall, the Seattle citywide condo median sales price came in at $600,000 for May, a new all-time high. That reflected a year-over-year (YOY) increase of 9.1% and a one-month improvement of 0.2% over April.

By NWMLS neighborhood areas, all areas except Downtown/Belltown (-7.6%) and South Seattle (-0.2%) reflected a YOY increase in their median sales price. Northwest Seattle (24.9%), Northeast Seattle (23%) and West Seattle (29.1%) clocked in double-digit YOY increases. View complete neighborhood info here.

The published figures by the NWMLS includes all properties categorized under the “Condominium” classification. This includes a number of non-traditional condo properties such as condoized houses, attached accessory dwelling units (ADUs), detached accessory dwelling units (DADUs), townhomes and boat moorages.

These properties are typically larger, newer and more expensive. They accounted for 23.2% of all closed condo sales in May and they skewed the median sales price numbers.

In looking at just traditional condo properties (excluding non-traditional condos) the Seattle citywide condo median sales for May would have been $525,000 rather than $600,000. That’s quite a difference. That said, that was still good news for sellers. Comparing only traditional condos, that exhibited a YOY and one-month increase of 4.3% and 5%, respectively.

Condo Inventory On The Rise

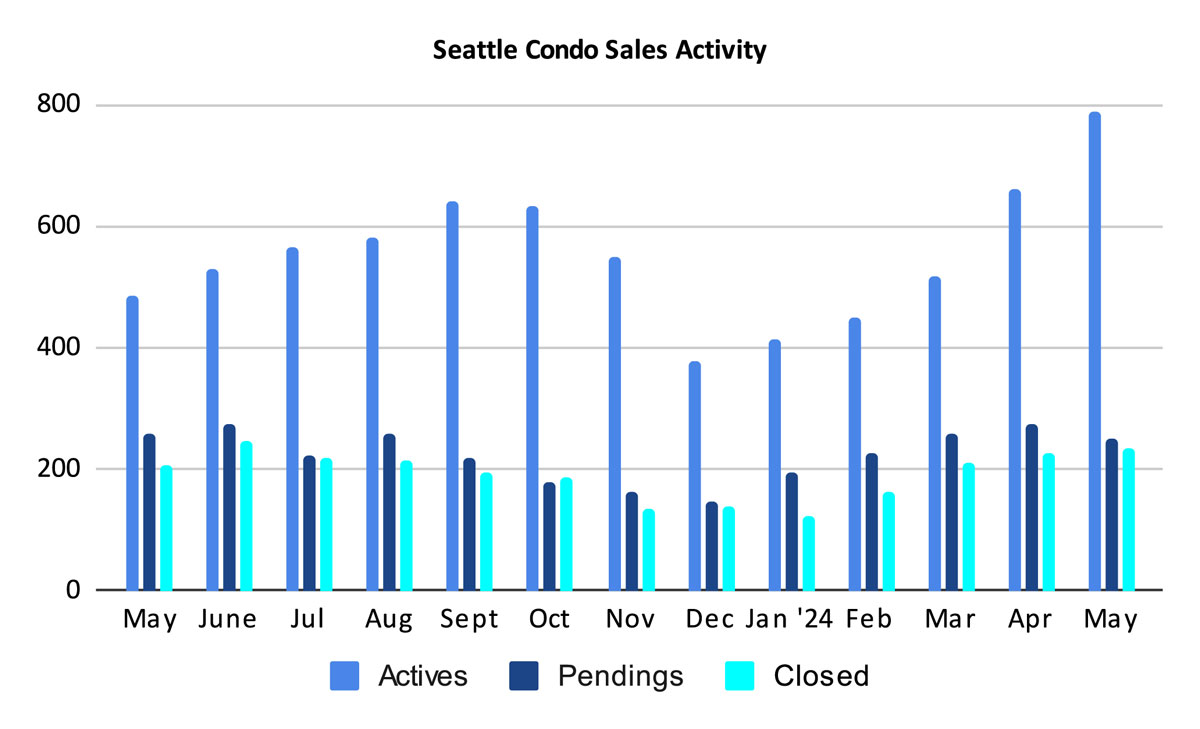

Seattle ended the month of May with 789 active condo listings for sale (traditional and non-traditional), a whopping 62.4% increase over the same period last year and 19.7% more than April. This was the highest number of listed properties since November 2020. However, we actually have more properties available when contemplating unlisted properties available for purchase in new construction developments. Developers usually only list a handful of properties at a time.

There had been 1,133 units listed for sale overall in the NWMLS in May. We started the month with 659 units and sellers added 474 new listings throughout the month for a total of 1,133. Of that number, 251 went into pending sales status and 93 came off the market for other reasons (e.g. expired, cancelled, rented, etc), leaving 789 at month end.

Of note, as of this writing, non-traditional condo properties comprise 14.2% of all active Seattle condos currently listed in the NWMLS.

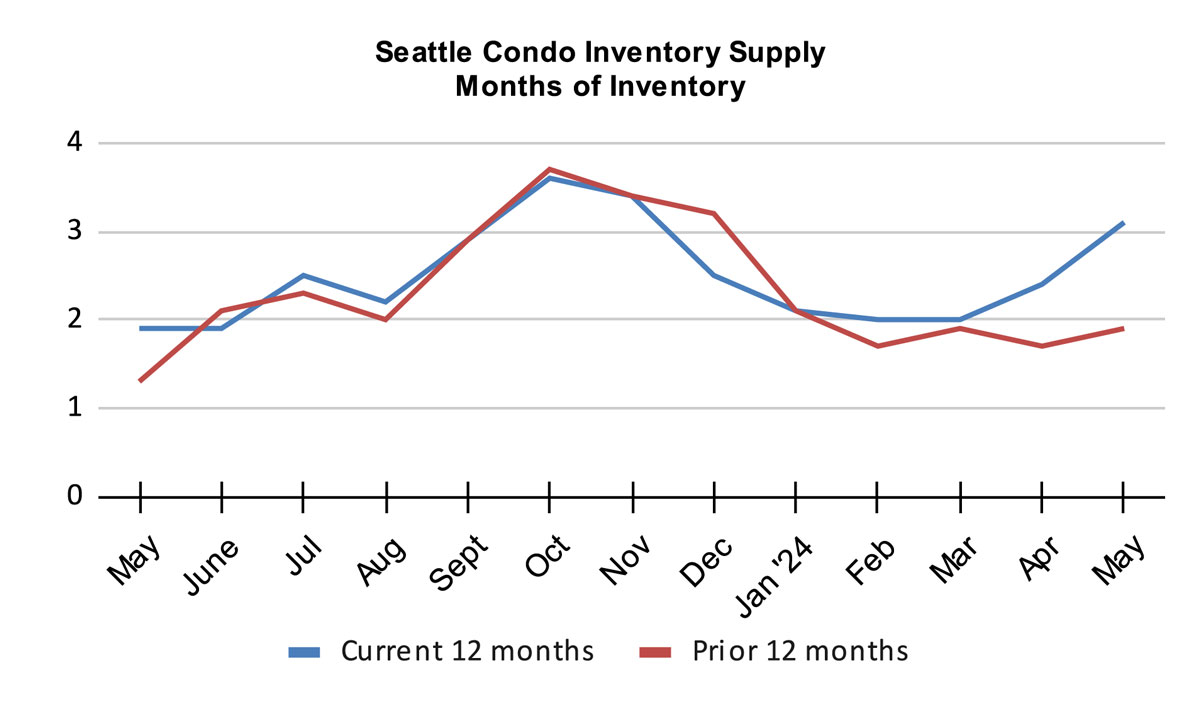

The Seattle condo inventory supply rate rose in May to 3.1-months of supply as a result of the increase in listings and a decrease in sales. This corresponds to a seasonal trend of rising inventory during the spring and summer months.

The supply rate identifies the current market environment. A rate of less than 4-months of supply is characterized as a seller’s market. A rate between 4 to 7-months is a balanced or normal market. And, a rate over 7-months is considered a buyer’s market.

Seattle’s condo inventory rate hasn’t been above 4-months of supply since January 2012. Essentially, Seattle has been in a seller’s market for the past 12 years. But, that’s citywide. Seattle real estate is local, down to the micro-neighborhood level. Buyers and sellers will encounter differing experiences in Seattle’s various neighborhoods and price points. For example, condo dense downtown had a 4.8-month supply rate in May, classifying it as a balanced market.

The market environment can also be expressed as an absorption rate percentage. In May, the Seattle condo market had an absorption rate of 31.8%. A rate over 20% is typically considered a seller’s market.

Condo Sales Stumble

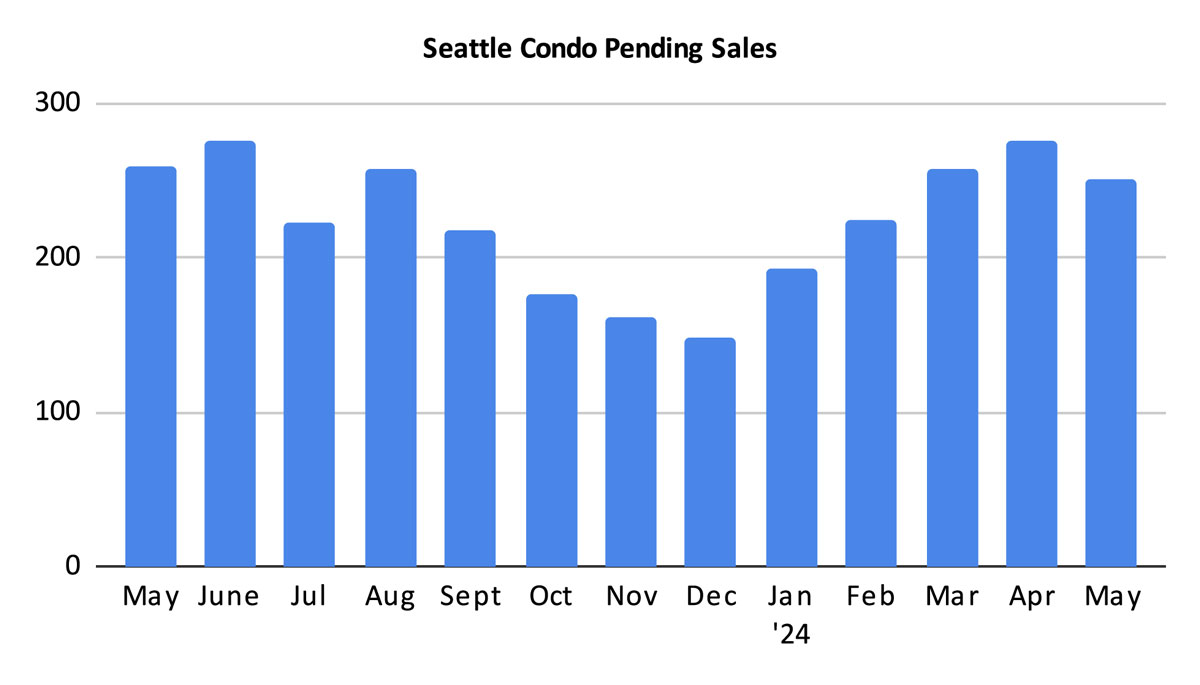

The number of pending sales transactions dipped in May to 251 units. That was 3.1% fewer than last May and 9.1% fewer than the previous month. Historically, sales start to plateau in the summer before trending downwards in autumn. We may be starting earlier this year and there has been a noticeable slow down in the marketplace as a whole.

Mortgage interest rates are still impacting affordability and sales velocity.

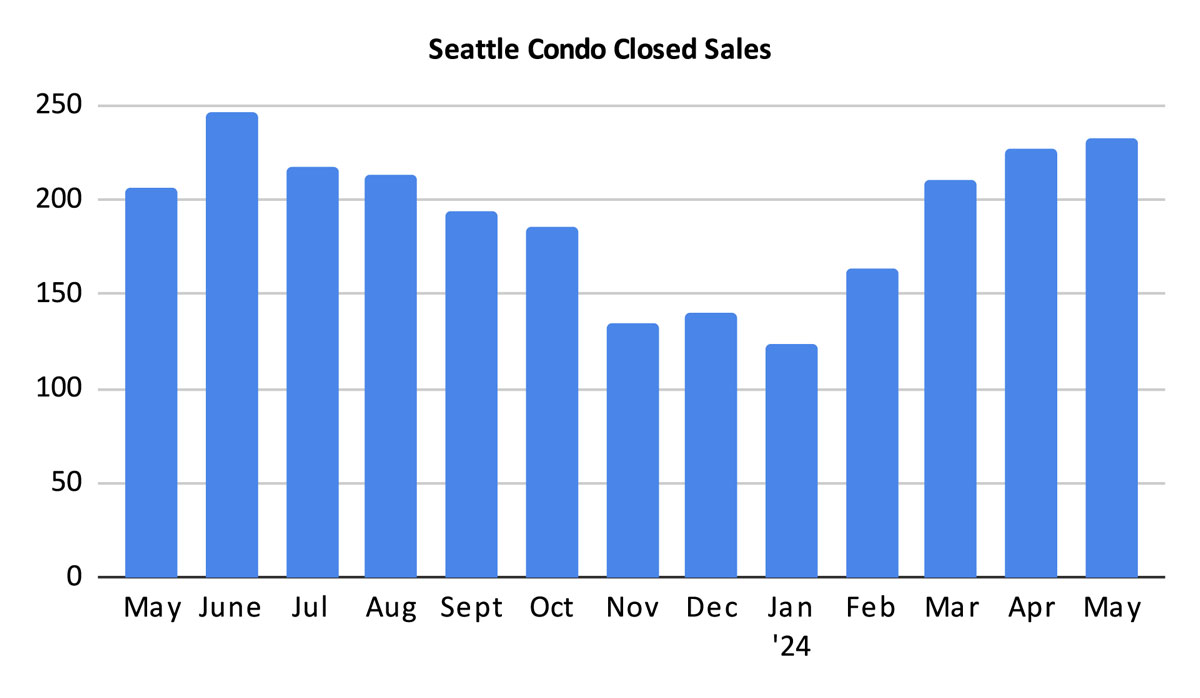

Closed Seattle condo transactions increased 12.6% YOY, and 2.6% over the prior month, to 233 units in May. That was expected given the high number of pendings in April (closings follow pendings by a month). The number of closing will drop in June due to fewer pendings in May.

In Summary

Overall, Seattle’s condo market was fairly typical for May. Sales prices and inventory rose, although sales activity did take a little tumble.

On the strength of non-traditional condo sales Seattle reached a new citywide median selling price record of $600,000. Non-traditional condos represented 23.2% of condo sales (nearly 1 in 4) and currently account for 14.2% of the condo properties on the market.

These are single dwelling units (houses), ADUs, DADUs and townhomes, which tend to be newer and more expensive than the typical condo unit. Thus, they have a significant impact on condo statistics.

With rising inventory sellers may find themselves in a saturated market. They may encounter stiffer competition, face longer market times and diminishing values the longer they are on the market. That said, with Seattle’s micro markets, sellers will encounter different experiences depending on price point and locale.

Buyers have the upper hand as inventory grows. They’ll have more choices and may gain a negotiating advantage, particularly with properties lagging on the market.

If you’re a buyer or a seller, let our experienced and savvy agents guide you through the market. Drop us a line and let’s get you started on your way.

Seattle Condo Market Statistics May 2024

Source: Northwest Multiple Listing Service. Some figures were independently compiled by Seattle Condos And Lofts and were not published by the NWMLS.

© SeattleCondosAndLofts.com