April 2024 Seattle Condo Market Review

Up. That’s one way to describe Seattle’s condo market last month. Sales, selling prices and inventory all rose year-over-year and month-over-month.

Selling Price Records Keep Breaking…Sort Of

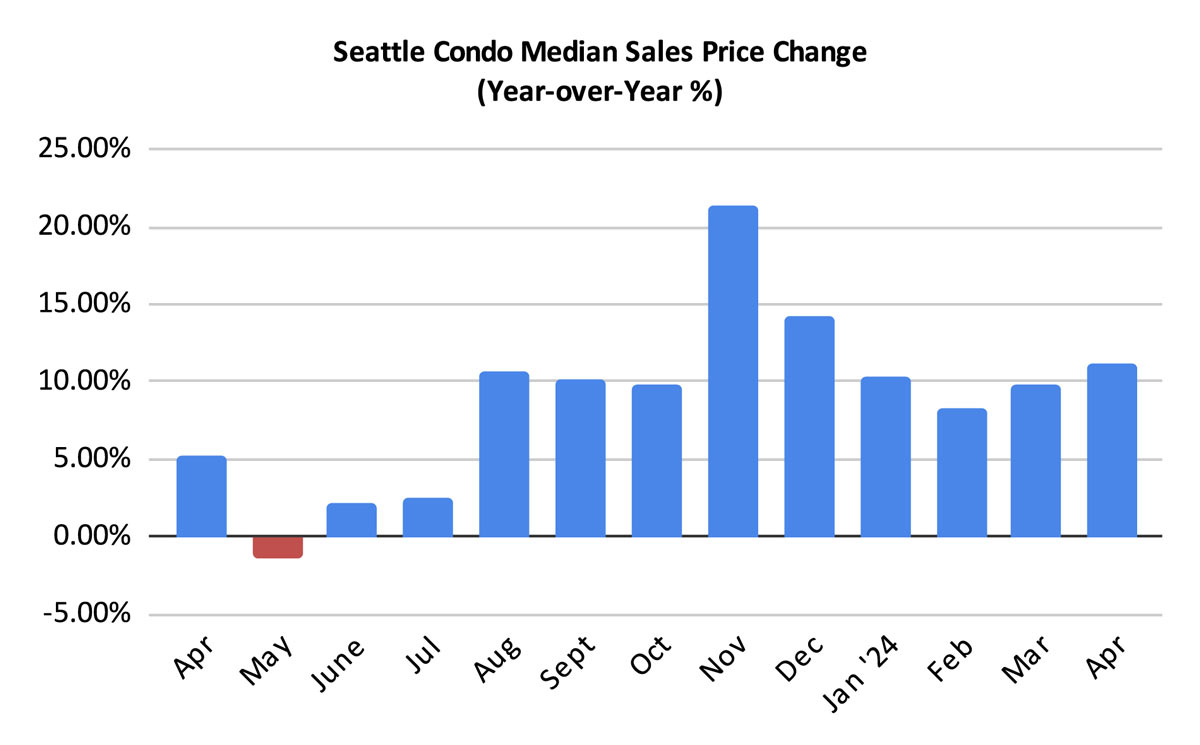

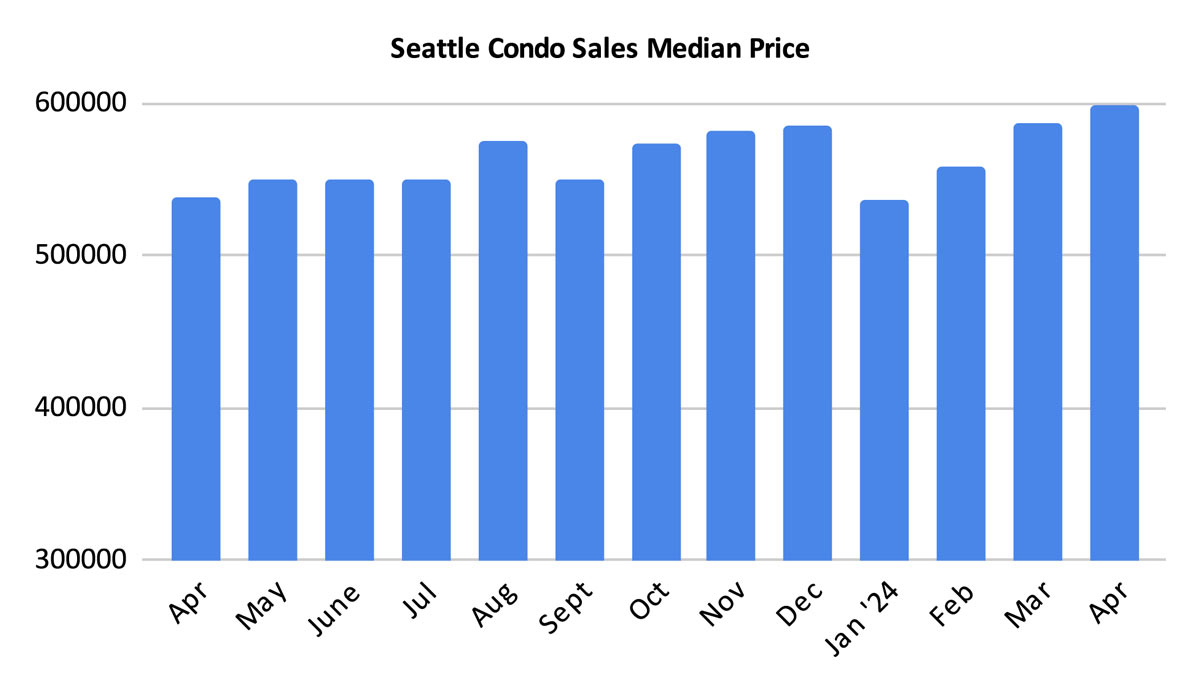

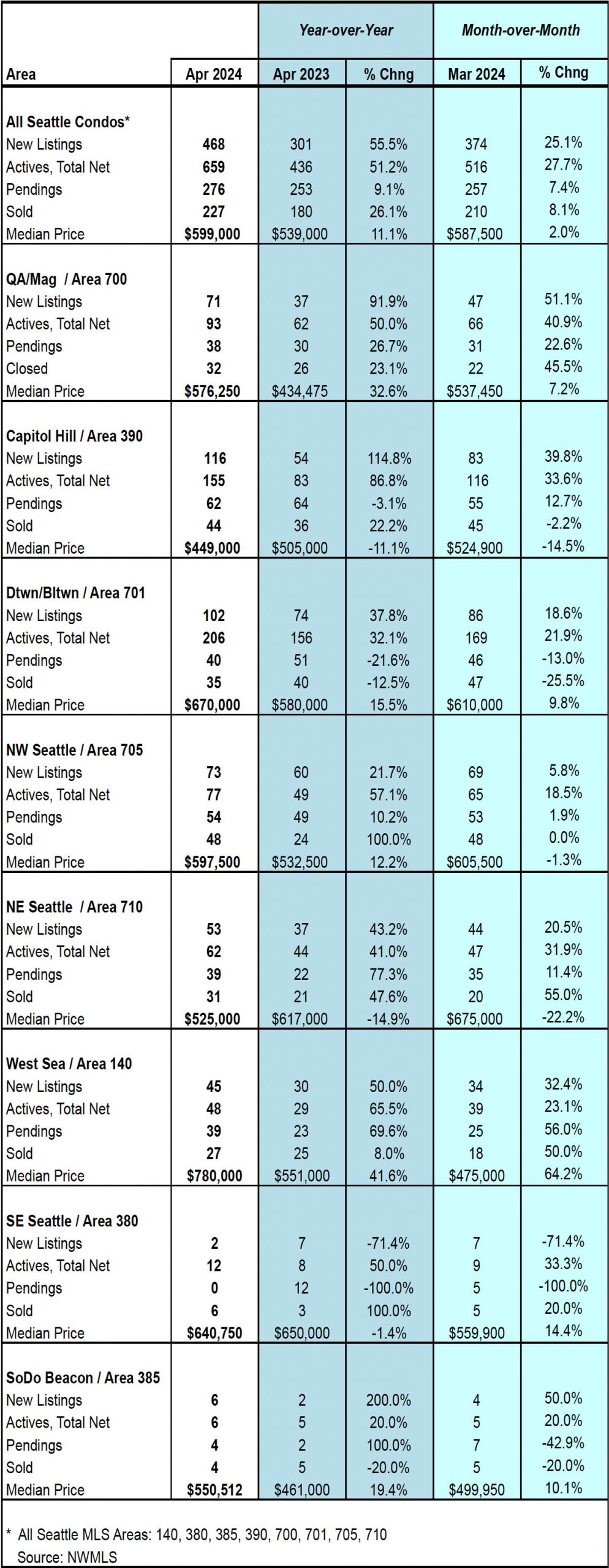

The Seattle condo market reached another milestone in April, and probably one many may wish we hadn’t. The citywide condo median sales price broke the record set just one month ago, coming in at $599,000. That represented a year-over-year (YOY) and a month-over-month (MOM) increase of 11% and 2%, respectively.

On the surface, it looks like condo prices are off the charts, and thus becoming more unaffordable for many buyers. Check out the table at the end of the post here for all the neighborhood results.

Of course, this comes with a major caveat – condominium classification. What exactly is a condo? For the Northwest MLS, it comes down to a legal terminology. Any property organized legally as a condominium is counted in the statistics as a condominium.

The challenge here is that developers are reclassifying individual structures like single family houses, detached accessory dwelling units (DADU), attached accessory dwelling units (ADU), as well as townhouses as condominiums. And, moorages have been classified as a condominium. These are not what usually come to mind when we think of condos. Typically, historically, condos are individual units in a large building or complex.

So, if you’re in the condo market (buyer or seller) be mindful that condo statistics are a bit skewed.

Condoized single family homes, DADUs, ADUs & townhomes are usually larger, newer and more expensive. In April, they accounted for 28% of the closed condo sales and had a significant impact on selling prices.

If we exclude these properties and focused on traditional condos, the Seattle citywide condo median sales priced would have been $500,000 instead of $599,000 last month. In fact, the median sales price for traditional condo units would have remained unchanged YOY and reflected a 6.5% decrease from the previous month.

Inventory Grows

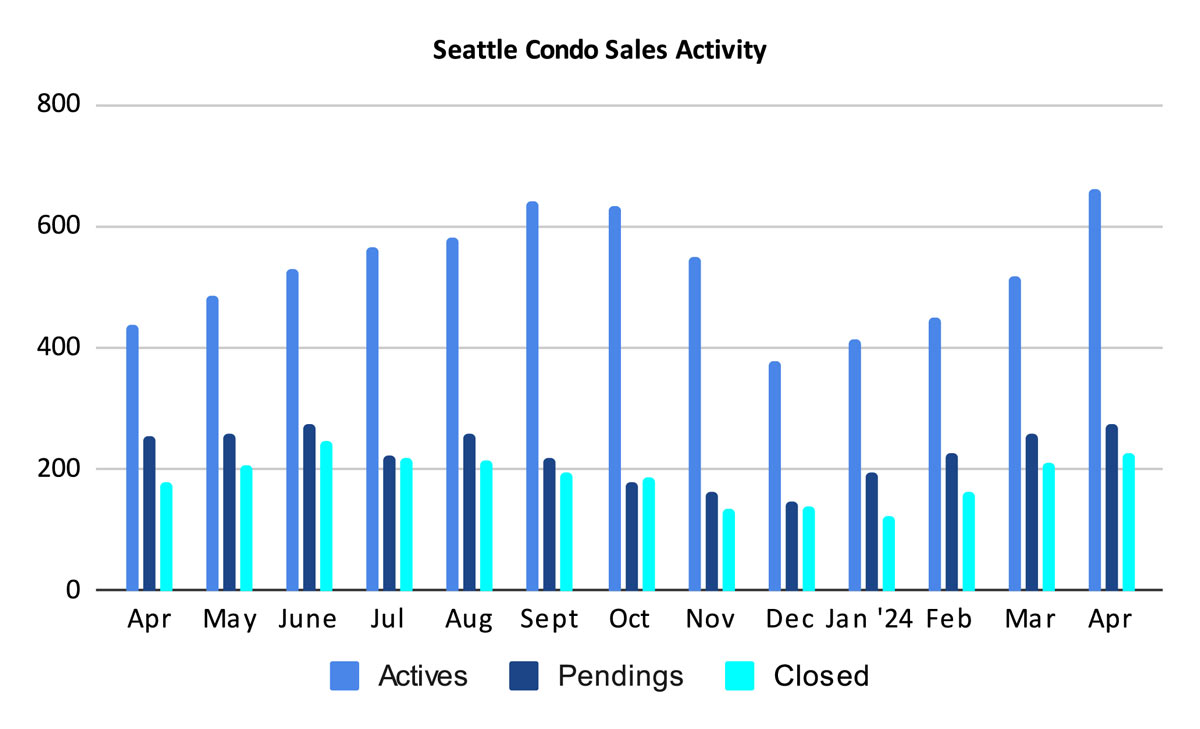

Seattle’s condo inventory grew considerably in April, ending the month with 659 active listings for sale. That was a whopping 51.2% increase over the same period last year and 27.7% more than the prior month.

We started the month with 516 active listings, then added 468 new listings throughout the month and ended at 659. Thus, 325 properties came off the market through pending sales, quick closings, cancellations, expirations or were rented.

April also marked the greatest number of condo units for sale since November 2020.

As of this writing (May 15th) non-traditional condos (e.g. houses, DADUs, ADUs, townhomes) make up approximately 13.5% of the NWMLS listed condos for sale. Though, there are actually more units available since developers only actively list a handful of units at any one time.

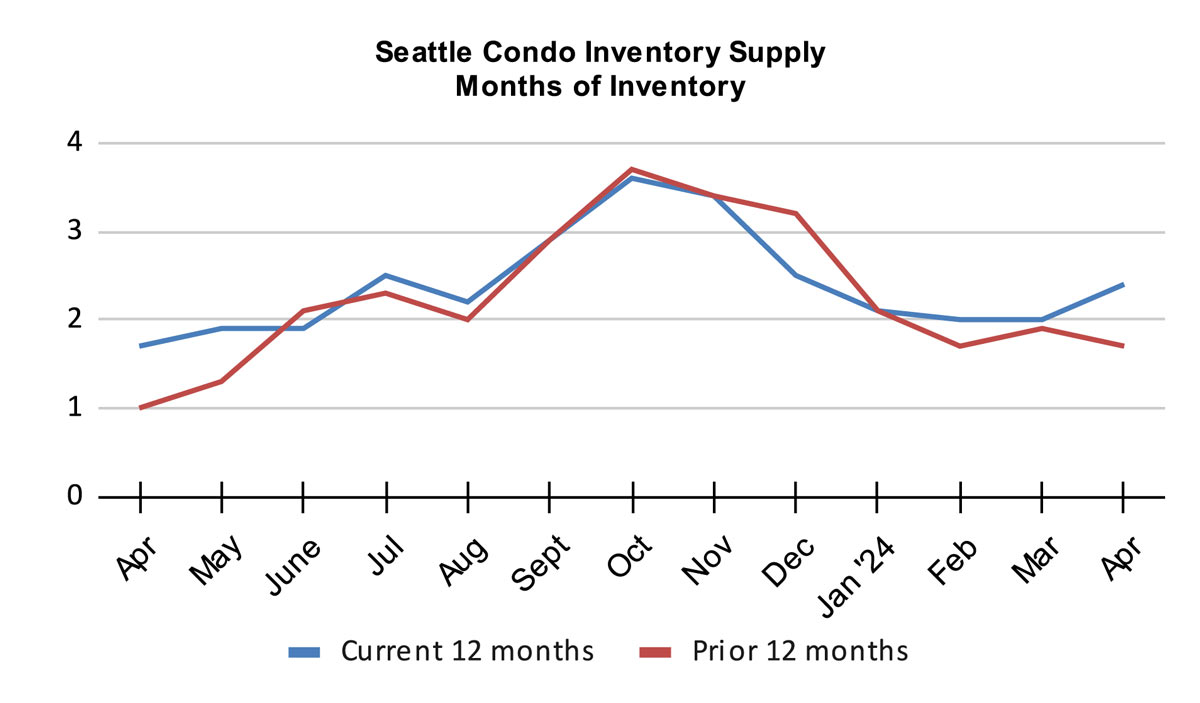

As a result of more listings on the market, the Seattle condo inventory supply rate rose to 2.4-months of supply last month. This is expected as the supply rate cyclically rises starting in late-spring, early summer.

The supply rate is a metric used to characterize the current market conditions. A rate of less than 4-months of supply is characterized as a seller’s market. A rate between 4 to 7-months is a balanced or normal market, while over 7-months is considered a buyer’s market.

Interestingly, Seattle’s condo inventory rate hasn’t been above 4-months since January 2012. Seattle has not experienced a balanced condo market in over 12 years. That’s citywide. Downtown, is an exception, having experienced buyer market conditions during that 12 year period.

Inventory supply can also be expressed as a percentage, known as the absorption rate. The Seattle condo market absorption rate in April was 41.8%.

Buyers Are Buying…Sort Of

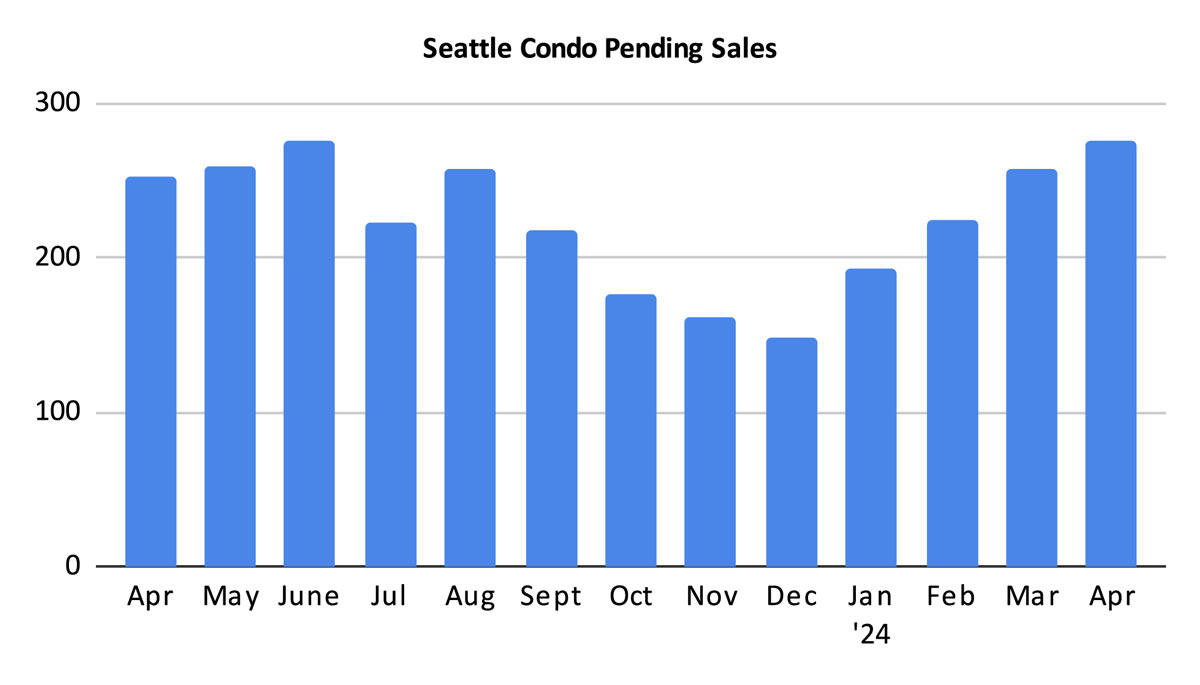

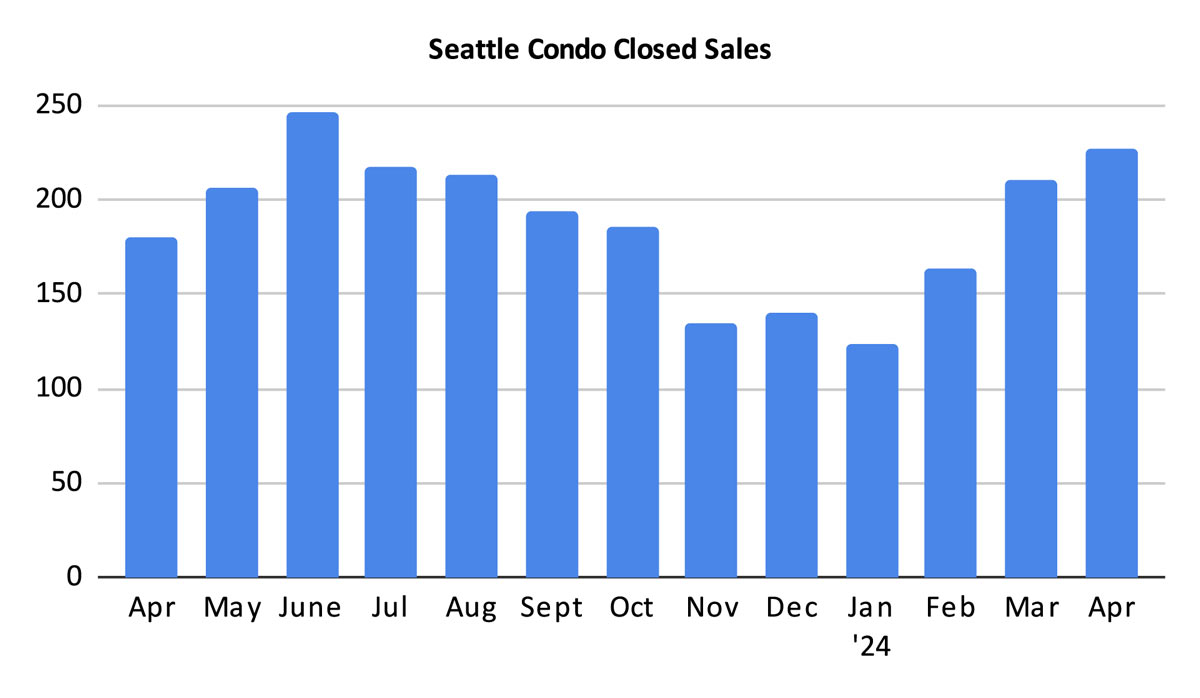

The number of pending sales (property under contract in escrow) continued to increase. There were 276 pending condo sales in April exhibiting a YOY increase of 9.1% and a one-month bump of 7.4%.

That is fantastic news indicating Seattle has a healthy and robust condo market. But, here again, the statistics are skewed by non-traditional condos. At present, they make up approximately 13.5% of the active listings, 18% of the pendings and 28% of the closed sales.

Thus, percentage-wise, more non-traditional condos are selling compared to traditional condos. That makes sense, though. Buyers who can afford it are opting for house-like homes rather than apartment-style flats.

One other tidbit, 15% of current pending sales are at new construction condo buildings – Graystone, Spire, Fitzgerald and Infinity Shore.

There were 227 closings in April, reflecting one-year and one-month improvement of 26.1% and 8.1%, respectively. As closings lag behind pendings by a month, this number will increase in May given the strong sales volume in April.

In Summary

Seattle’s condo market was on the upswing in April. Overall, selling prices, inventory level and sales volume all improved over the prior year and month.

However, with the classification of new townhomes, DADUs, ADUs and condoized single family dwellings as condos, the statistics were skewed. Without these larger and higher valued properties, the citywide condo median sales price would have reflected a decrease in April rather than setting a new record high.

The number of condo listings for sale jumped considerably last month. We experienced the highest number of listings on the market in nearly four years. And, it will likely continue to increase in the coming months.

This is good news for traditional condo buyers as they’re seeing more options and softening prices. Their experience will depend on price point and neighborhood location. For example, buyers of affordable condos appealing to first-time homebuyers may encounter a more competitive market compared to high-end condos. And, the marketplace for townhomes and DADUs is quite strong.

Seller experiences will vary as well. Lower priced condo units are selling briskly, while the higher-valued properties seem to be lagging. Resale condo sellers at the luxury end of the market are facing greater competition from rising inventory and from new condo developments. These properties will sell, it may just take a little longer.

Seattle Condo Market Statistics April 2024

Source: Northwest Multiple Listing Service. Some figures were independently compiled by Seattle Condos And Lofts and were not published by the NWMLS.

© SeattleCondosAndLofts.com