January 2022 Seattle Market Report

Seattle’s condo market ended 2021 on a high note and started off 2022 even higher. January saw condo unit sales spike at higher selling prices along with a plummeting resale inventory stock.

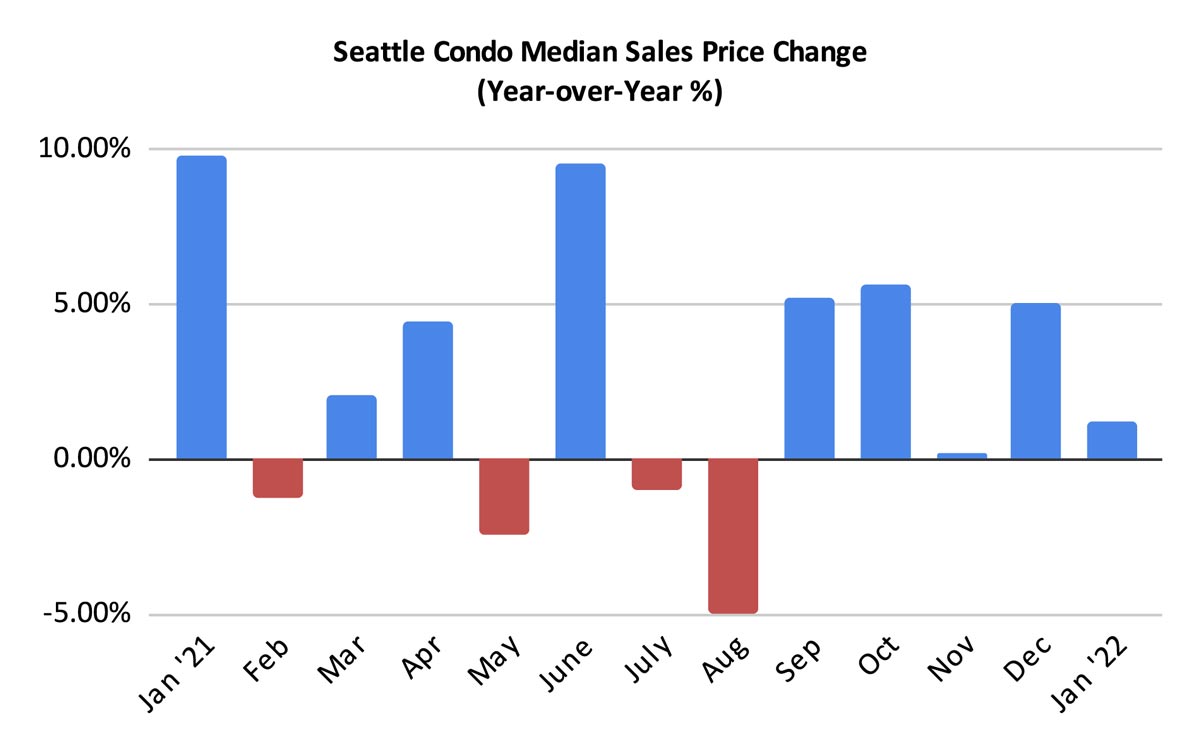

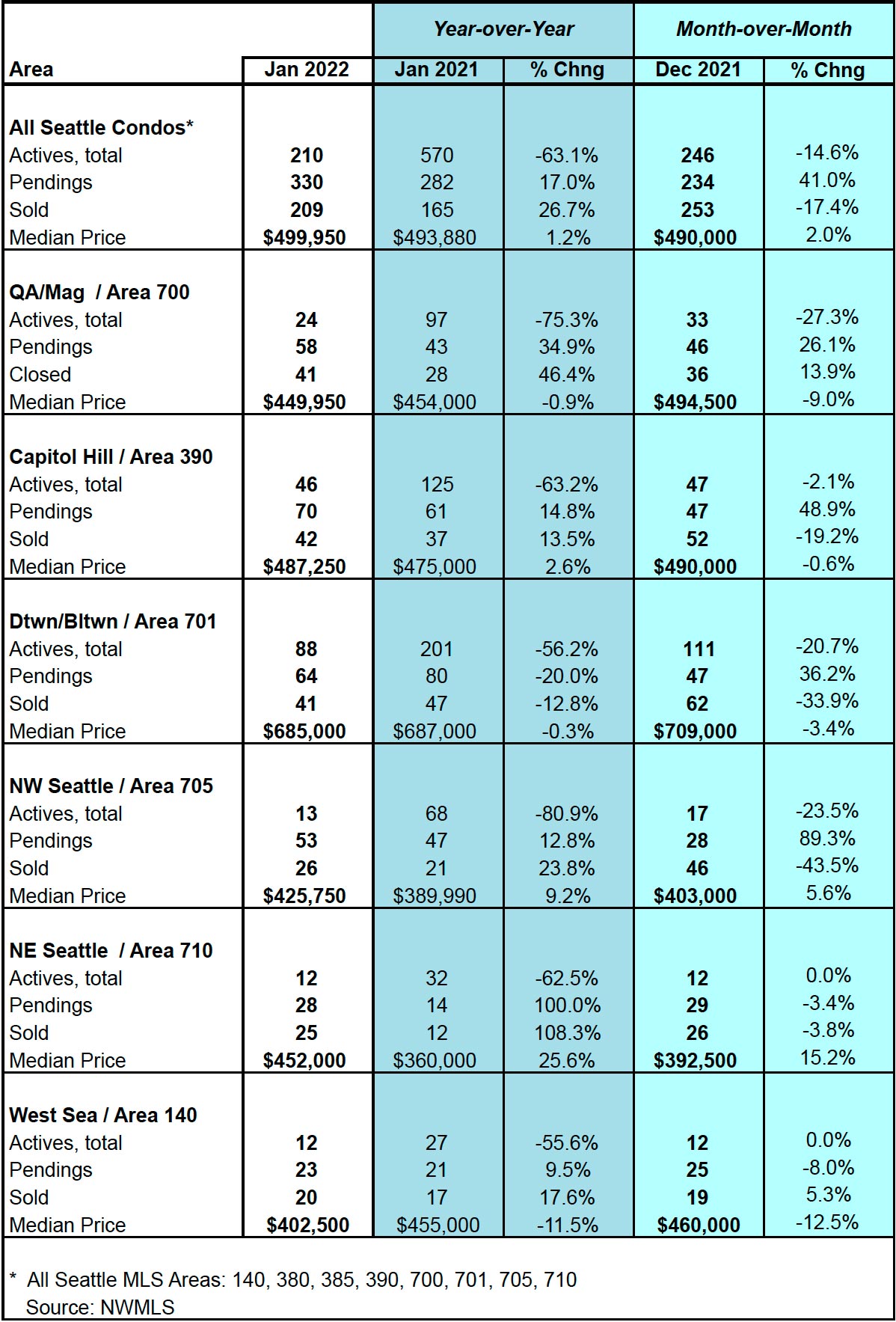

The median sales price for condos citywide was $499,950 in January. That reflected a modest 2% year-over-year (YOY) and a 1.2% one-month increase, respectively

North Seattle condos saw the biggest jump in median sales prices for the month. NW Seattle increased 9.2% YOY and NE Seattle increased 25.6% YOY. On the other hand, Queen Anne (-0.9%), downtown (-0.9%) and West Seattle (-11.5%) exhibited a decrease in January compared to a year ago. See table at bottom of post for more info.

Condo Listings Tumble in January

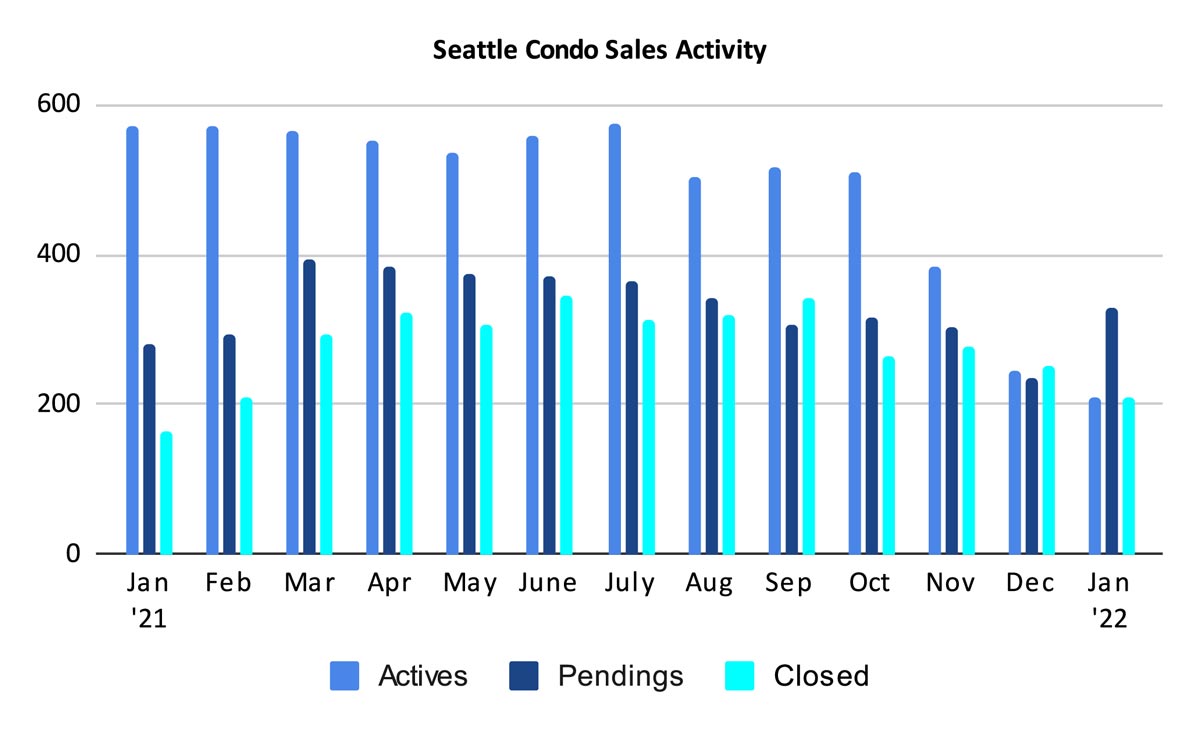

The number of active condo listings in the NWMLS dropped to 210 units last month. That was the lowest number of condo units for sale since March 2018.

As mentioned previously, this number does not take into account the 100s of newly completed condo units primarily in the downtown area. Developers typically only list a handful of units in the NWMLS at any one time. As a result, this practice skews the true inventory numbers.

When contemplating these unlisted units, the number of available condo properties for sale is much high. Actual inventory more closely aligns with the number of units we had available a year ago.

One thing to consider, though, is that the units listed January were mostly resale condo units. So, even though we have a comparable number of units overall, the availability of resale units is down considerably.

This is significant since the resale inventory is far more diverse in terms of prices, location and quality. The new condo stock are higher end, higher priced and mostly in the downtown area.

Seller Market Conditions Tightened Further

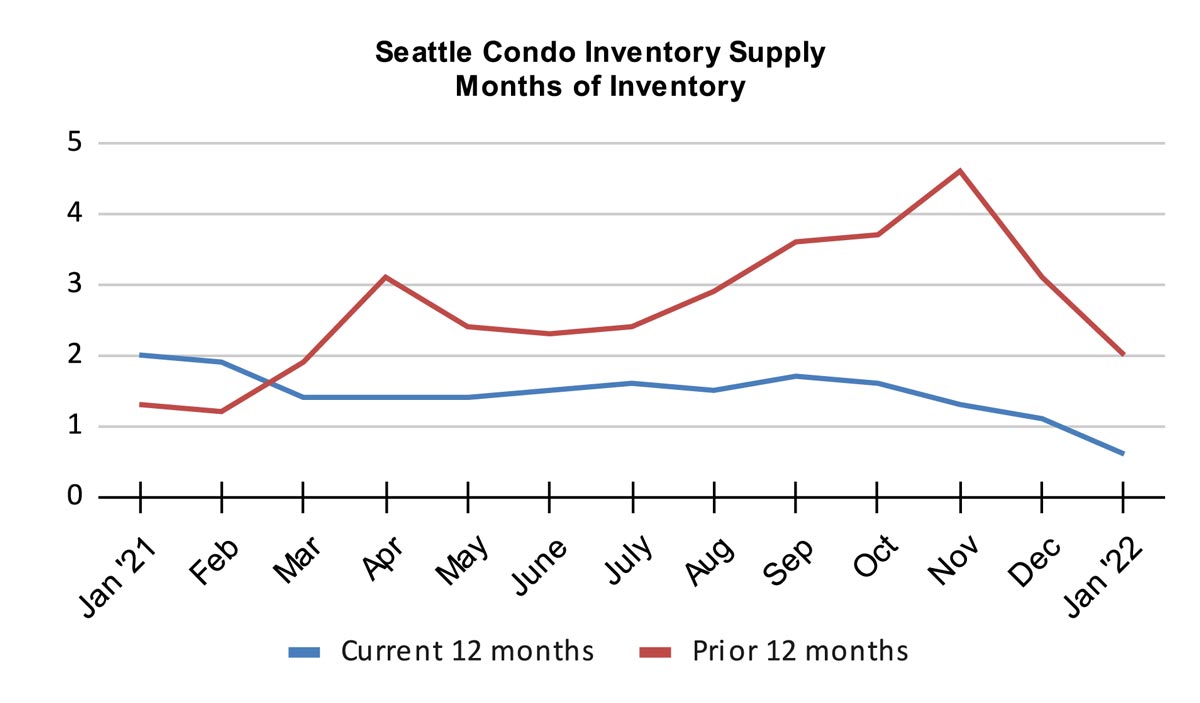

The Seattle condo inventory supply rate dropped to 0.6-months of supply in January based on NWMLS listed condos and pending sales. This was the lowest rate level since November 2017.

Essentially, unless you’re in the market for a luxury downtown condo, there really isn’t much available.

The inventory supply rate characterizes the current market environment. A rate of less than 4-months is a seller’s market, between 4-6 months is a balanced market and over 6-months would be a buyer’s market.

Another way to express inventory is the absorption rate, which was 157% for the month. That means that well over 100% of the condos listed in January was sold. Note, we use pending sales for our calculations.

How can there be more sales than listings available? Statistics. The figures we utilize (in the table at bottom of the post) are published by the NWMLS and is a snapshot of the market on the date that the stats were run.

In this case, the 210 active listings for January were the those that were active on the date the stats were run. Basically, it’s the number of active condo listings at the end of the month rather than the total number of listings available throughout the month. In essence, it is the number of actives at the beginning of the month plus new listings minus listings that went pending during the month.

Pendings, on the other hand, are simply the total number of property listings that were changed to pending status during the month.

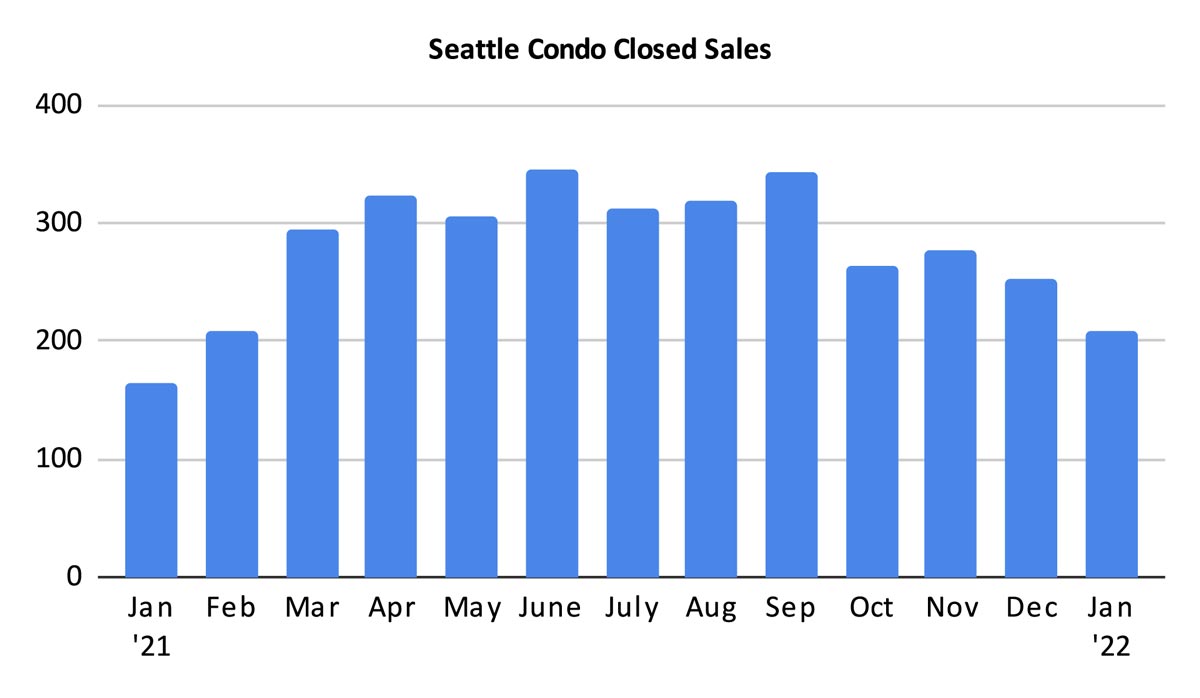

Condo Sales Take Off to Start the Year

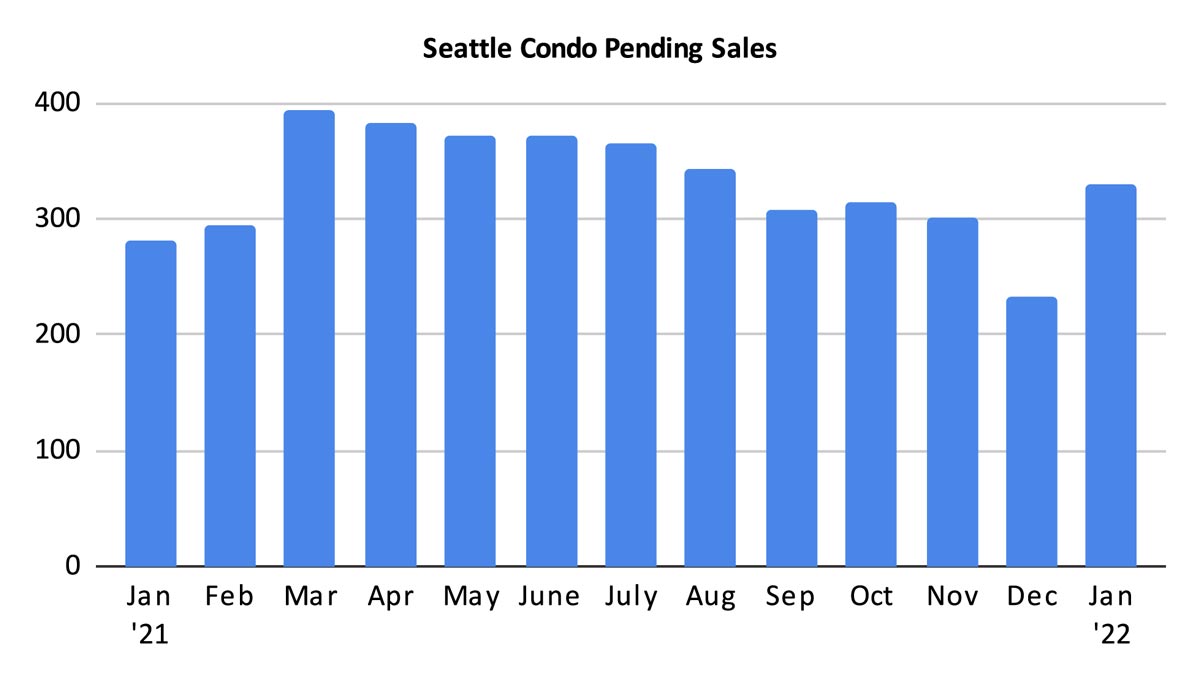

There were 330 pending transactions in January, reflecting a 17% YOY increase and a 24% improvement over December. Seasonally the number of pendings should trend upwards through Spring. Though, the low number of resale condos available may hamper that this year.

There were 209 condo units that closed in January reflecting a 26.7% increase over the same period last year. It declined 17.4% decline from the prior month, which makes sense given the lower number of pendings in December.

Fortunately, this should rise in February with the increase in pendings in January. Closings generally lag behind pendings (listings in escrow) by a month.

January exhibited a great start of the new year for Seattle’s condo market. If the resale market inventory remains low, it could spell a challenging adventure for condo buyers. Moreso when considering added pressure from rising interest rates and additional Fannie Mae / Freddie Mac requirements for condo mortgages.

On the other hand it could be a boon for sellers who can take advantage of a tightening seller’s market.

Source: Northwest Multiple Listing Service. Some figures were independently compiled by Seattle Condos And Lofts and were not published by the NWMLS.

© SeattleCondosAndLofts.com