Seattle Condo Report for June 2024

The Summer real estate market plateau was evident in Seattle’s condo market results for June. Condo sales were tepid, selling prices were flat and inventory grew rapidly last month.

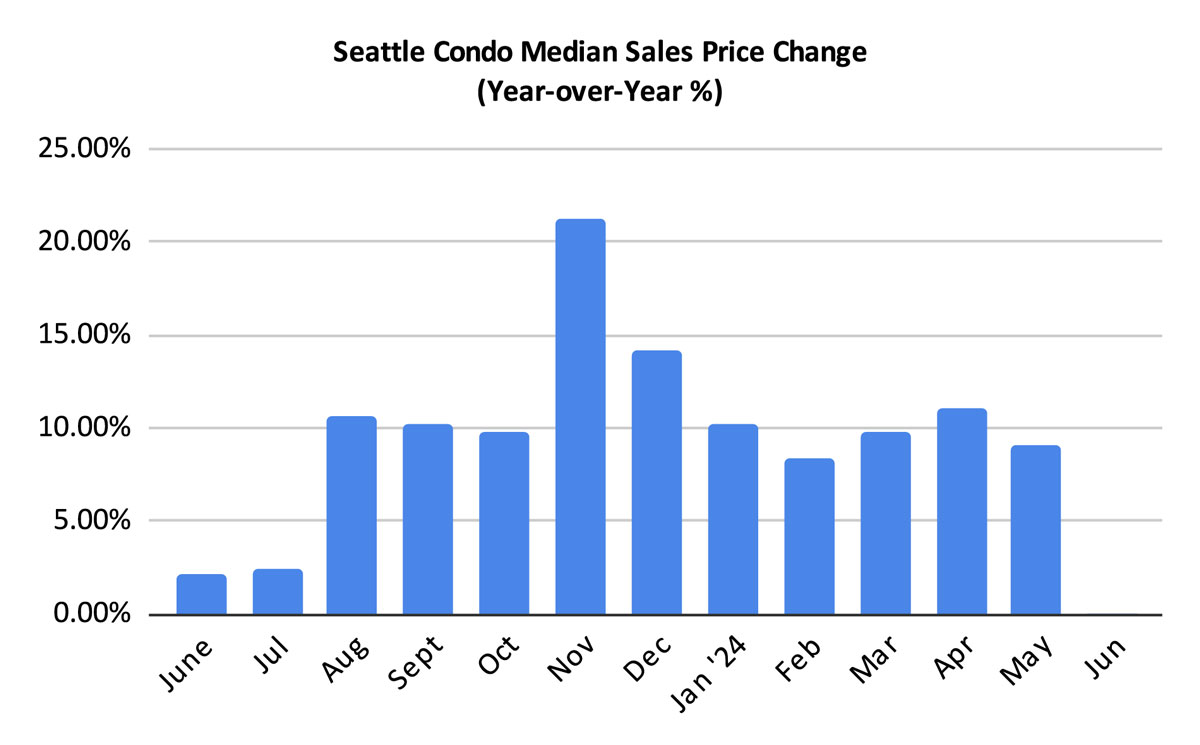

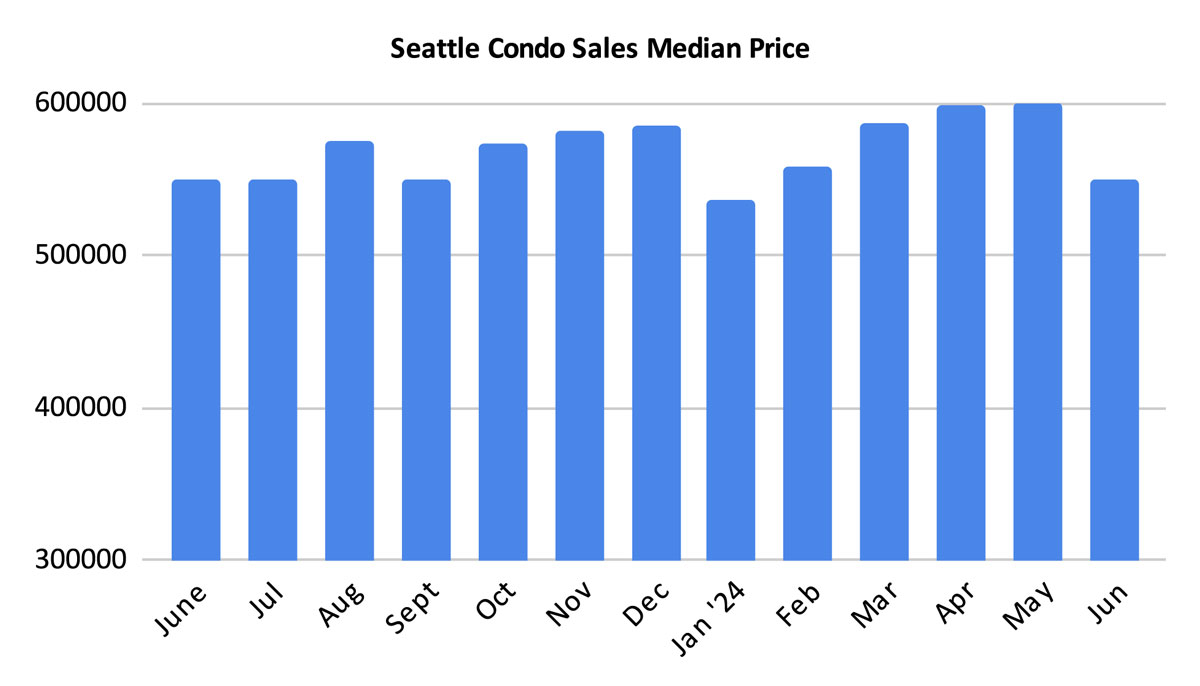

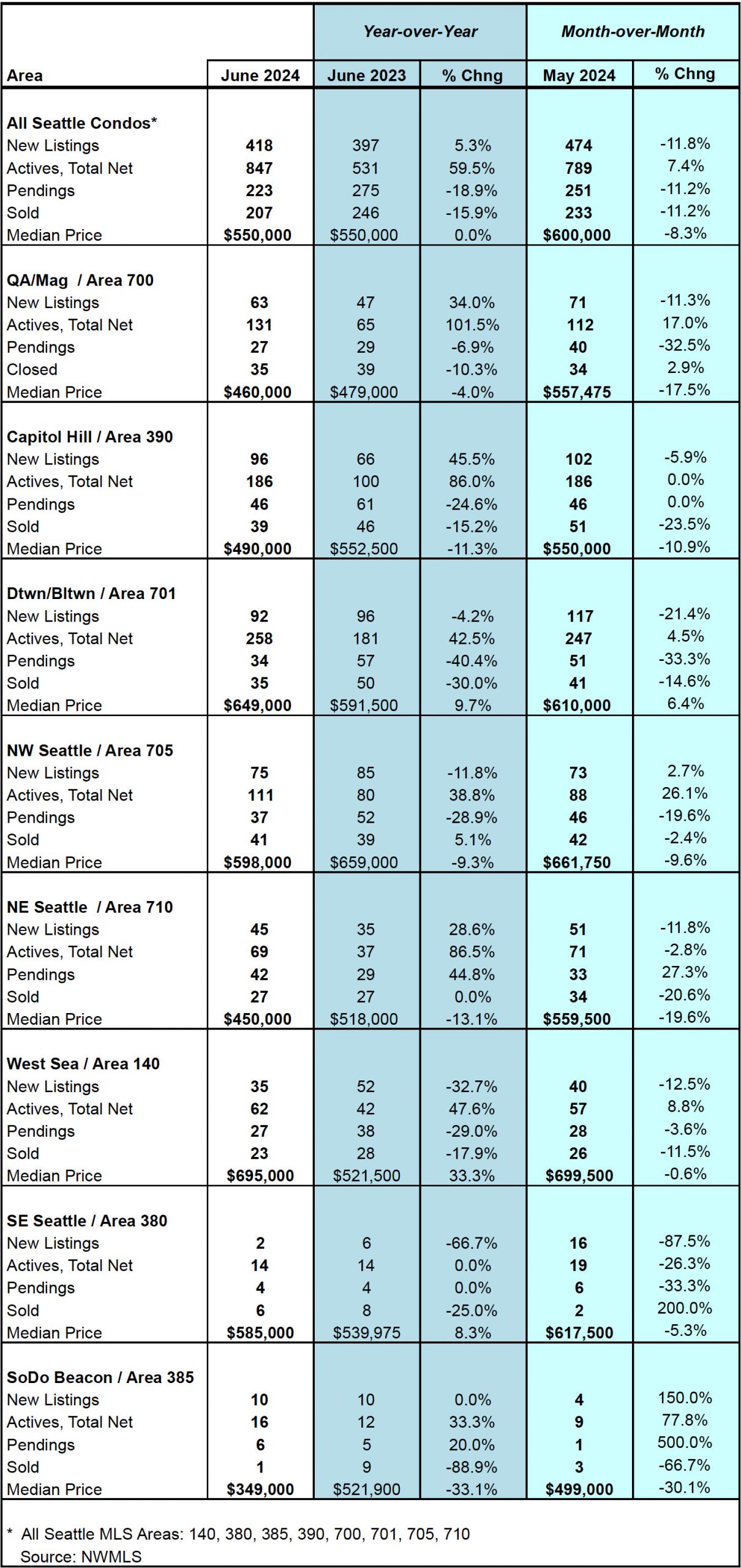

The Seattle citywide condo median sales price was $550,000 in June, same as it was a year ago and 8.3% below the prior month. By NWMLS areas, downtown, Southeast and West Seattle reflected year-over-year increases while the remainder of the city experienced year-over-year decreases in their median selling prices for the month. View complete results here.

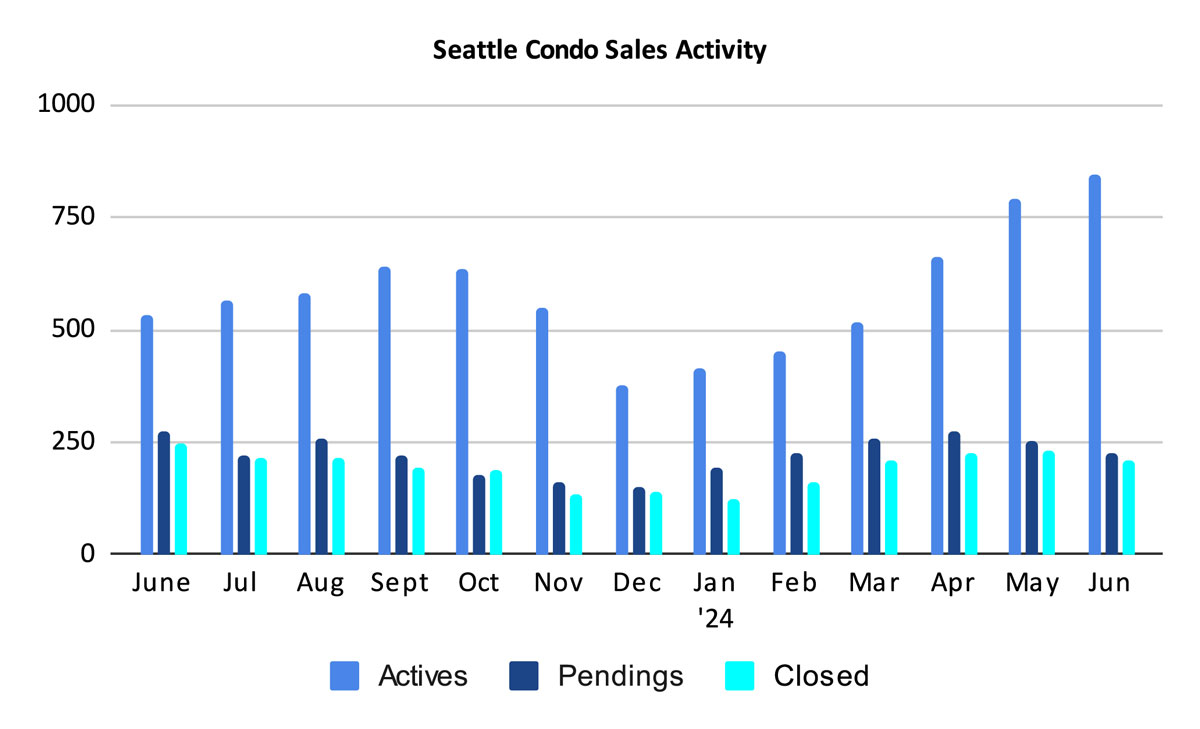

Seattle’s condo inventory grew significantly in June. We ended the month with 847 properties listed for sale in the NWMLS. That reflected a year-over-year increase of 59.5% in the number of listings, and 7.4% more than that prior month.

To break that down…we started the month with 789 listings, then sellers added 418 new listings throughout the month for a total of 1,207. Of that amount, only 223 went under contract with another 137 coming off market for other reasons (e.g. expired, canceled, rented, etc), leaving 847 at month end.

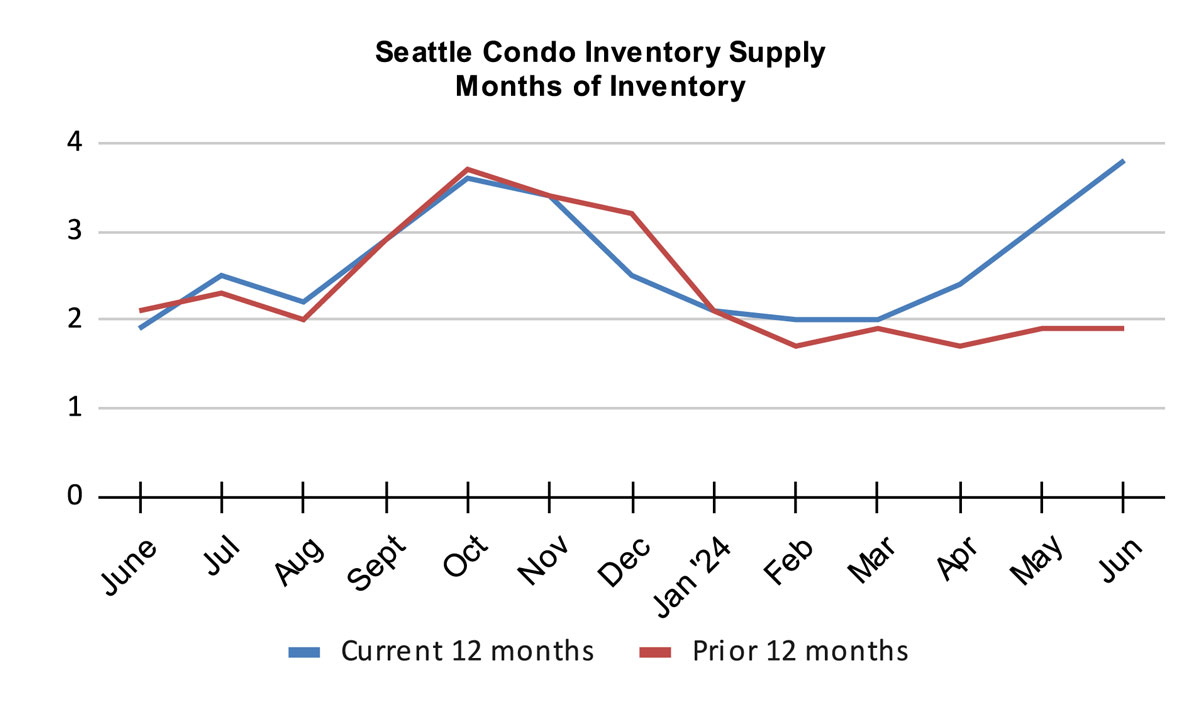

The result was a rise in the inventory supply rate to 3.8-months of supply. The supply rate we use is calculated by the number of active listings divided by the number of pending sales. Note, this can also be calculated using closed sales instead of pending sales.

The inventory supply rate is a metric that classifies the current state of the real estate market. A rate of less than 4-months of supply is characterized as a seller’s market. A rate between 4 to 7-months is a balanced or normal market. And, a rate over 7-months is considered a buyer’s market.

With a 3.8-month supply rate in June, this moved Seattle, as a whole, on the borderline of a balanced or normal market place. That said, Seattle is comprised of a number of neighborhood and price point micro-markets, thus buyers and sellers will experience varying market dynamics. For instance, Northeast Seattle and West Seattle reflected a seller’s market environment in June.

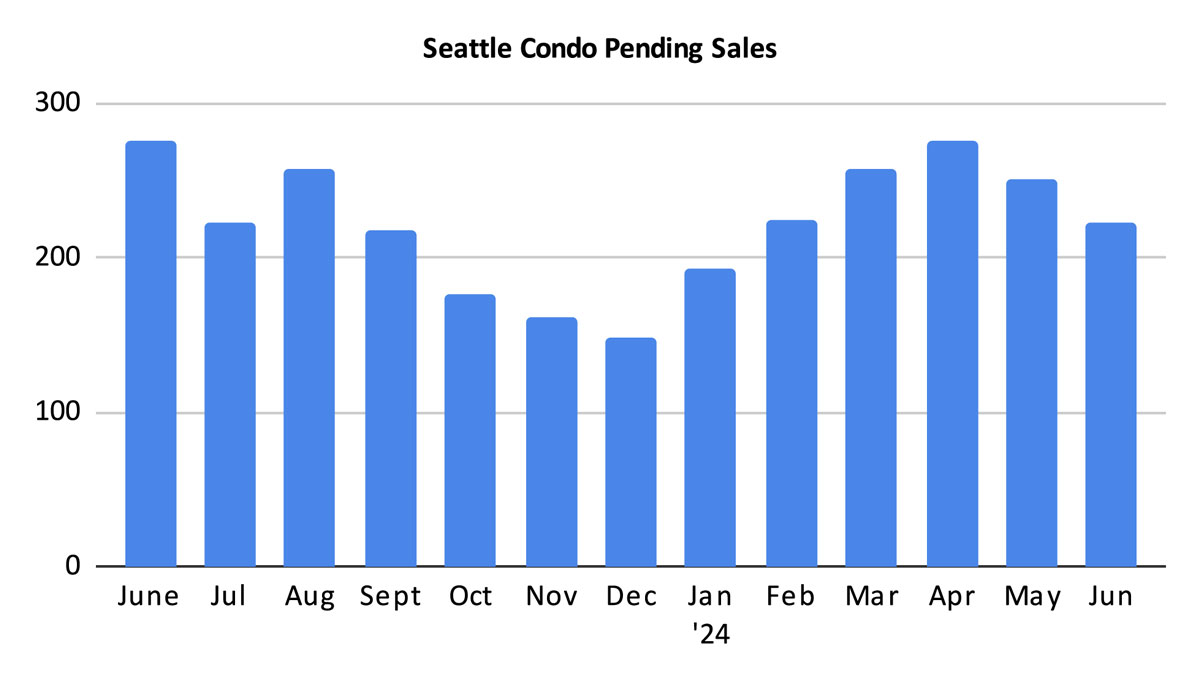

Perhaps it was the improving weather, summer activities, mortgage interest rates or election concerns that kept buyers on the sidelines in June. The number of pending sales transactions (listing going under contract) dropped to 223 properties. That reflected a one-year and one-month decrease of 18.9% and 11.2%, respectively.

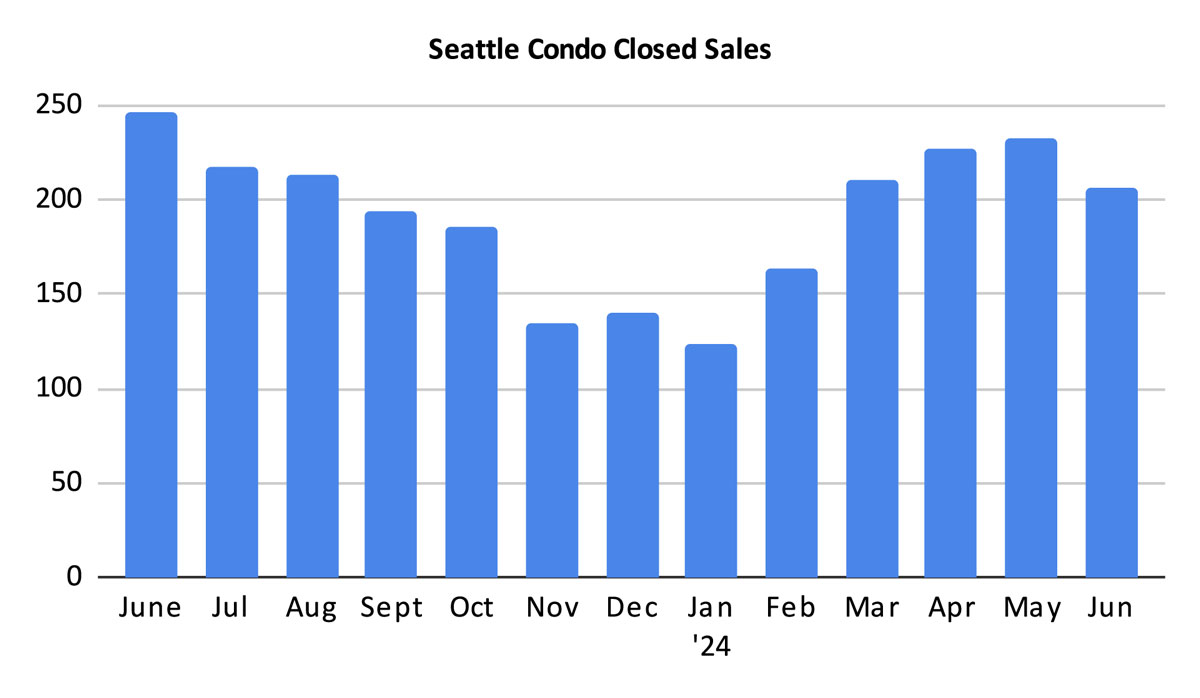

There were 207 condo closings in June. That was 15.9% fewer than the same period last year and 11.2% fewer than in May. Though, that was anticipated since closings lag behind pendings, which started to dip in May.

The Summer real estate season is fully upon Seattle’s condominium market. The June market results exhibited robust listings with seller’s taking advantage of the better weather ahead of the upcoming slower Fall season.

With more listings the Seattle condo market inched ever closer to a balanced market, which benefited buyers. Overall, median selling prices flattened.

However, buyers were tepid with fewer properties being purchased. The summer weather along with vacations and the abundance of activities in the Pacific Northwest may have drawn buyers away from house hunting. Or, mortgage interest rates and the election may be weighing on buyers’ minds.

Seattle Condo Market Statistics June 2024

Source: Northwest Multiple Listing Service. Some figures were independently compiled by Seattle Condos And Lofts and were not published by the NWMLS.

© SeattleCondosAndLofts.com