Seattle Condo Market Update January 2024

Seattle’s condominium market started 2024 auspiciously. Inventory, condo sales activity and selling prices improved across the board.

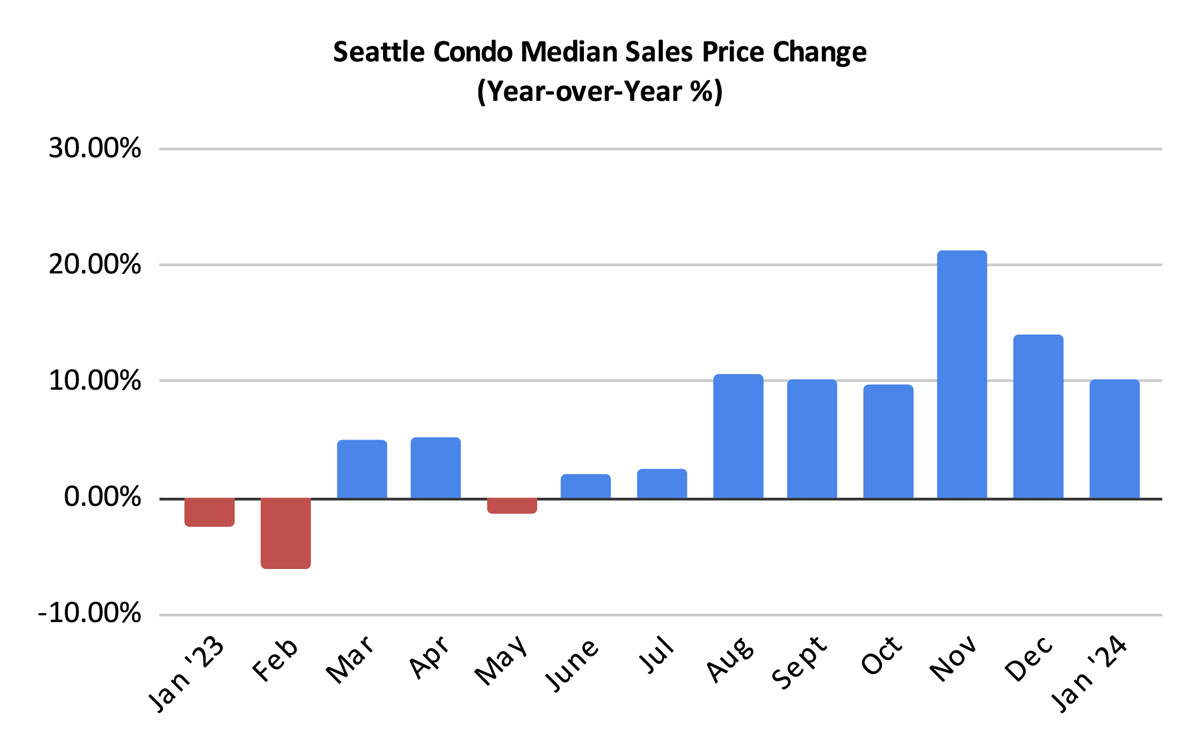

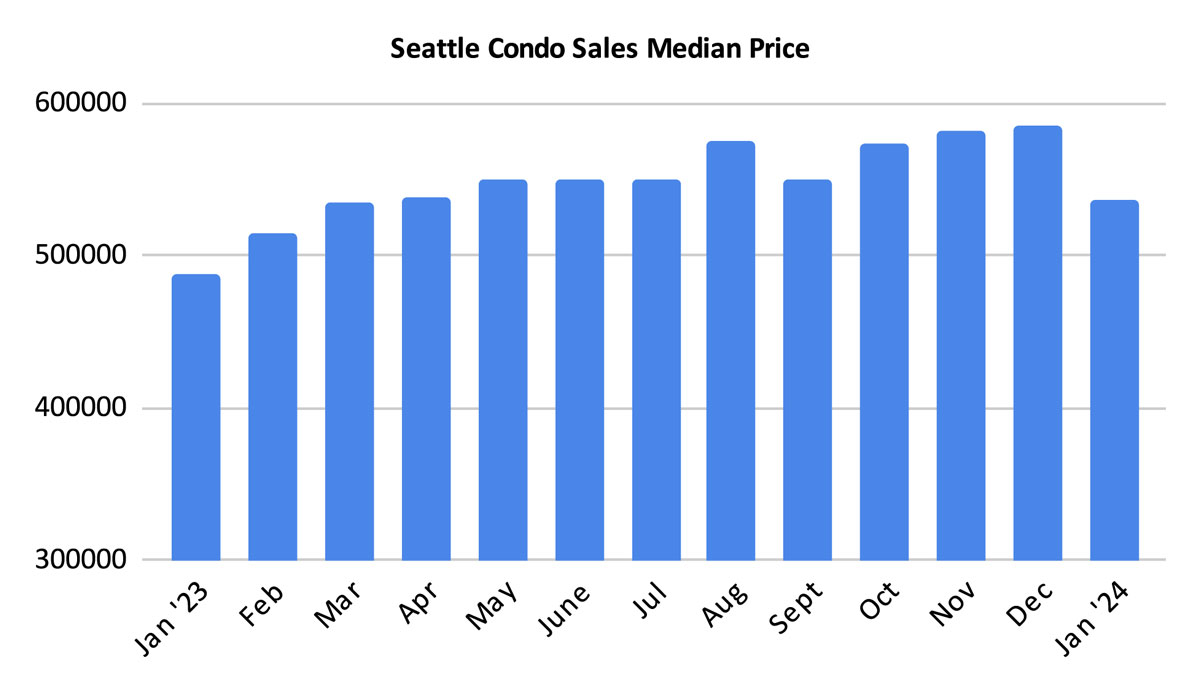

Citywide, the median sales price for Seattle condos rose 10.3% year-over-year to $537,500. However, that was 8.1% below December’s median of $585,000, which was the all-time record high.

By NWMLS neighborhood area, most areas of the city experienced year-over-year (YOY) double-digit increases in their median selling prices. These were NE Seattle (+26.3%), NW Seattle (+13.4%), downtown (+12.6%) and Capitol Hill / Central (+10.1%). Technically, Sodo/Beacon Hill lead the way at 36.1%, but that was based on a sample size of one property. Two areas exhibited YOY decreases — Queen Anne / Magnolia (-5.4%) and West Seattle (-0.5%).

As virtually all new townhomes, accessory dwelling units (ADU) and detached accessory dwelling units (DADU) are now classified as condominiums, I’m including Sodo / Beacon Hill Area 385 and Southeast Seattle Area 380 in the NWMLS neighborhood area table (click to view). Most of the “condo” sales in 385 and 380 are townhomes (and a few moorage slips).

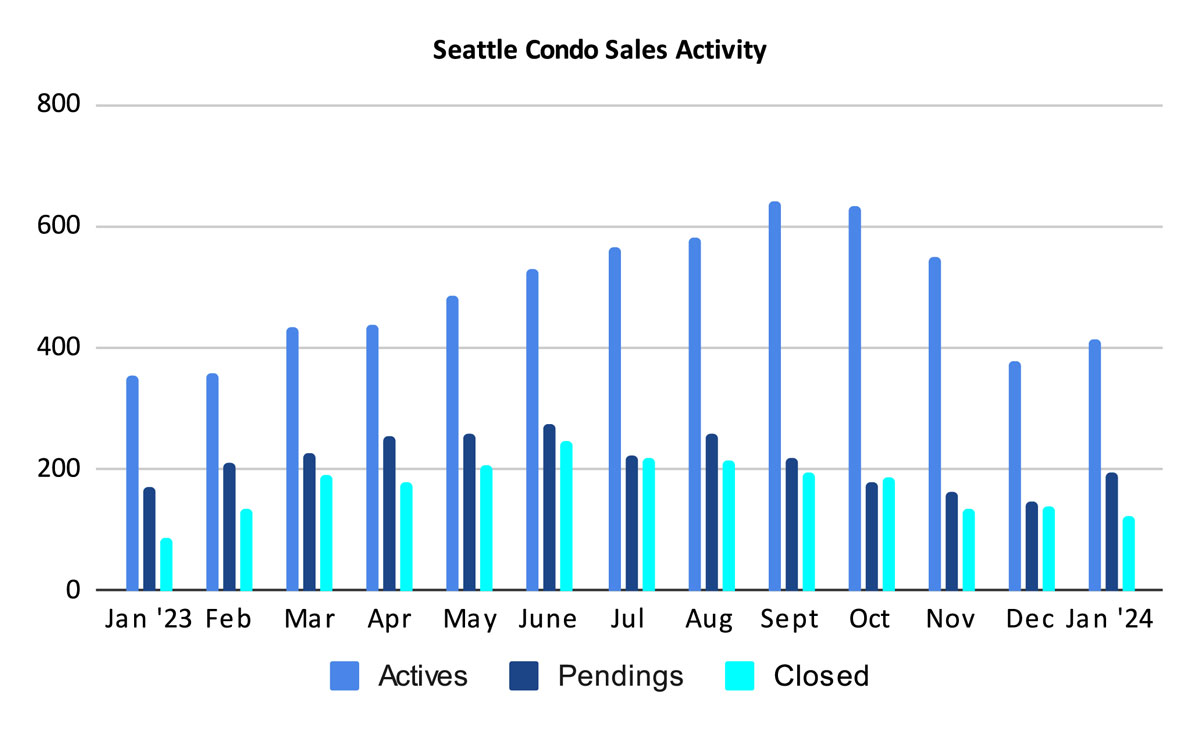

As we would expect with the start of the new year condo inventory started to rise. Both the number of new listings coming to market during the month and the overall number of listings increased in January. There were 268 newly listed units for sale during the month, which was 34.7% more than the same period last year and 191.3% more than had come on the market in December.

We ended the January with 414 active listings available, which was 16.3% more than last January and 9.8% more than the prior month.

There are a number of unlisted new construction condo flats and townhome units available but are not reflected in the NWMLS listing database. Therefore, actual inventory is a little higher than officially published by the NWMLS.

Inventory Rose, Yet Market Tightened

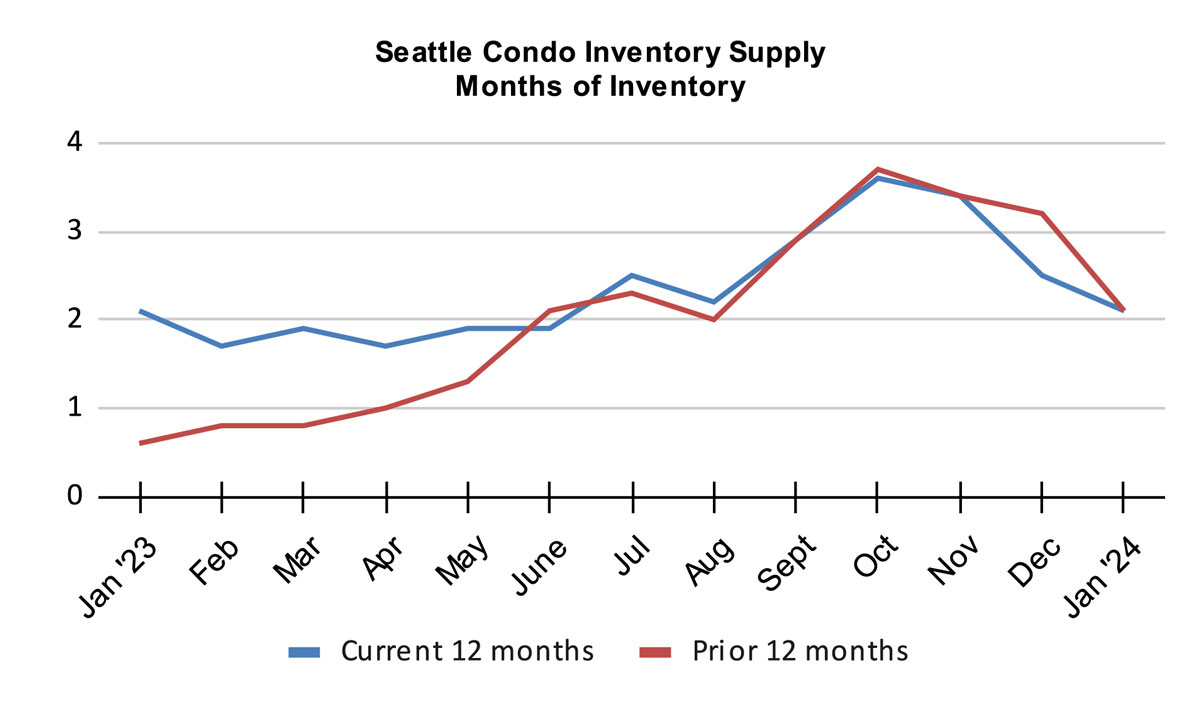

Although the number of active listings increased in January, so did condo sales. As a result the inventory supply rate reduced, or tightened, in January to 2.1-months of supply citywide.

The inventory supply rate is a metric that characterizes the market environment. Essentially, if no new listings come on market, then at the current rate of absorption it will take 2.1 months to exhaust current inventory.

In terms of market environment, a rate of less than 4-months of supply is considered a seller’s market. A rate between 4 to 7-months of supply is a normal or balanced market. And, a rate greater than 7-months is characterized as a buyer’s market.

For a little historical context, Seattle’s condominium market has been in a seller’s market since the start of 2012. We flirted coming close to a balanced market a few times, but never crossed the threshold as noted in graph below in October 2022 and 2023.

With that in mind, however, Seattle’s real estate market is comprised of micro markets in terms of price points and neighborhood area. Therefore, depending on the price points and where they are located, sellers and buyers will encounter differing experiences and market dynamics.

In condo dense areas such as downtown and Capitol Hill, the inventory rate places these neighborhoods at the cusp of a normal market. Although, when factoring available but unlisted units in the downtown area, then downtown is actually in a normal market currently.

And, buyers searching for condos in the more affordable price points will face greater competition and fewer inventory options compared to higher end properties.

Condo Sales Rebound

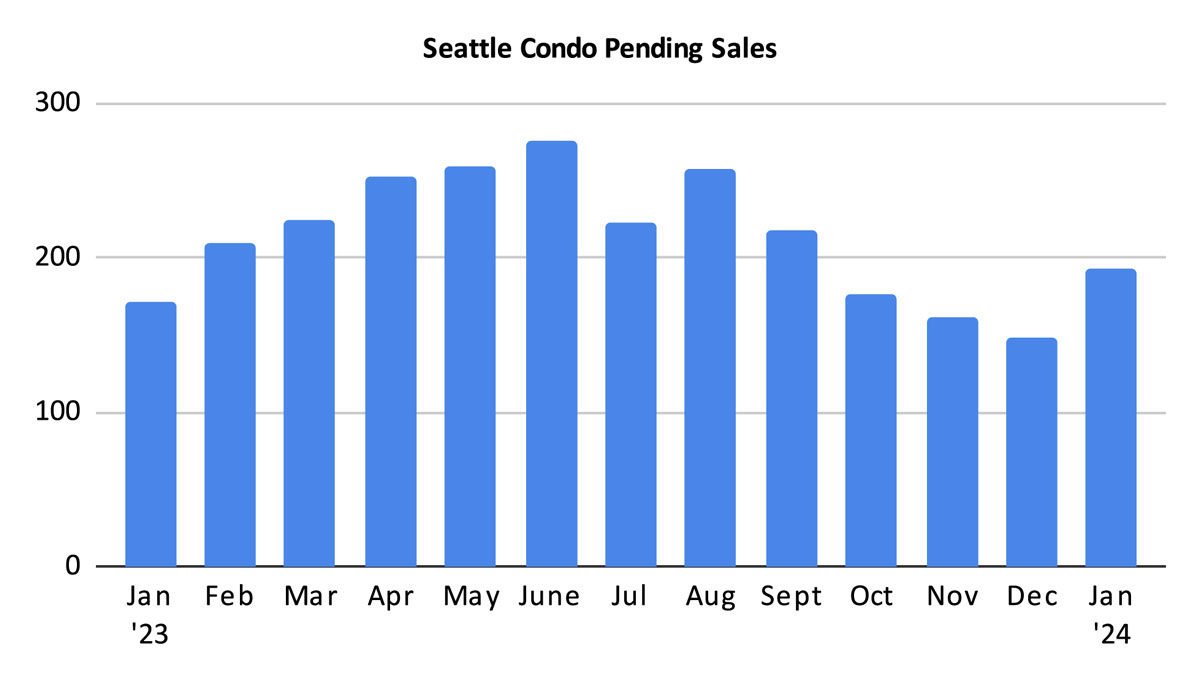

There were 193 pending condo sales in January, reflecting a one-year and one-month increase of 12.2% and 29.5%, respectively. Again, not unexpected as sales always pick up with the start of the new year. Though, this year exhibited greater activity than in January 2023, which may portend a good year for the condo market.

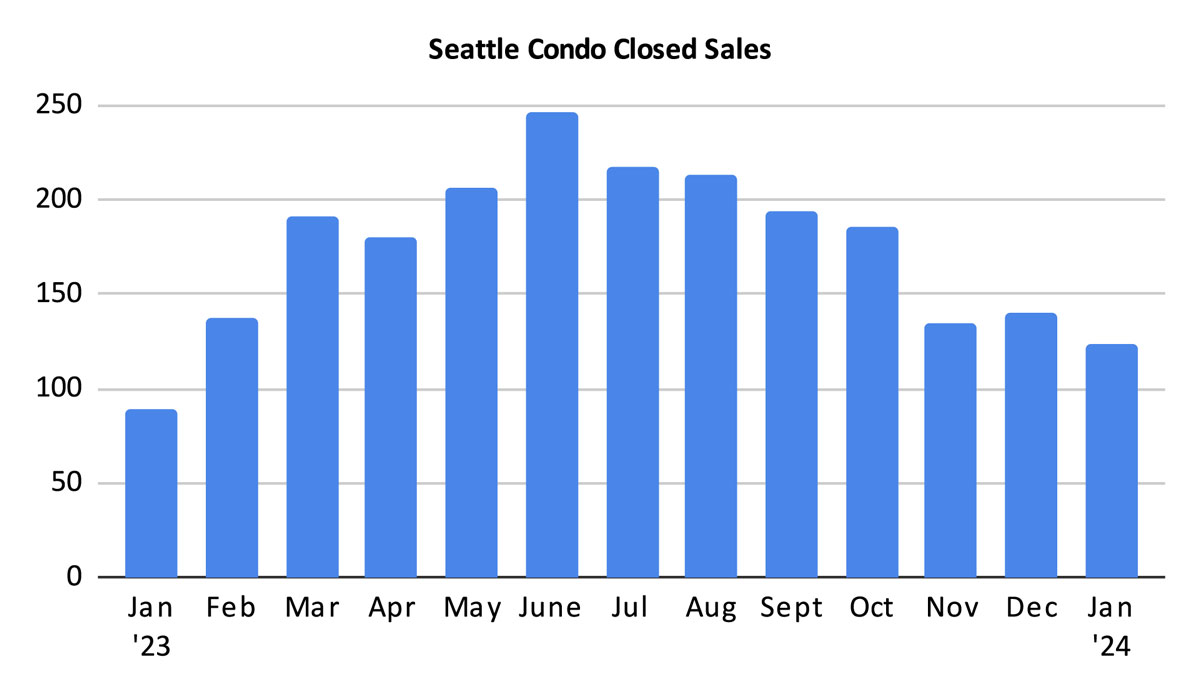

There were 124 closed condo sales in January, which was 39.3% more YOY, though 11.4% fewer than in December. Fortunately, closings typically lag behind pendings so the number of closing for February will rise due to the number of pendings in January.

In terms of property type, 27% of January’s condo closings were townhomes, ADUs, DADUs or converted single family houses. This is an important distinction to make, and more so, in areas where there is a limited supply of typical condo flats and a boom in new townhome development.

Take NWMLS Area 705, which encompasses NW Seattle from the ship canal up to 145th and west of I-5. Of the 22 closings in January, only 40% were the typical condo flat. The other 60% was comprised of 10 townhomes, 2 DADUs and 1 converted single family house. And, the current active listings are evenly split between condo flats and townhomes.

Thus, if you’re looking for a one-bedroom condo flat in the Ballard urban village area, the published results may not be applicable. For example, the median sales price in NW Seattle rose 13.4% year-over-year, but that doesn’t mean prices appreciated by double digits. It may certainly have appreciated in value, though the median (midpoint) shifted upwards due to a greater number of higher priced townhomes selling.

In Summary

Seattle’s condominium market enjoyed a quick start to 2024 with solid results in January. Compared to the same period last year, inventory levels, selling prices and sales activity increased.

Condo selling prices increased and will likely to continue doing so. Not necessarily due to appreciation. In fact, in some area values haven’t improved that much. Rather, the condominium classification of new townhomes, ADUs, DADUs, and single family homes, have contributed to the rising median sales prices of condos.

As we brush off the winter doldrums and prep for spring, Seattle’s cyclical real estate market will gain momentum. In the coming months, inventory will continue to rise as will sales activity and selling prices.

Buyers will benefit from greater supply and more options. Though, depending on their desired neighborhood and price point they may find themselves in a competitive market place, especially for entry level properties. Or, for higher priced units in condo dense neighborhoods where sales are lagging, they may find a good deal.

Sellers generally will encounter a strong market overall. But, again, location and price points will affect their experience and outcome.

Thinking of buying or selling a condo this year? Drop us a line and let us get you started on your homeownership journey.

Seattle Condo Market Statistics January 2024

Source: Northwest Multiple Listing Service. Some figures were independently compiled by Seattle Condos And Lofts and were not published by the NWMLS.

© SeattleCondosAndLofts.com