January 2011 Seattle Condo Market Update

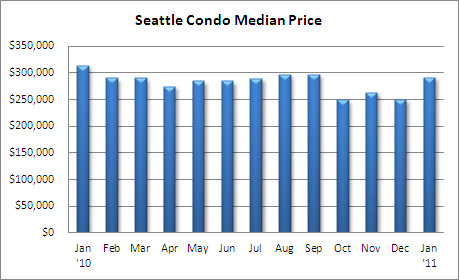

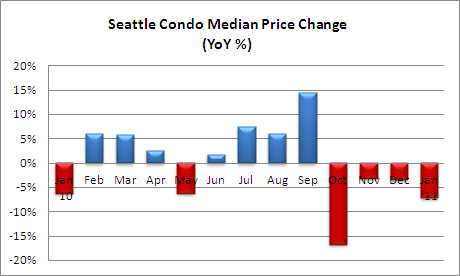

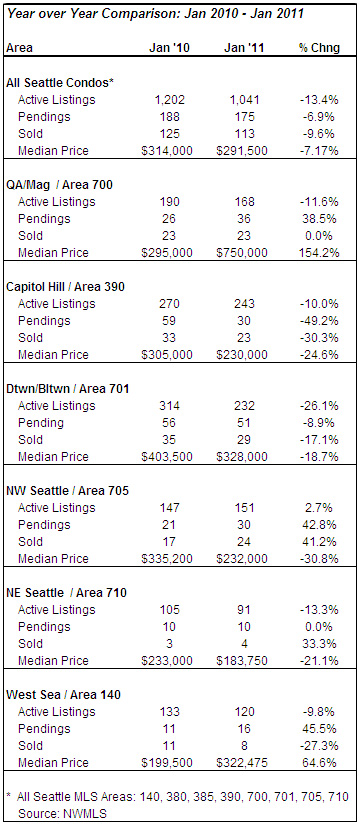

Seattle’s January citywide $291,500 median condo price reflected a decrease of 7.17% compared to the same period last year, but improved 16.1% over December. However, last January’s median price of $314,000 was the peak over a 24-month period…for the most part median prices hovered between $275,000 and $300,000.

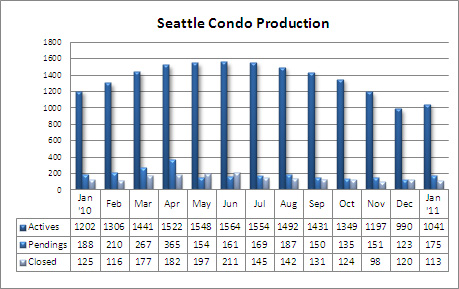

As expected, sales activity picked up with pendings increasing 42.2% to 175 transactions over the prior month (and a 5-month high). Though, that was still 6.9% fewer than last January. And, for the next few months we will not match 2010’s unit sales volume; the April 30th tax credit deadline generated a huge surge last year. Without the external boost this year, we’ll see steep declines in pendings throughout Spring, compared to 2010.

The 113 closed condo sales in January reflected a year-over-year decline of 9.6% and a 5.8% dip from December. Like pendings, the next 4-5 months will exhibit fewer closed sales compared to last year.

The number of condos listed for sale last month increased 5.1% above December to 1,041 units, which was expected, though it was far less than last Janary. Active condo listings will continue to rise from this point on and will peak during Summer.

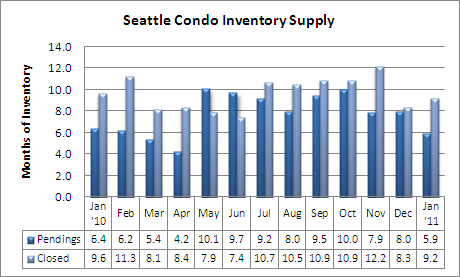

The Seattle condo inventory supply rate dipped to 5.9 months based on pendings and rose to 9.2 months based on closed sales. Either method continues to suggest a buyers market environment.

Going forward, Seattle’s condo market faces challenges, especially through the first half of the year. The lack of artificial stimulus and an increasing foreclosure rate will place greater pressure on sellers to adjust to the ever changing market place. On the other hand, lower prices, perceived value and sustained mortgage interest rates may open the door for more future homeowners. I do think we’ll see plateauing of both median prices and unit sales activity, though at a lower threshold than last year.

Thanks for this post. Very in depth analysis of the Seattle condo market. Invaluable – as usual!

Seems like this report is saying ‘Well…there’s good news and bad news. Which one do you want first?’ The additional foreclosures and short sales are going to put a lot of pressure on owners who are trying to sell their condos for enough to cover their mortgages. Let’s see if the mortgage rates can be sustained all the way through to late second and early third quarters. With all the chaos in the Middle East, declines in the Dollar and spike in commodities prices, it is not easy to project what might be happening in even a few months.

I would suspect that the lack, as you say, of any “artificial stimulus” is having a big effect, as I think that it is here is Southern California. It is going to be interesting to see what happens to the real estate market if interest rates start to rise significantly.

@Rich Eddy Southern California. It is going to be interesting to see what happens to the real estate market if interest rates start to rise significantly.

In the short term as rates start to rise and I believe it’s starting to happen, it will get those on the fence to take action and buy now. Long term who knows, but it does not look good.