Seattle Condo Market Update December 2023

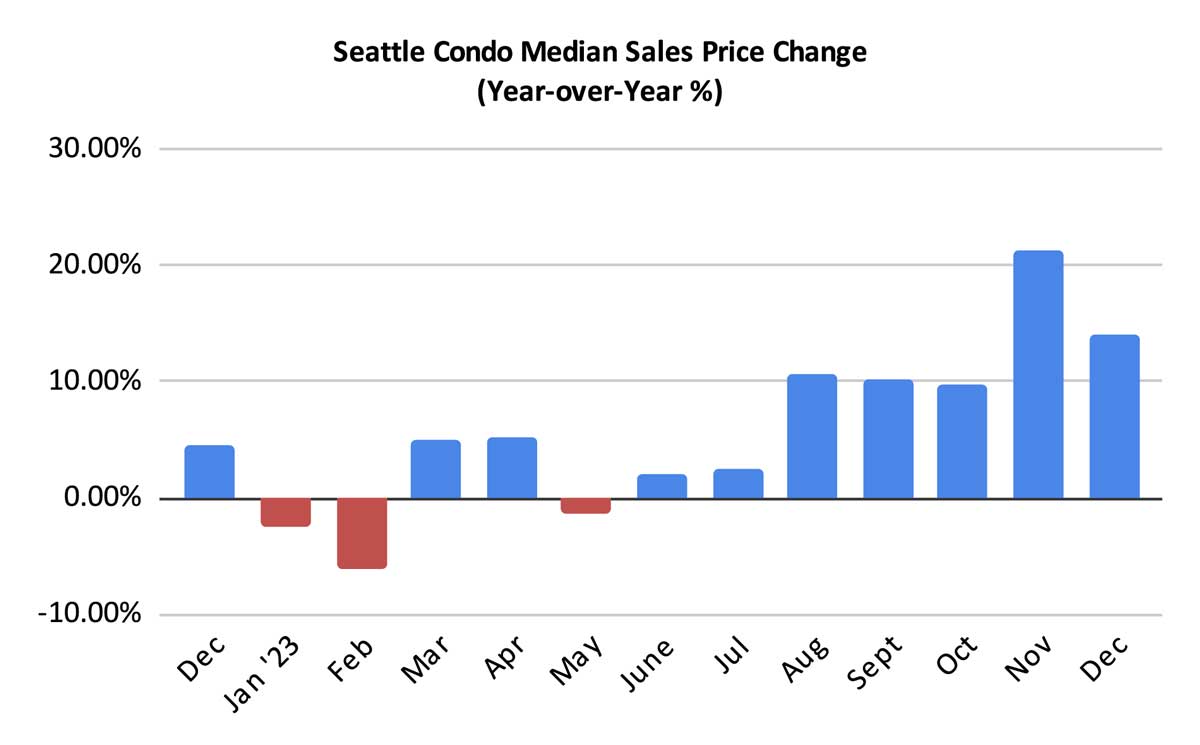

The Seattle condo market ended the year on a high note with a new record median sales price for Seattle condos and strong sales activity.

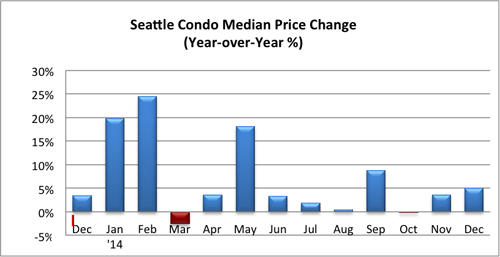

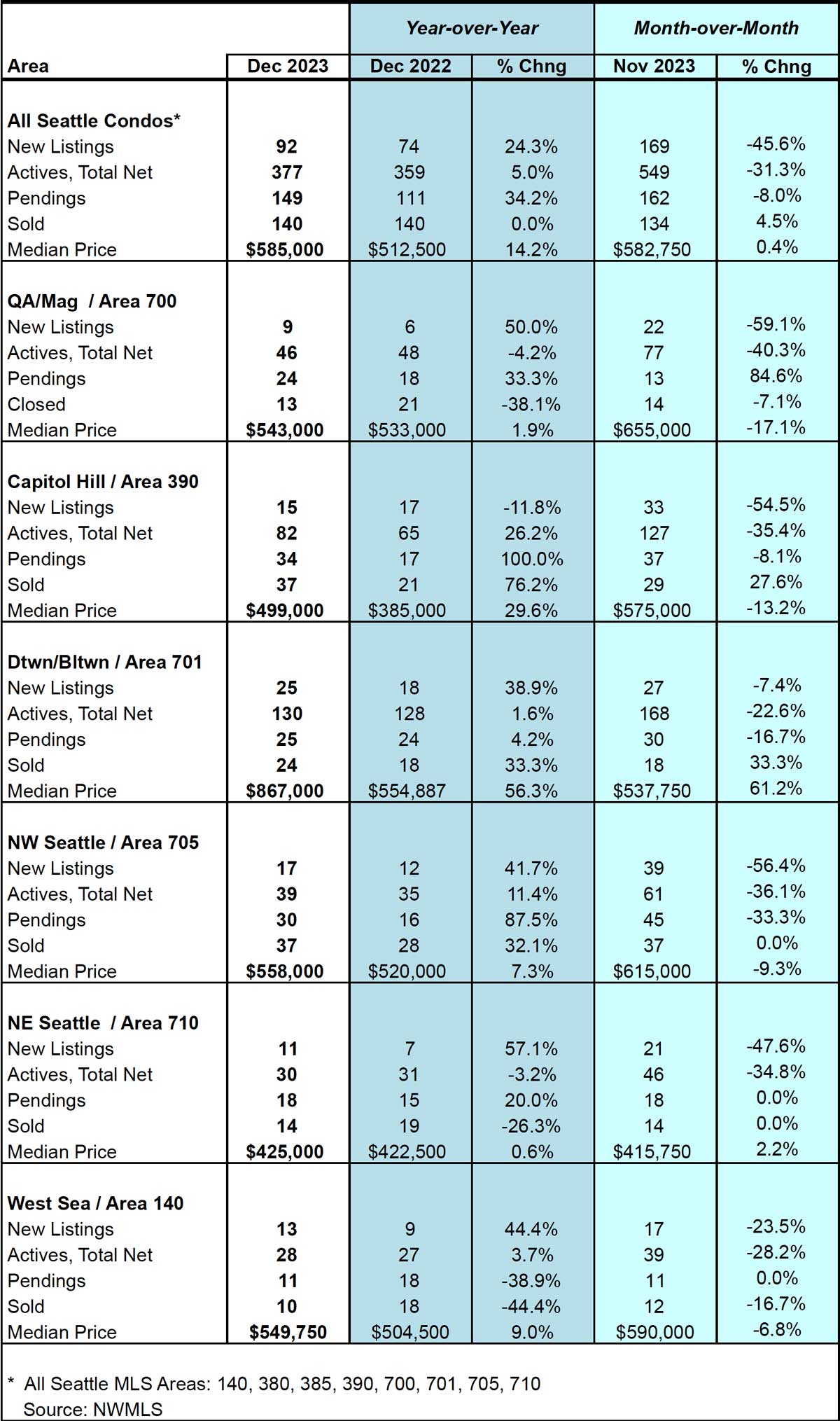

The Seattle citywide condo median sales price rose 14.2% year-over-year and 0.4% over the prior month to $585,000.

As mentioned in previous posts, the strength of the median sales price of Seattle condos is due in part to the trend over this past year of classifying townhomes, single family dwellings, accessory dwelling units (ADU) and detached accessory dwelling units (DADU) as condominiums. These made up 26% of the closed sales in December.

If we only looked at what we traditionally think of condos – multiple flats/units in a single building or complex – then the median sales price would have been $499,000 instead of $585,000.

By MLS neighborhood areas, two saw significant year-over-year increases, Capitol Hill/Central (+29.6%) and downtown (+56.3%). These were the result of a greater number of luxury condo units that closed in December, as well as, closings at the just completed Graystone Condominium on First Hill. These closings contributed in moving the median point upwards in December. View complete neighborhood results here.

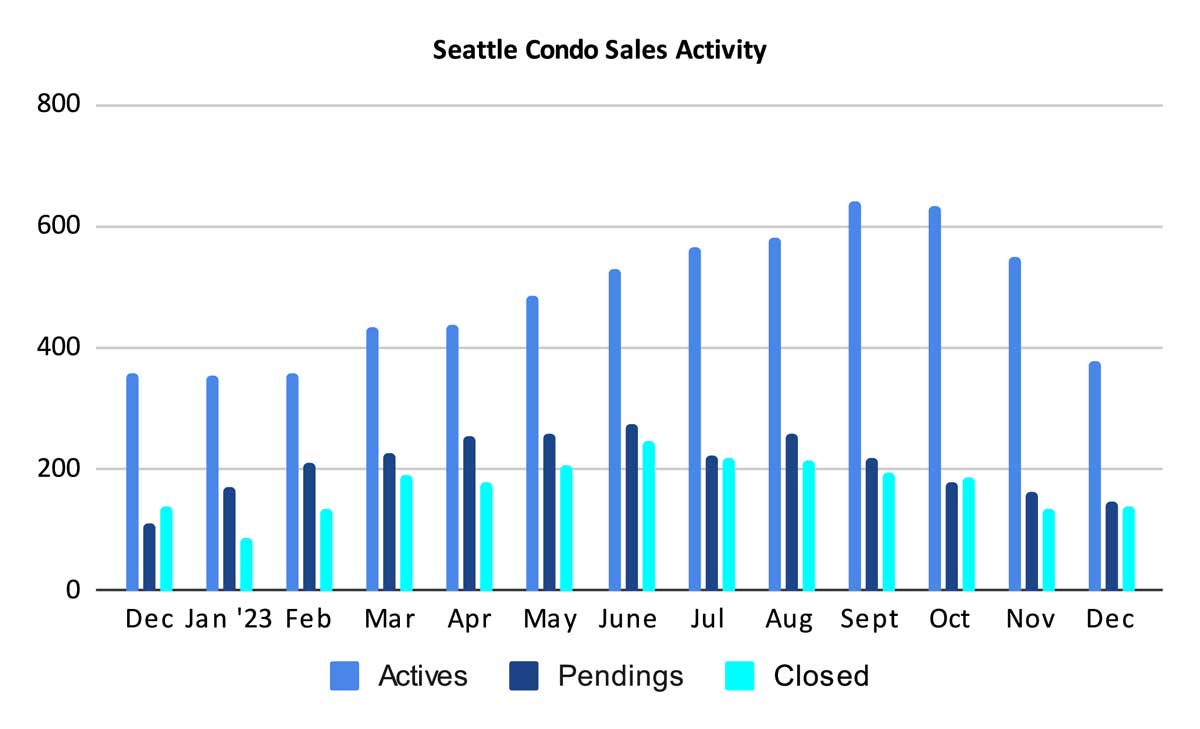

December is typically the slowest month of the year for Seattle’s real estate market, and that was evident by the number of listings for sale. We ended the month with 377 units for sale. That was 31.3% fewer than November, but a slight increase of 5% over last December.

Interestingly, there were more new listings coming to market compared to a year ago. Sellers brought 92 new listings to market in December 2023 compared to 74 in December 2022, a 24.3% increase.

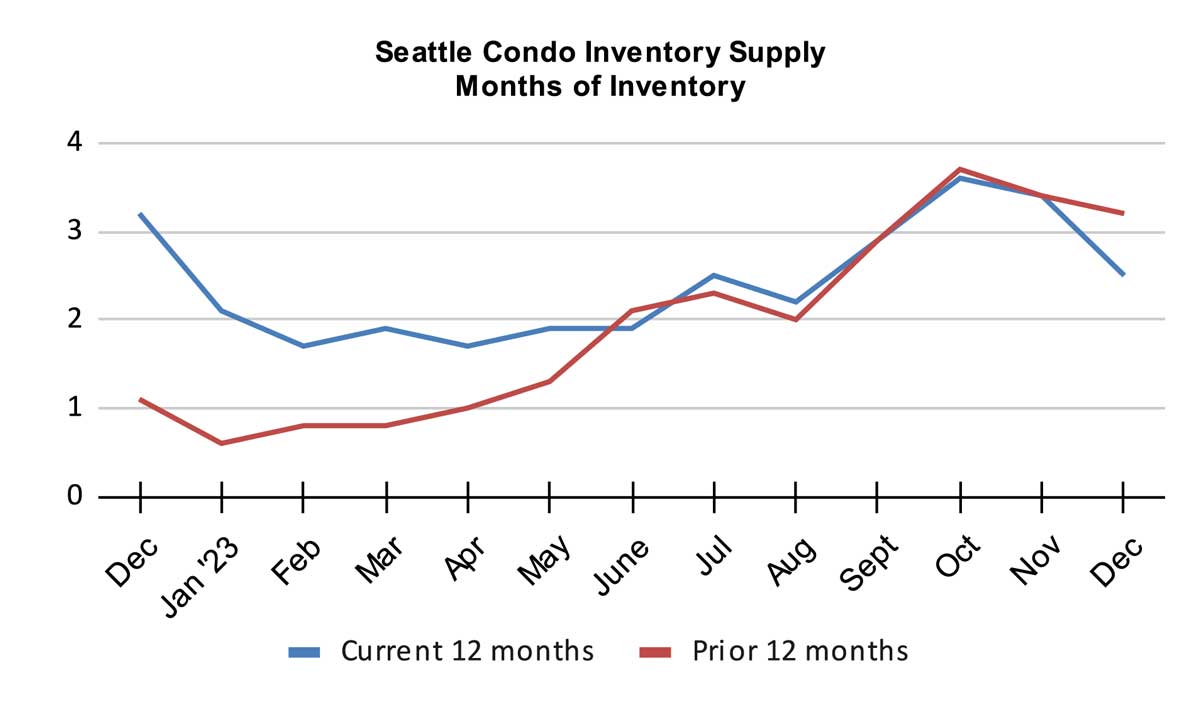

The number of listings combined with an uptick in pending condo sales in December reduced the Seattle condo inventory supply rate to 2.5-months of supply last month.

The inventory supply rate is a metric that characterizes the housing market environment. A supply rate under 4-months is considered a seller’s market. Between 4-7 months is a balanced or normal market, while a rate over 7 months would be a buyer’s market.

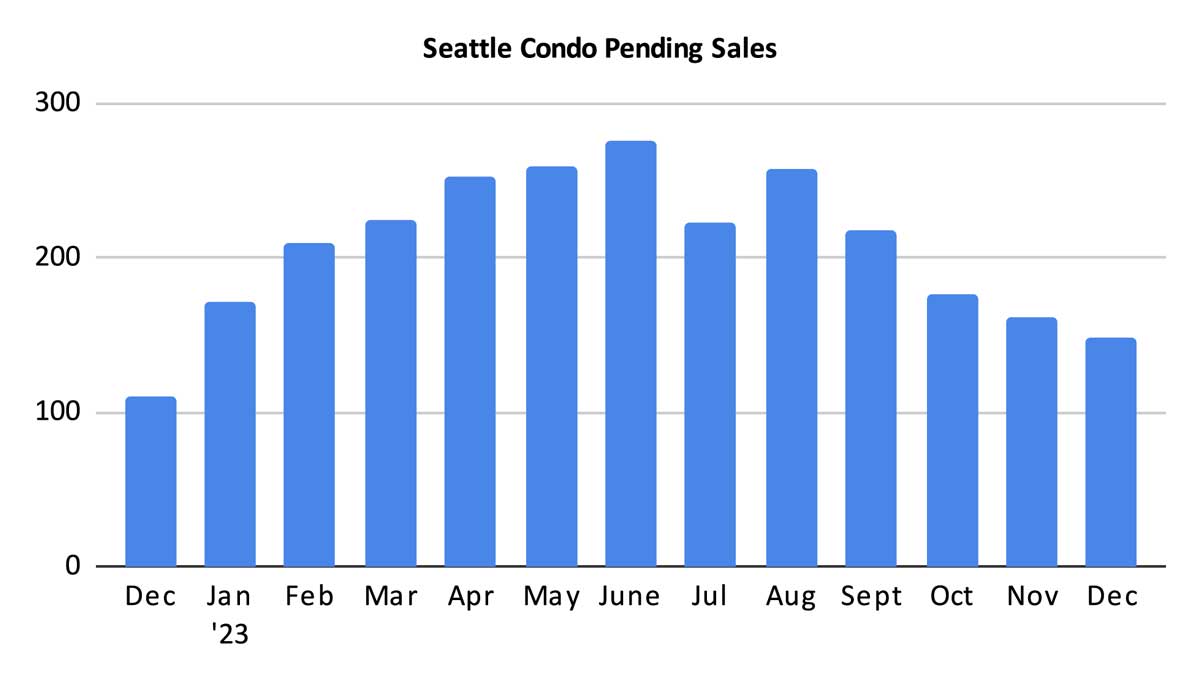

There were 149 pending transactions (listings under contract in escrow) in December, reflecting a year-over-year improvement of 34.2%. Though, it also reflected an 8% dip from the previous month. With our cyclical, seasonal market, condo sales activity and listings will increase with start of the new year.

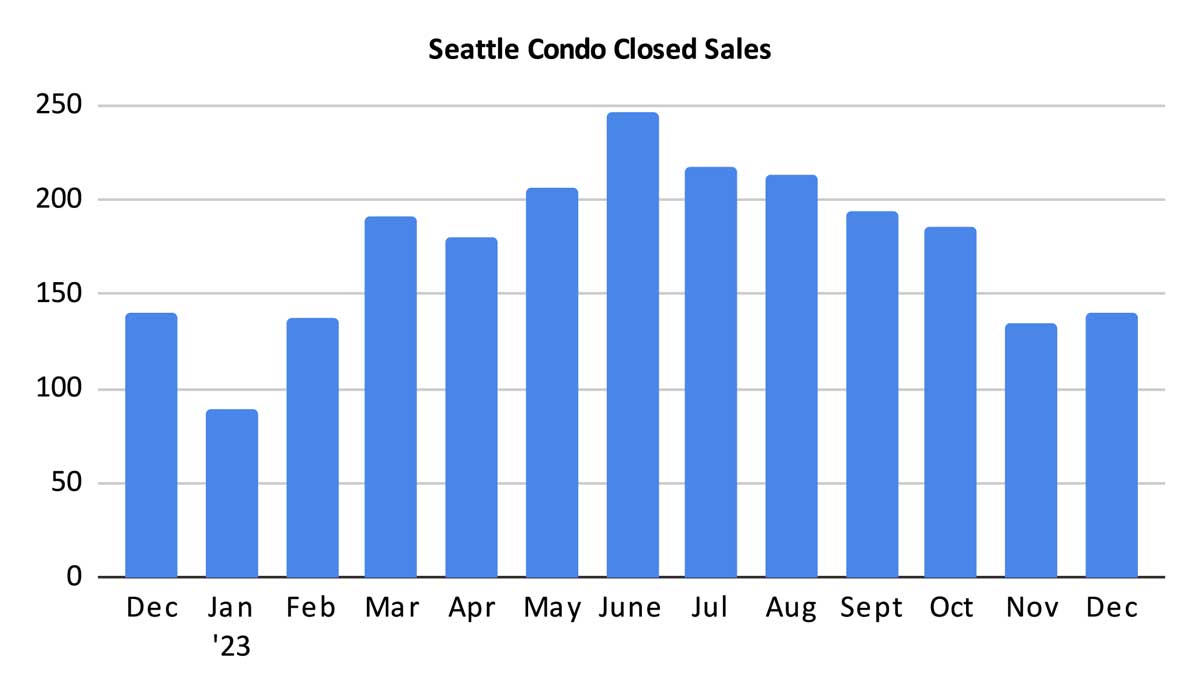

There were 140 closed condo listings in December, the same that we last December, and a 4.5% increase over November.

December wrapped up a fairly solid year for Seattle’s condo market. Low inventory levels of traditional condo units helped sustain demand along with strong selling prices. Though, high interest rates and tech company employment reductions had tempered condo sales in the downtown core areas.

The classification of new townhome developments along with in-fill housing with ADUs and DADUs added to single family dwelling lots impacted selling prices and inventory levels. These are larger, higher valued properties and contributed to resetting the median sale price record several times throughout 2023.

Going forward in 2024, the start of the new year will bring an uptick in listing inventory, buyers and selling prices. Falling mortgage interest rates may spur a more competitive market as we move toward the speak spring season.

Seattle Condo Market Statistics December 2023

Source: Northwest Multiple Listing Service. Some figures were independently compiled by Seattle Condos And Lofts and were not published by the NWMLS.

© SeattleCondosAndLofts.com