September 2009 Seattle Condo market update

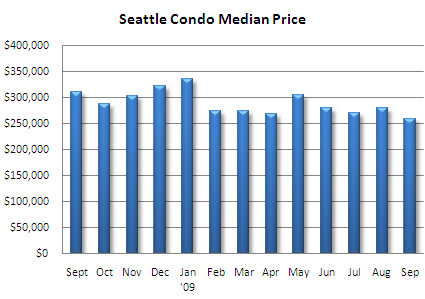

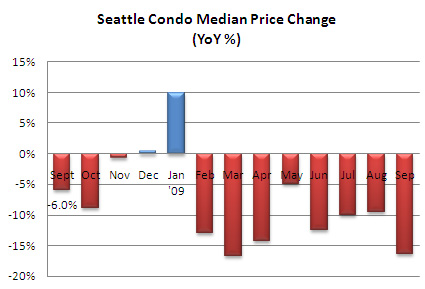

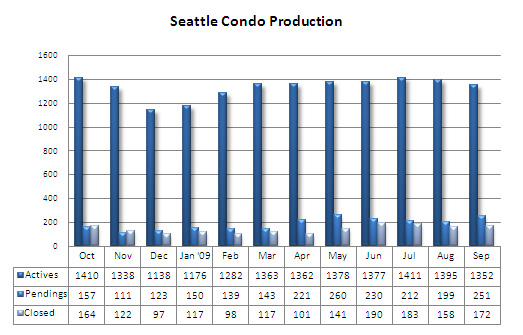

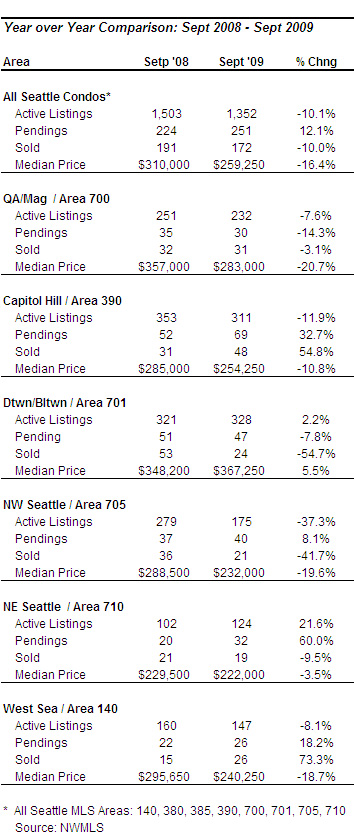

Seattle’s condo market kept churning through September even though the citywide median price fell to $259,250, a one month and year-over-year decline of 7.5% and 16.4%, respectively. The number of properties going under contract and closed increased over August, while available inventory and the condo supply rate dropped.

The $259,250 median condo price last month marked the lowest value point since February 2006 when the median price was $251,725. Historically, median prices tend to plateau or decline between August and September, then drop considerably in October. However, in addition to the down market and seasonal fluctuation, the first-time home buyers tax credit also contributed to the price slide. The median price is the middle point of homes sold, that is, half above and half below. In September 2007 and 2008, condos under $350,000 made up 61.9% and 64.2% of the total number of units sold. In September 2009, condos priced under $350,000 accounted for 80% of the total units sold, a significant increase in the number of lower-priced properties that shifted the median point downward. The pricing trend will continue for the next two months with the rush to buy before the tax credit expires at the end November and the seasonal Fall downturn.

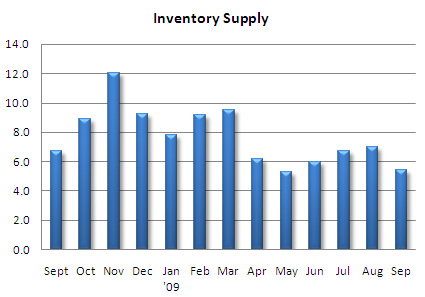

The condo inventory supply rate decreased to 5.4 months in September due to a drop in active listings and a rise in the number of properties going under contract (Pendings), which would move Seattle back towards normal market conditions. However, pendings generally decline between August and September so last month’s bump may be attributed to the tax credit. Additionally, mortgage rates on 30-year fixed recently dipped below 5%, increasing affordability and buying power, which may have spurred sales as well.

The data used in this report comes directly from the Northwest Multiple Listing Service (NWMLS) database and are either compiled and published by the NWMLS or compiled by myself. The database, however, does not include all properties for sale or that have sold, and is missing a good chunk of sales last month. The 80 or so units sold (pending) at auction last month – Brix and Gallery – are not reflected in the NWMLS database, therefore, understating the number of pending transactions. Officially, there were 251 pendings last month, though it’s probably closer to 330. It will have a greater effect next month as it’ll not only under count the number of closed sales for October, but their exclusion will deflate the median price. The median price of the Brix and Gallery auctions was $330,000.

Some say the tax credit artificially boosts sales volume, others say it provides the needed inertia for the market to rebound. In any case, the tax credit is slated to expire on November 30th. Given the current escrow time frame (about 45 days), the long Thanksgiving weekend and the rush to get sales closed in time, properties should be under contract by the end of this week at the latest to ensure eligibility for the credit.

The National Association of Realtors has been lobbying Congress to extend and/or expand the credit beyond November 30th, but at this time, opinion is mixed on the outcome. Given more pressing issues like health care, Congress is unlikely to vote on the tax credit any time soon, which according to Lennox Scott, CEO of John L. Scott, means that the credit will cease on November 30th. Scott, who is involved with NAR’s legislative arm, stated it takes about 45 days from passing a bill until its implementation; therefore, October 15th is basically the last day to pass the extension bill in order continue the credit uninterrupted. It is hoped that the credit will be continued in 2010.

The inventory supply rate shows months of supply. For September 2009, the supply rate was 5.4 months.

Source disclaimer: Most, though not all, information and statistics were complied and published by the NWMLS.