October 2009 Seattle condo market update

The Seattle condo market rebounded in October with increases in sales, number of closings and median price, likely fueled by the rush to qualify for the first time home buyers tax credit that was set to expire at the end of this month.

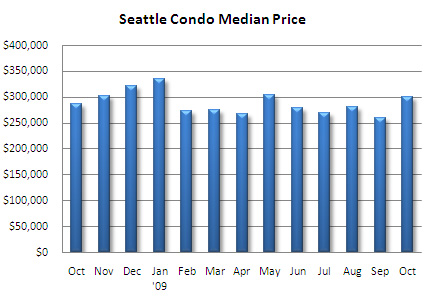

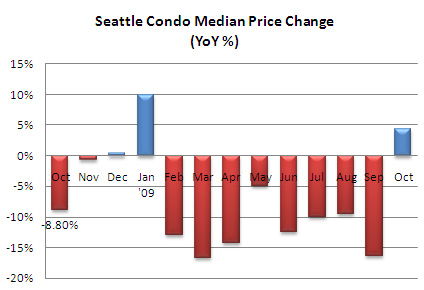

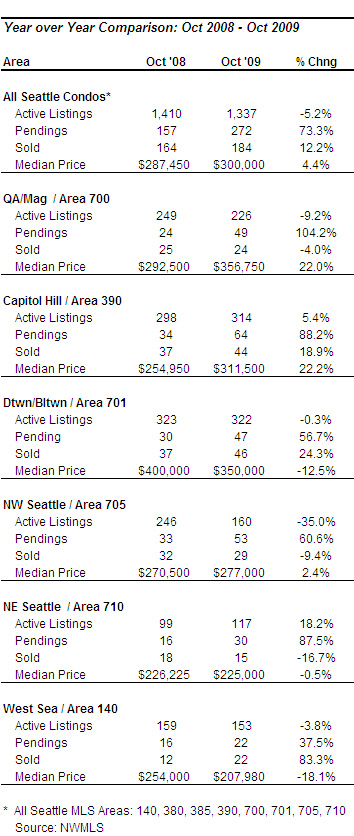

The median condo price rose to $300,000 last month, reflecting a 4.37% increase over last October and a one-month rise of 15.7% from September. That also reversed an 8-month slide in the year-over-year median price figures. In theory, the actual median price was higher than $300,000 as sales resulting from non-traditional means are not attributed in the NWMLS statistics. While I don’t have up-to-date closing numbers from the Brix and Gallery auctions (they were supposed to close by the end of October), only a handful of Brix sales were accounted for in the NWMLS figures, out of approximately 80 sales. The median sales price for the Brix and Gallery auctions was $330,000.

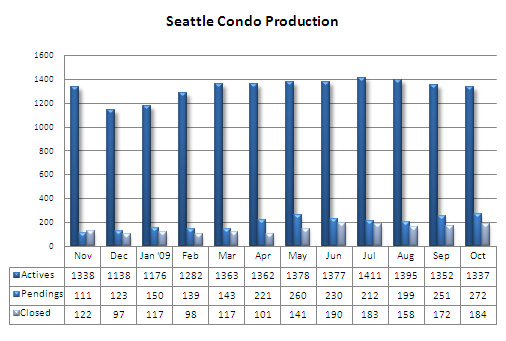

The number of Pending sales (under contract but not yet closed) increased dramatically in October to 272 units, an increase of 73.3% over the prior year and 8.4% more than September, presumably due to the tax credit deadline.

Closed sales increased 12.2% in October to 184 units compared to the same period last year. This is rather significant as it was the first year-over-year increase in closed unit sales since November 2007.

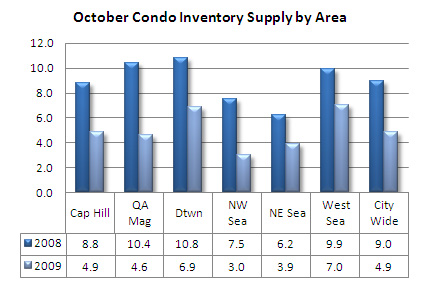

The number of active listings dropped to 1,337 units last month, a 5.2% decrease from October 2008 and a 1.1% dip from September.

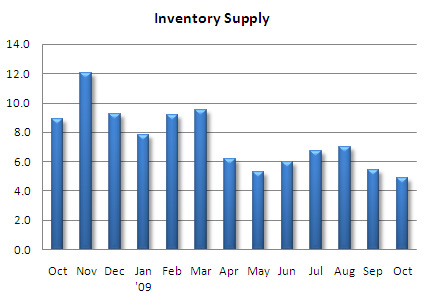

The inventory supply rate decreased to 4.9 months, the lowest since August 2007, which would be indicative of normal market conditions. I base the supply rate on pending transactions rather than closed sales, which is the most common method. A case can be made that given the prevalence of short sale failures that using closed sales is a better option. In that case, the supply rate would be 7.3 months of inventory – a buyer’s market. However, supply is dependent on available properties and once a property goes pending it’s generally removed from active inventory and is no longer available to other buyers.

What does all this mean? Have we reached bottom and are now on the upward swing? For now, I’m going to say that October results were a little anomalous given that much of the activity was spurred by the pending deadline (at the time) of the first time home buyers tax credit. The same will hold true for November as well. Now with the credit extended through April 2010 and expanded to include existing homeowners, there’s no longer an urgency to incent buyers to act. On the other hand, the tax credit may provide just enough inertia to keep the condo wheels spinning through the end-of-the-year cyclical downturn.

Source disclaimer: Most, though not all, information and statistics were complied and published by the NWMLS.

We are seeing an uptick in condo sales in Leavenworth this fall, but unrelated to the first time home buyer credit. Last year at this time our first condo auction froze the market while folks waited to see what was going to happen. This year, savvy investors and vacation home buyers are taking advantage of oversupply and buying condos at big discounts over past pricing.

http://iciclecreekrealestate.com/2009/10/19/leavenworth-condo-update-fall-2009/

Just wondering…?

Has demand for condos been brought forward with the looming expiration of the 1st time home buyer credit in Nov 2009? Year over year closed sales data for most of this decade has a pattern of diminishing sales in the fall but this year the trend has been broken with increased sales in the fall.

If the demand was brought forward then what does that mean for future sales. Is this going to look like the cash for clunkers program which produced a bubble of sales that diminished rapidly when the program ended?

If sales fall will prices fall with them? We will have to wait and see.

Some demands definitely have been brought forward by the home buyer credit, it will be very interesting to see the effect of the newly expanded credit – will that encourage enough people to sell their home and buy condo (or vice versa) and hence activate the market?

The first time home buyers tax credit has contributed to greater sales volume this year. In looking at sales volume of condos under $350,000 for the past several months, the percentage of sales under $350,000 relative to total sales have increased greatly this year compared to prior years.

October messed that thinking up a bit. Sales of units under $350,000 in October 2009 accounted for 69.3% of total sales; in October 2008 it was 73%. Not only did the year-over-year figure decrease, there was a smaller percentage of sub-$350,000 units sold (69.3%) compared to prior months as well.

Unit sales of sub-$350,000 units for October 2009 and 2008 were 129 and 119, respectively, an increase of 10 units sold or 8.4%. Therefore, it’s difficult to say the tax credit, alone, had much of an impact on sales last month. Better values and low interest rates probably had considerable influence as well.

November will be more telling as closings this month went under contract back in September and October and tax credit buyers were up against the deadline, noted by the huge spike in Pendings last month.

Had the extension/expansion not been approved, I would have anticipated a drop in activity going forward. There’s going to be a significant decrease from November to December (rush to meet the old deadline artificially boosts November figures) and the cyclical slowdown. Though, I do think the extension will stabilize the market further. (Note: the market was fairly stable this year – median prices plateaued, inventory supply rate normalized.)

I don’t think the expansion will have much impact; $6,500 doesn’t seem sufficient to incent a current homeowner to buy a higher priced home, plus it’s limited in that owners must have lived in the property for 5 of the last 8 years. Rather, it’s a “bonus” for those qualified buyers who are planning to move-up. The same could be said of the first-time buyers credit, but I think $8,000 is more significant to a first-time buyers as are different motivational factors.

Here is Texas we have def. seen an increase in buyers since the expansion of the tax credit.