July 2024 Seattle Condo Market Report

The Seattle summer seasonal market plateau was clearly evident with July’s condo market results. Seattle condo sales were down and the number of new listings stagnated. On the other hand, the median sale price was up.

Selling Prices Holding Steady

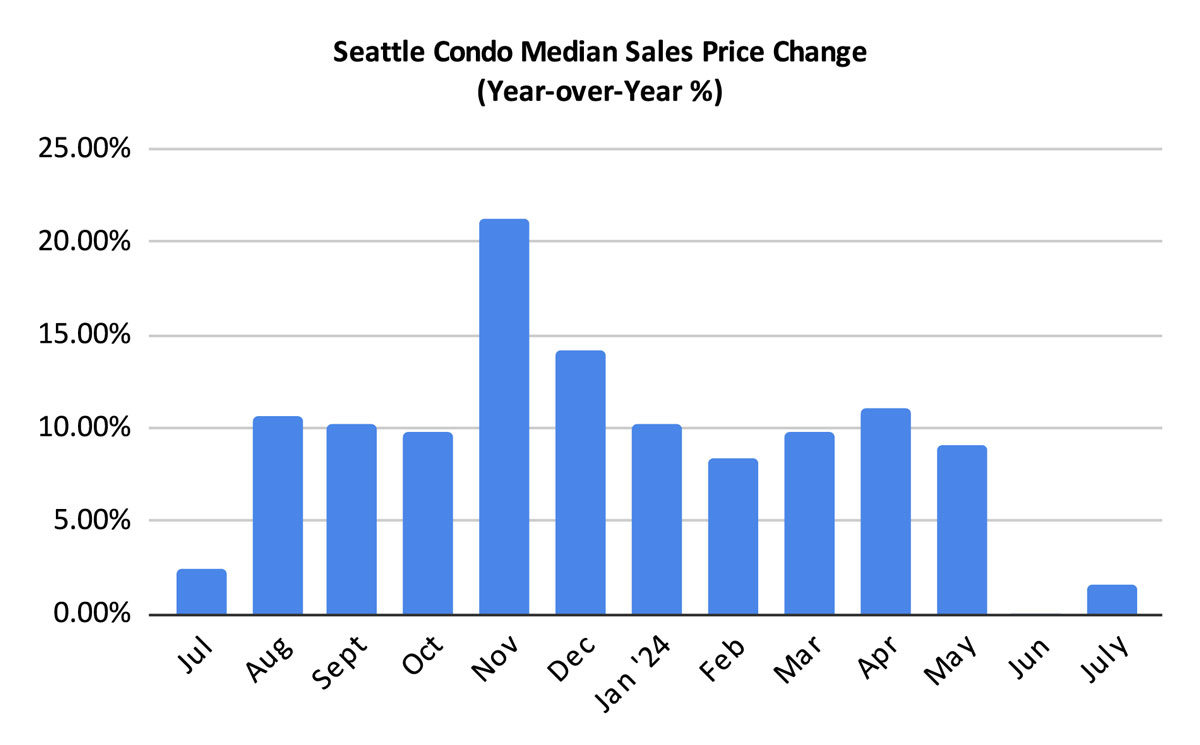

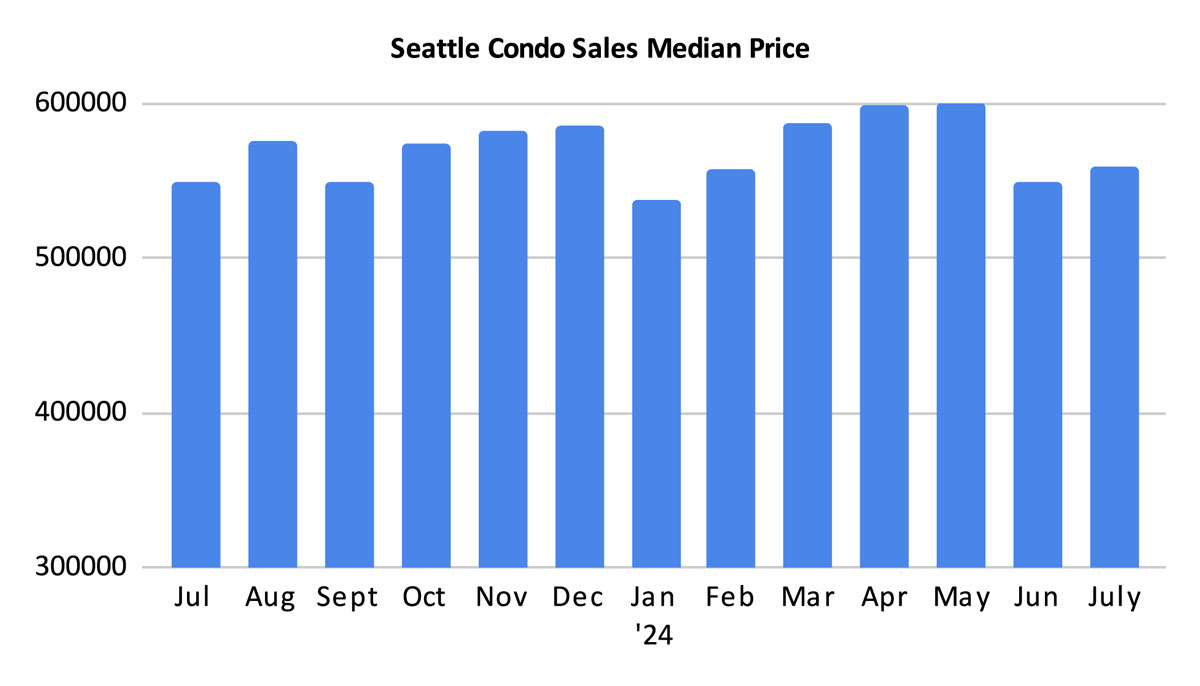

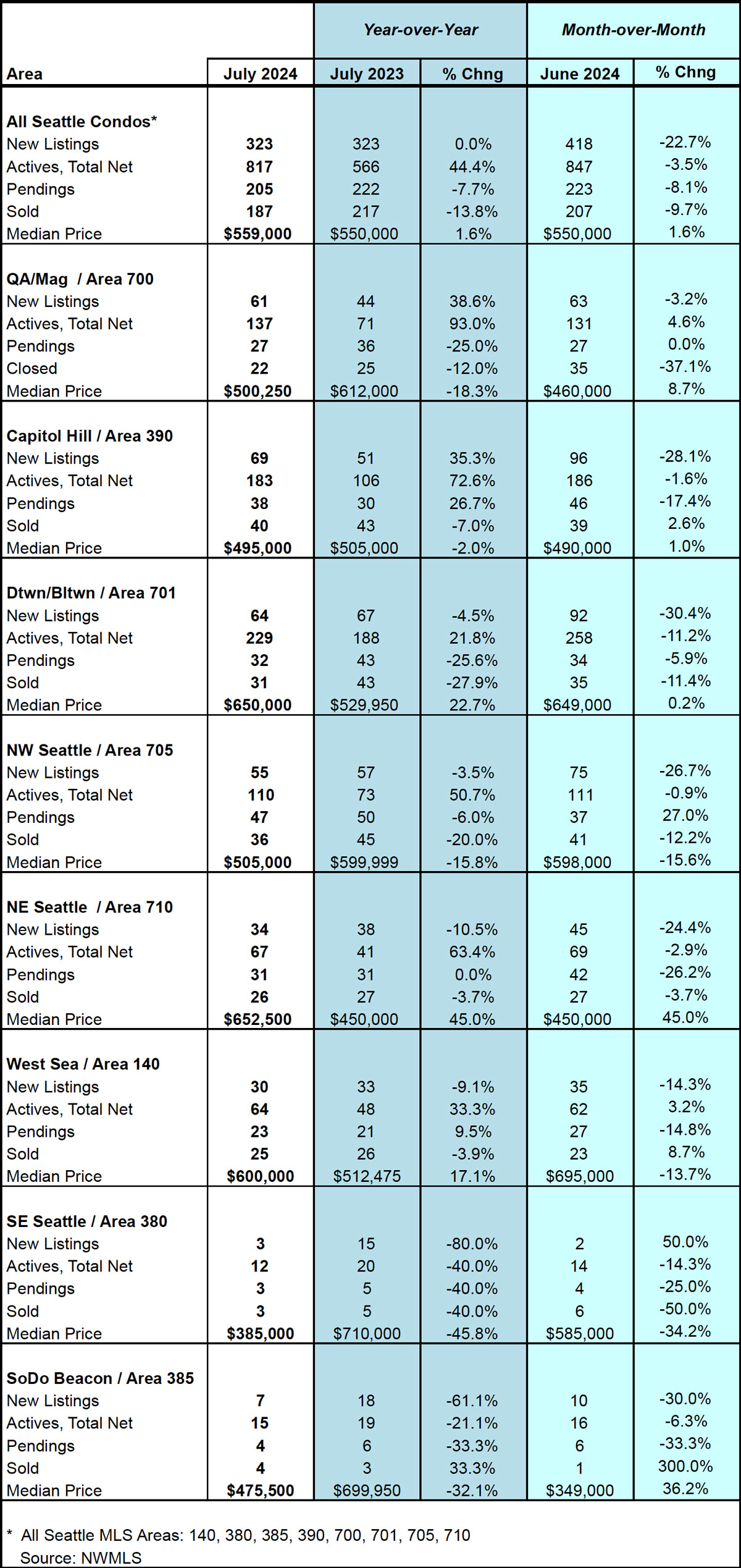

Seattle’s citywide condo median sales price in July was $559,000, reflecting a modest 1.6% percent increase year-over-year (YOY) and month-over-month. Several areas also experienced YOY increases – Northeast Seattle (+45%), downtown/Belltown (+22.7%) and West Seattle (+17.1%). Conversely, Southeast Seattle (-45.8%), South Seattle (-32.1%), Queen Anne / Magnolia (-18.3%), Northwest Seattle (-15.8%) and Capitol Hill / Central (-2%), exhibited decreases in their YOY median sale prices. See this table for complete area results.

While these percentages may seem huge, they are based on relatively small sample sizes and are only comparing two one-month periods.

The median sale prices also include non-traditional condo properties such as townhomes, accessory dwelling units (ADU), detached accessory dwelling units (DADU), single family houses and boat moorage. These made up 21.4% of the sales in July and are generally newer and higher priced than the typical condo unit.

If we exclude non-traditional condo properties, then the citywide condo median sales price last month would have been $480,000 instead of $559,000, a sizable difference. And, compared to the same period last year, the condo median sales price actually decreased 2%.

Listings Stall

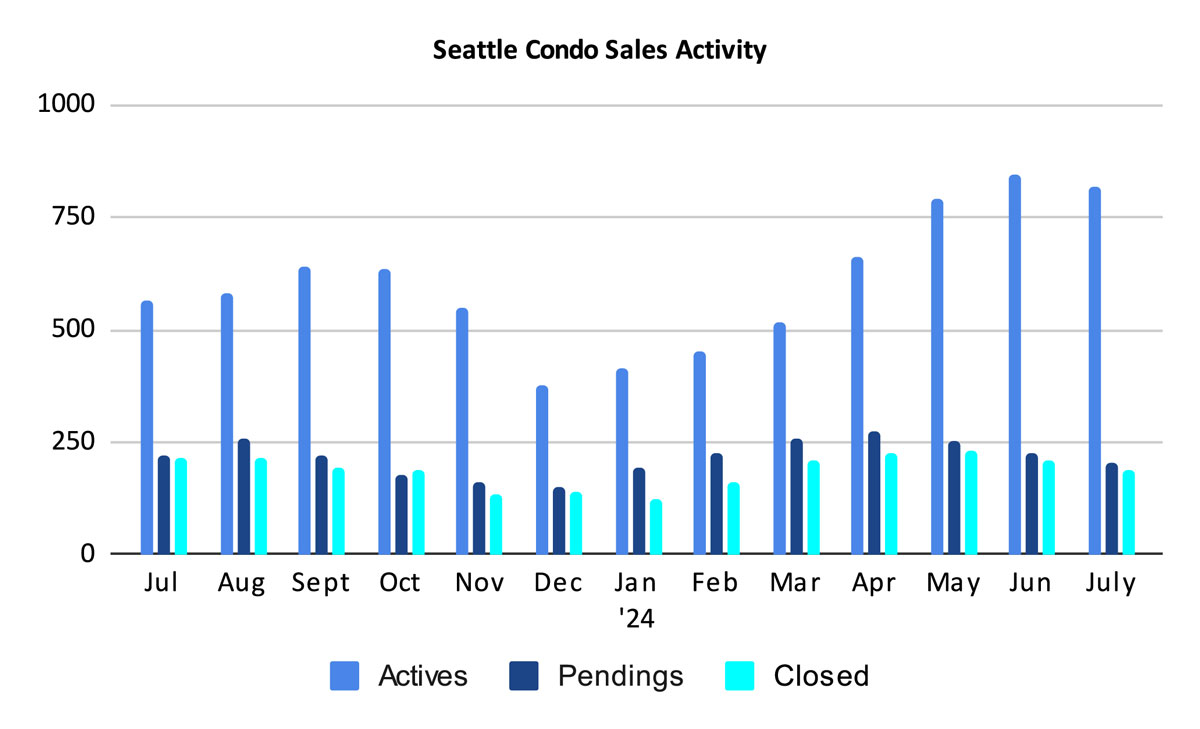

We ended July with 817 active listings for sale. That reflected a one-year increase of 44.4% over last July, but also a dip of 3.5% from the previous month.

The number of new listings coming to market slowed in July as well with 323 units, which was the same number as a year ago, and 22.7% fewer new listings than we had in June. That is not unexpected with the seasonal summer plateau – the sunshine, outdoor activities and vacation compete with selling homes.

Overall, there were 1,170 condo listings throughout the month of July (we started with 847 and added 323 new listings). Of that number 205 went under contract and 148 listings came off the market for other reasons – canceled, expired, temporarily off market or rented – leaving 817 listings at month end.

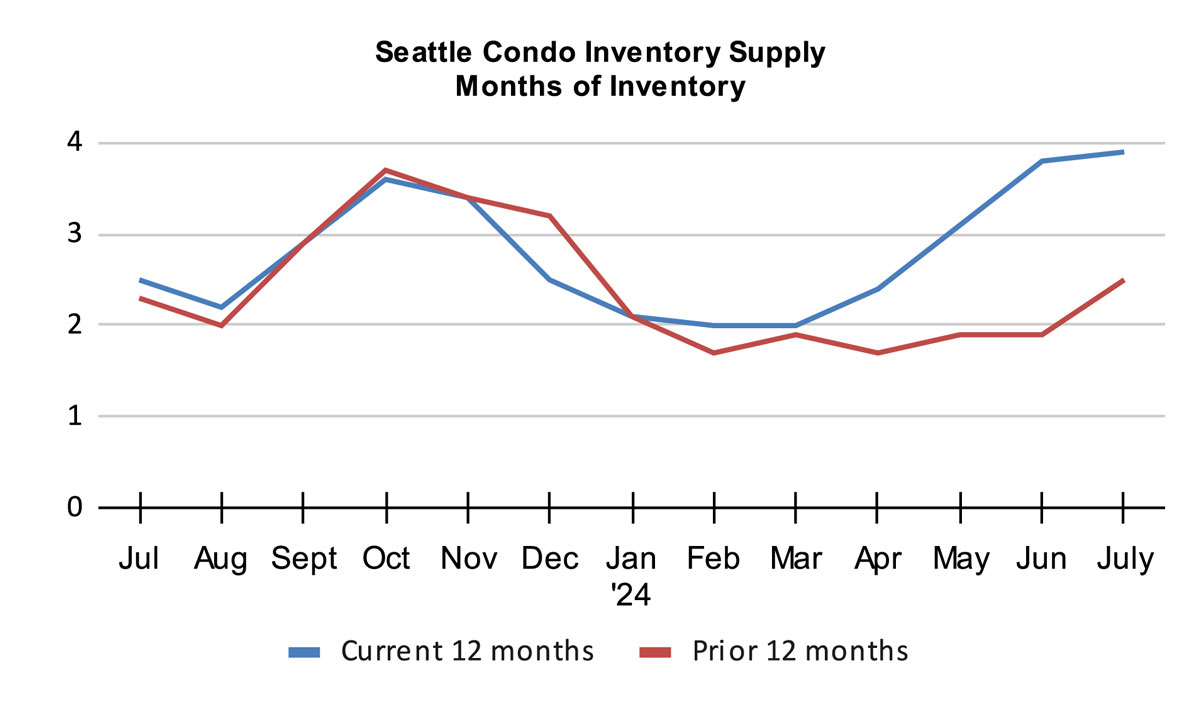

Although we had fewer listings in July compared to June, we also had fewer sales. As a result the inventory supply rate increased to 3.9-months of supply, placing Seattle’s condo market on the cusp of a normal / balanced market.

The inventory supply rate is a metric that classifies the current state of the real estate market. A rate of less than 4-months of supply is characterized as a seller’s market. A rate between 4 to 7-months is a balanced or normal market. And, a rate over 7-months is considered a buyer’s market.

With the exception of one month in November 2020 during the pandemic, Seattle has not experienced a balanced condo market since January 2012. That’s a 12.5 year seller’s market, technically speaking.

Seattle consists of a number of micromarkets based on neighborhood area, condo density and price points, therefore, buyers and sellers will experience varying market dynamics. For instance, a higher priced unit in condo dense downtown may reflect buyer market conditions versus a seller’s market for an affordable condo in Ballard.

Sales Velocity Diminish

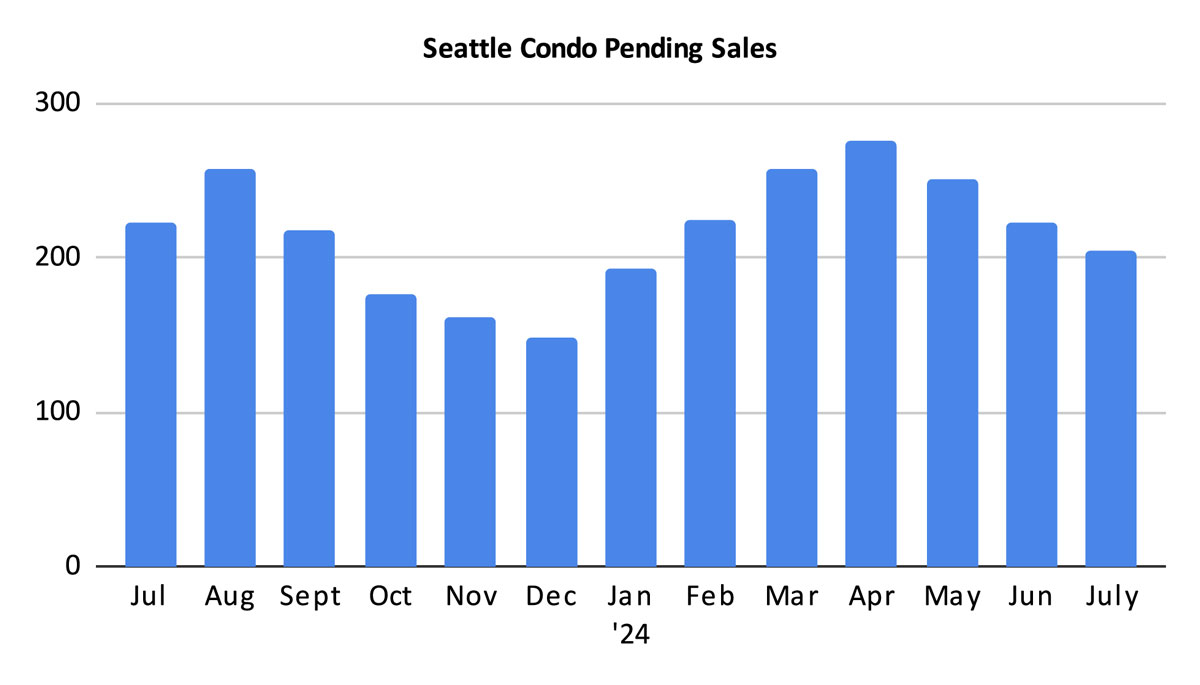

There 205 pending condo sales in July. That exhibited both a one-year and a one-month decrease in sales of 7.7% and 8.1%, respectively. Again, not completely unexpected as we typically see sales stagnate during the summer months before trailing off through the remainder of the year. Although, last year was a bit more robust for sales with 17 more sales.

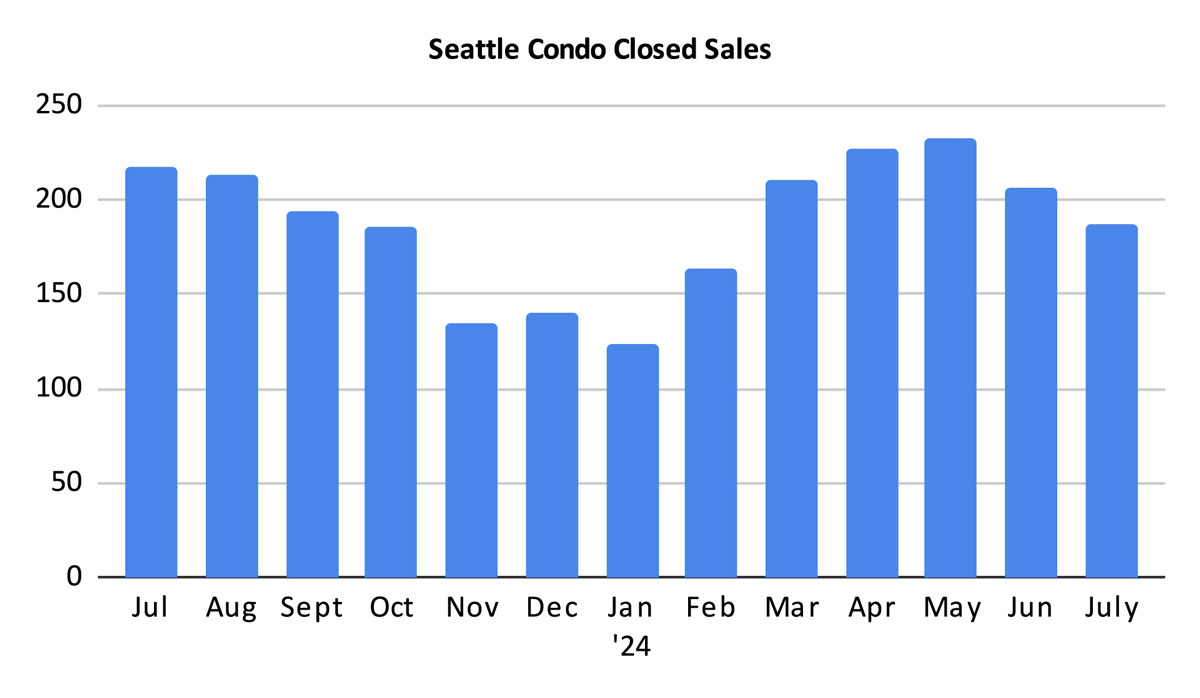

There were 187 closed condo sales last month, which also reflected year-over-year and month-over-month decreases of 13.8% and 9.7%, respectively. Closing transactions lag pending by a month, so as pendings start to decline, so too will the number of closings.

In summary…

Seattle’s real estate market is relatively cyclical, adjusting with the seasons. The summer seasonal reflects a transition from the active and competitive spring season to the softer autumn/fall season.

As a result, we see the market plateau and slow during the summer months. With our brief summer, people take advantage of the sunshine, outdoor activities and vacations. And, this year is no exception with fewer new listings coming to market and slowing sales velocity.

Overall, the citywide median sales price was up, but that included a number of higher-valued non-traditional condos such as townhomes, single family houses, ADUs and DADUs. Excluding these types of properties and looking at just traditional condo units, the median sales priced dipped 2% year-over-year.

This is good news for traditional condo buyers as they have plenty of options and have been encountering softening prices. However, their experience will depend on price point and neighborhood location.

Seller experiences will vary as well. Lower priced condo units are still selling relatively quickly. On the other hand, higher-valued properties are lagging on the market a bit longer.

Seattle Condo Market Statistics July 2024

Source: Northwest Multiple Listing Service. Some figures were independently compiled by Seattle Condos And Lofts and were not published by the NWMLS.

© SeattleCondosAndLofts.com