Seattle Condo December 2025 Market Recap

The Seattle Condo market finished off the year strong. The market shook off the winter doldrums and clocked in solid results in December. Median selling prices and unit sales increased, while inventory reduced.

Selling Prices Improve Slightly

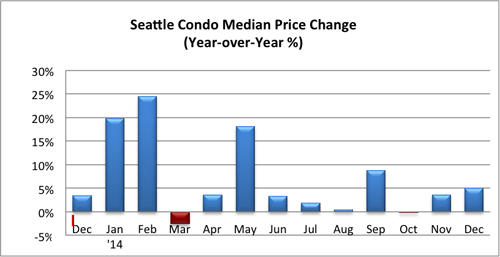

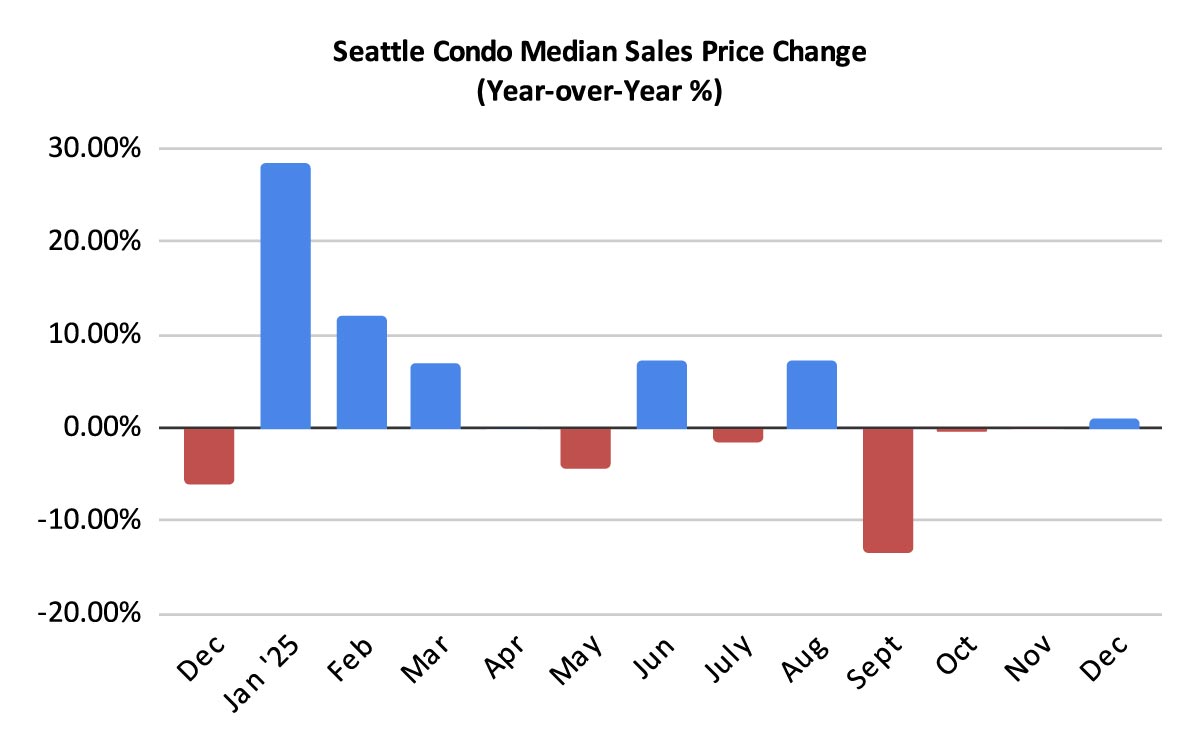

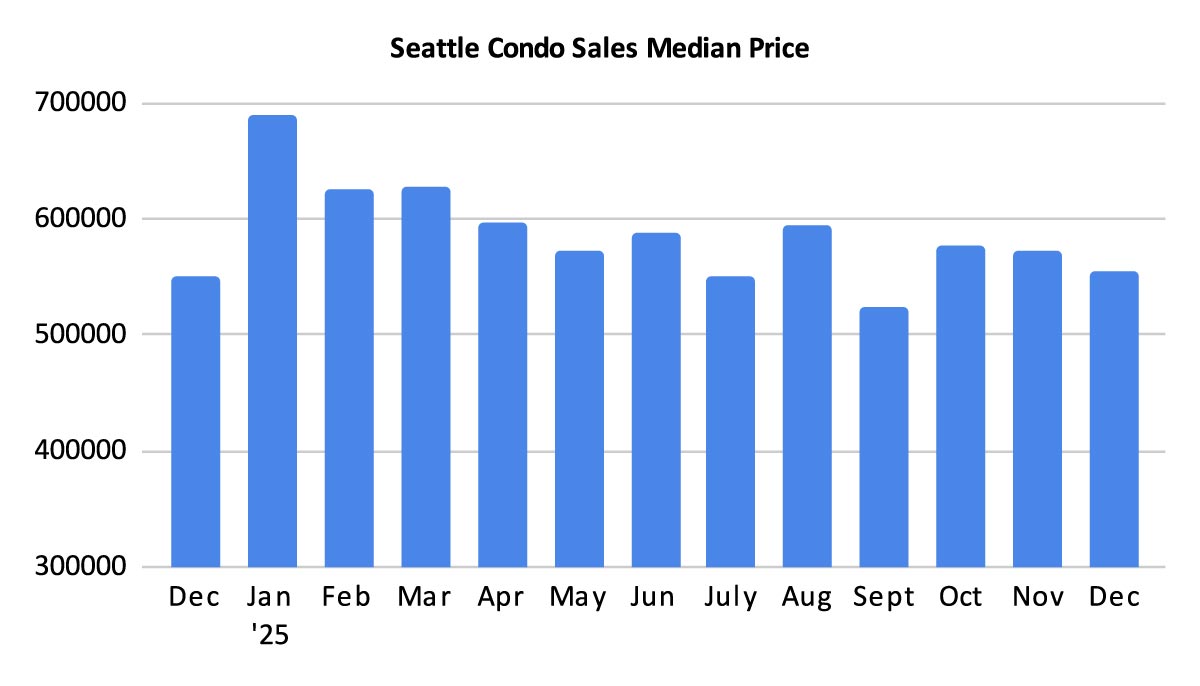

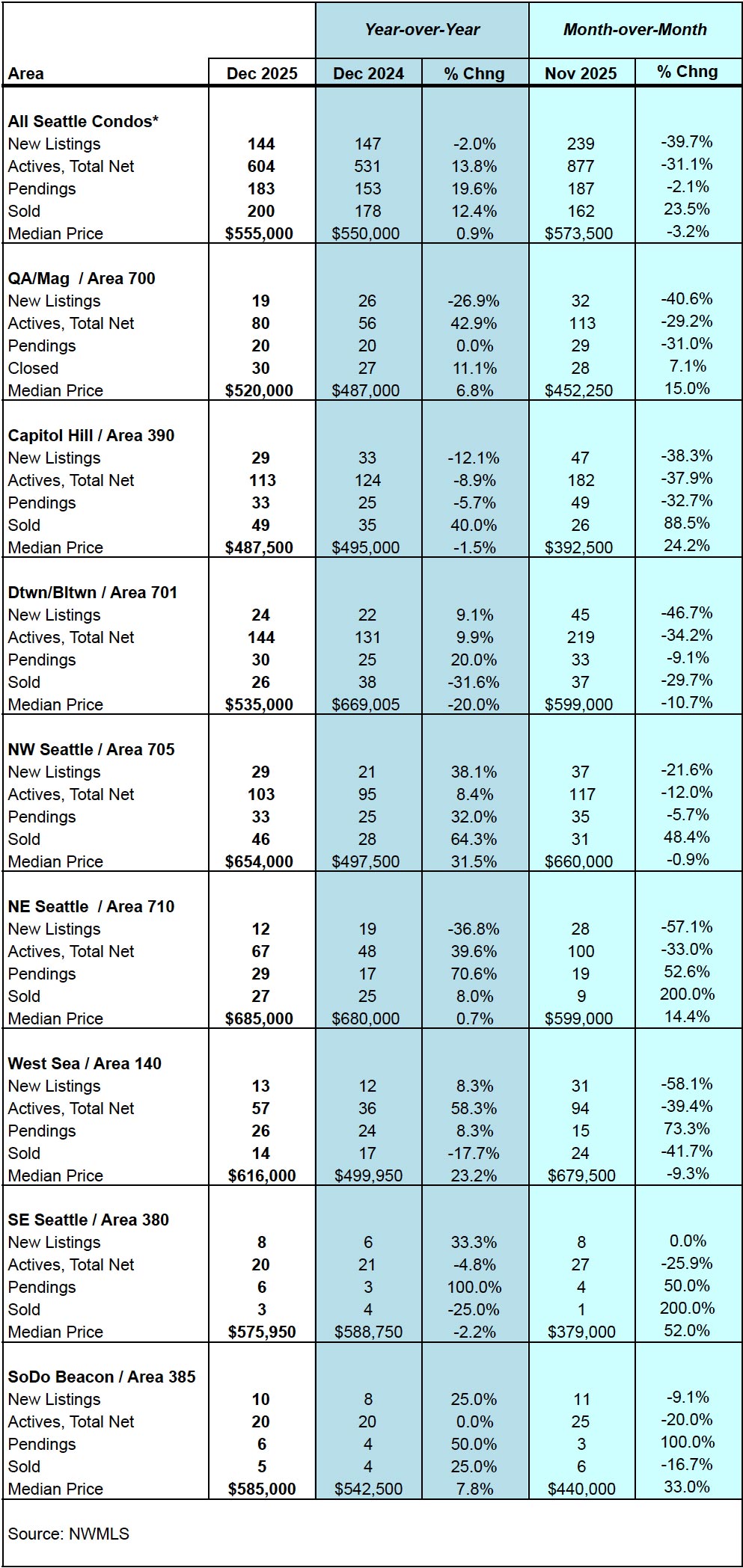

The Seattle citywide condominium median sales price was $555,000 last month. That reflected a year-over-year increase of 0.9%, but dipped 3.2% from the previous month.

Breaking that down by NWMLS neighborhood areas, Northwest Seattle (+31.5%), West Seattle (+23.2%), South Seattle (+7.8%), Queen Anne / Magnolia (+6.8%) and Northeast Seattle (0.7%) realized gains in their median selling prices for the month of December.

Conversely, Downtown / Belltown (-20%), Southeast Seattle (-2.2%) and Capitol Hill / Central (-1.5%) exhibited declines. Click here to view complete neighborhood stats.

These are based on all condominium sales. However, the NWMLS has a broad definition of “condominium”, which includes properties not traditionally thought of as condos. These include the plethora of new townhomes, condoized single family homes, accessory dwelling units (ADUs), detached accessory dwelling units (DADUs), boat moorage and parking spaces.

These non-traditional condo properties are usually newer, larger and more expensive than the typical flat-style unit in a multi-unit building or complex. In December, they accounted for 31.9% of all condo sales with a median sales price of $749,925. Non-traditional condos made up a larger segment of the condo market compared to last December (31.9% vs 24.9%), but reflected a year-over-year decrease of 13.6% as well as a one-month dip of 1.2% in its median sales price.

Traditional condos, on the other hand, had a median sales price of $489,875 in December and realized an increase in its median sales price of 4.8% over the same period last year and 4.2% more than in November.

Inventory at Year End Low

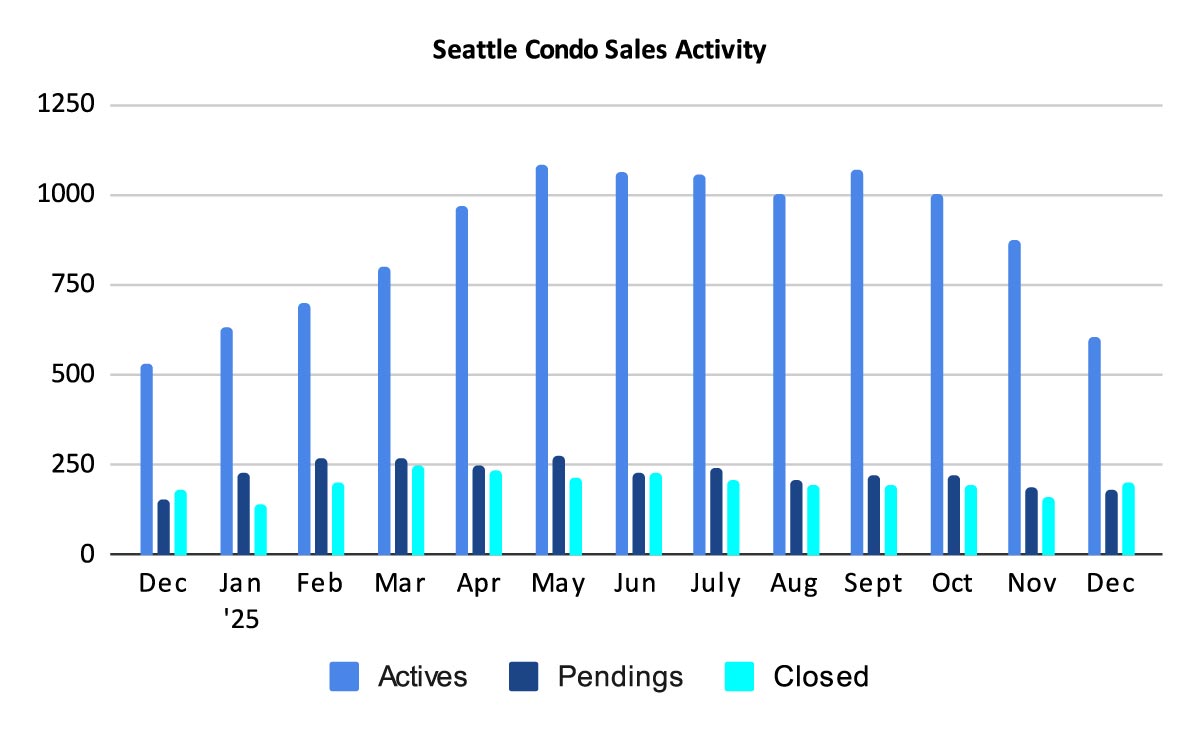

As we’d expect for December, the slowest month for real estate in the Northwest, and historically having the fewest number of listings, reflected a drop in inventory. Seattle ended December with 604 condo units listed for sale in the NWMLS, a decrease of 31.1% from November. However, that was 13.8% more than we had last December.

We started the month with 877 listings. To that, sellers and developers added 144 new listings throughout the month for a total of 1,021 units for sale. Of that, 417 listings came off the market in December due to sales, cancellations, expirations, being rented out or for other reasons, leaving 604 listings at month end.

That said, the most active season for real estate begins with the start of the new year and carries on into Spring. Cyclically, the number of condo listings will increase rapidly before plateauing in Summer.

With fewer listings for sale and strong sales volume in December, the inventory supply-rate dropped last month to 3.3-months of supply. That, technically, moved Seattle back into a seller’s market environment.

The inventory supply rate is a metric utilized to categorize the current market conditions. A rate of less than 4-month of supply is considered a seller’s market. A rate between 4 to 7-months is a normal or balanced market. And, a rate more than 7-months would be a buyer’s market. We utilize pending transaction when calculating the supply rate, though closed sales is also used.

Seattle’s condo market briefly experienced normal market conditions last year and I suspect we’ll be back there by Spring time. Interestingly, Seattle, as a whole, as not been in a buyer’s market since 2010.

However, Seattle’s real estate is comprised of micro markets based on locale and price points. For instance, with a combination of fewer listings and greater sales, North Seattle, Capitol Hill and West Seattle exhibited a seller’s market environment based on the supply rate (under 4-months). The rest of the city reflected a normal market environment.

Condo Sales Stronger Than Usual for December

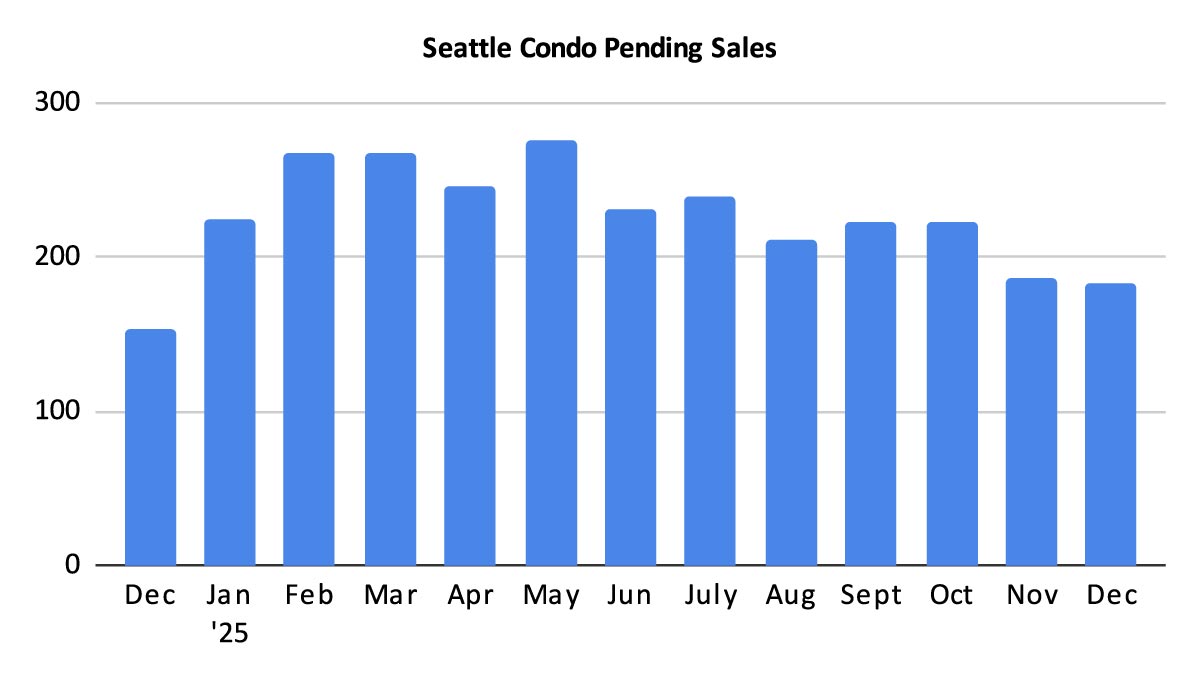

As hinted above, condo sales velocity increased in December with 183 properties going into pending status (accepted offers in escrow). That represented a one-year increase of 19.6% in sales, but a slight dip of 2.1% from the prior month. Although, that is to be expected given December is the slowest month for real estate sales.

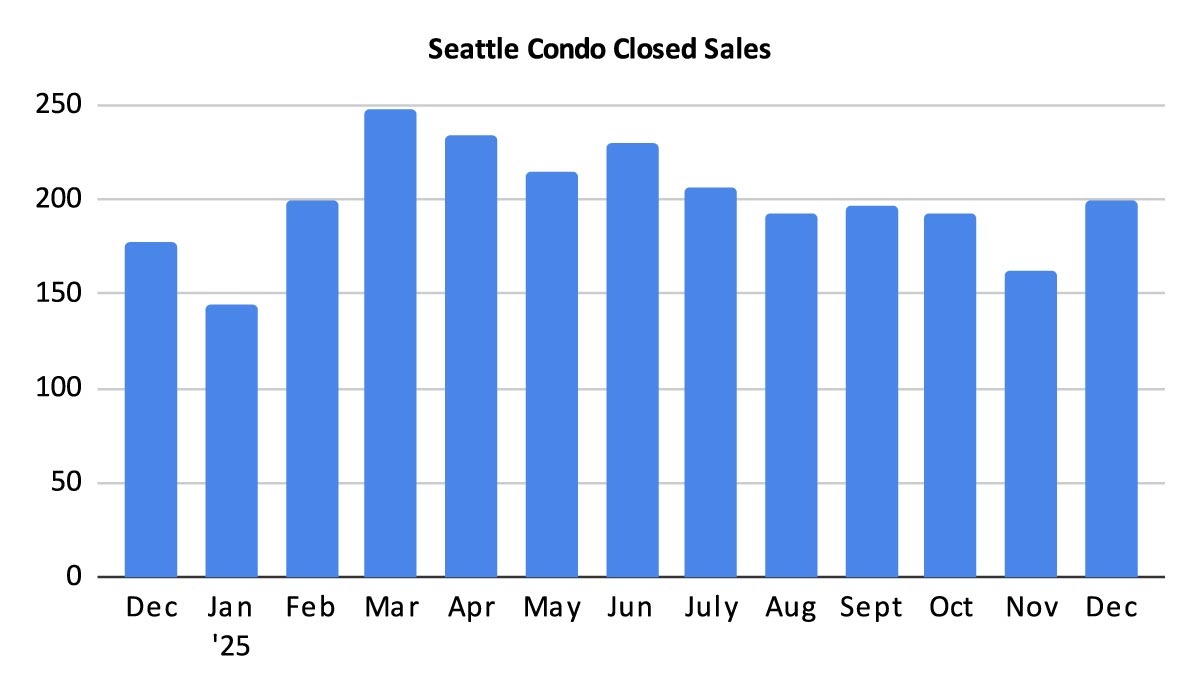

There were 200 closings in December, reflecting a year-over-year and month-over-month increase of 12.4% and 23.5%, respectively. It appears there were a number of pending transactions from October with extended closings in December.

In Summary

The Seattle condo market closed out 2025 on a high note. Median selling prices and unit sales improved in December. That bucked the historic trend with December being the slowest month for sales and with lower selling prices.

Inventory dipped as is typical for December. However, combined with stronger sales volume, the inventory-supply rate moved into a seller’s market territory.

Seasonally, as the market makes its way from Winter into Spring, inventory will increase as sellers dust off the winter doldrums. And, buyers will enter the market that’ll give rise to unit sales and prices.

Seattle Condo Market Statistics December 2025

Source: Northwest Multiple Listing Service. Some figures were independently compiled by Seattle Condos And Lofts and were not published by the NWMLS.

© SeattleCondosAndLofts.com