March 2024 Seattle Condo Market Review

Spring is now upon the Seattle condominium market. And, with the arrival of the spring season, the region’s real estate market has awakened from its winter slumber. In Seattle, that means a more active market place and rising selling prices.

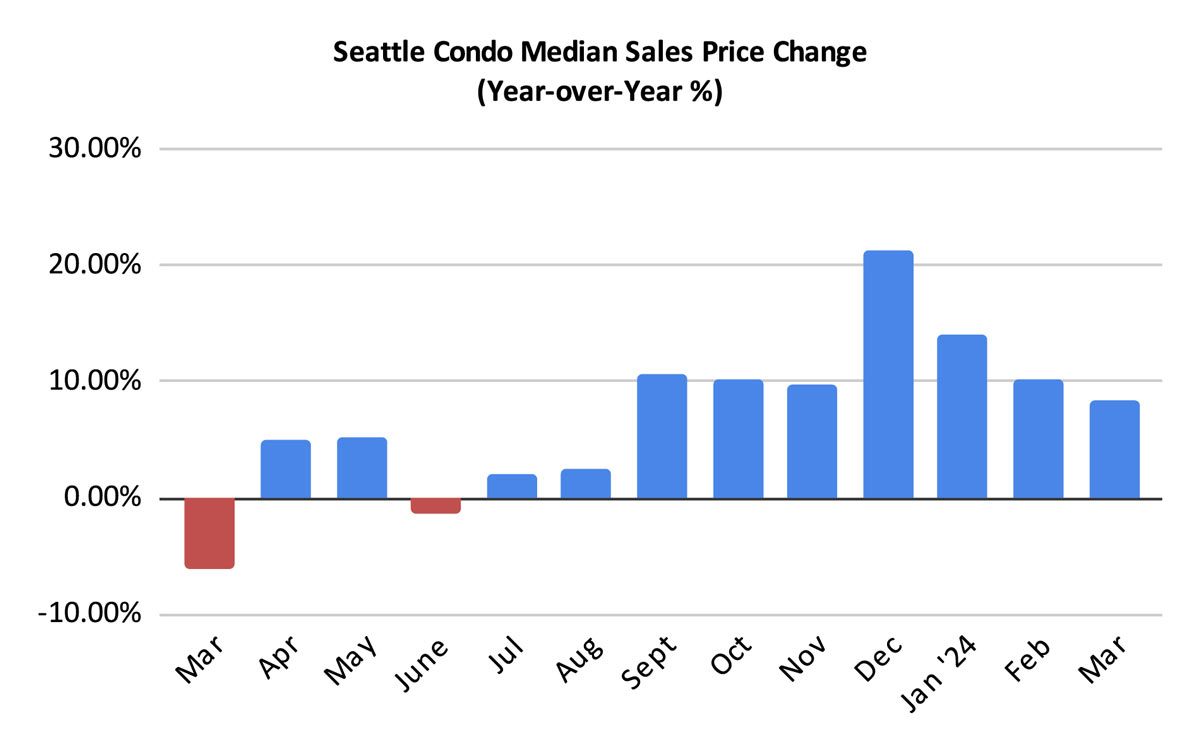

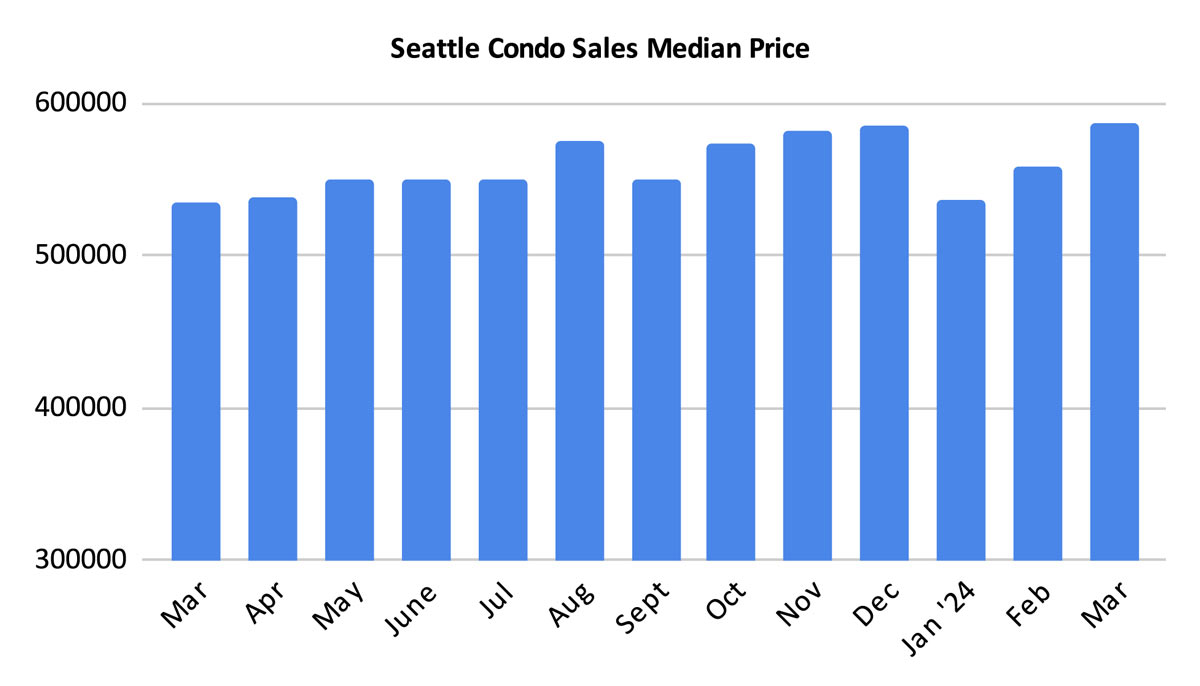

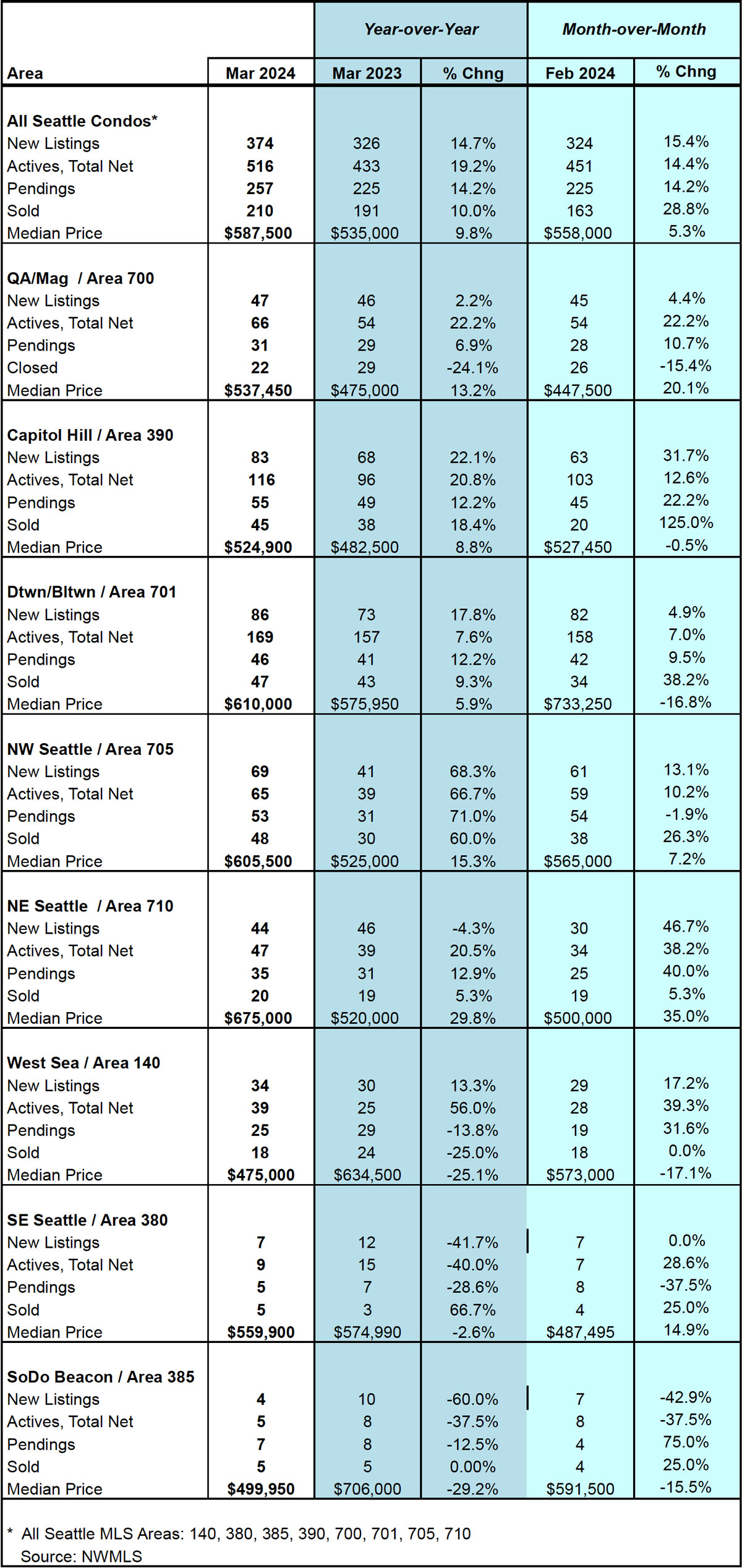

The Seattle citywide condo median sales price rose to a new all-time high of $587,500 in March, which eclipsed the previous record by $2,500. That reflected an increase of 9.8% year-over-year (YOY) and a 5.3% over the prior month.

Most areas of the city also realized YOY gains in March, notably Northeast Seattle (+29.8%), Northwest Seattle (+15.3%) and Queen Anne / Magnolia (+13.2%). Other areas bucked the trend and dipped like West Seattle (-25.1%). See full NWMLS neighborhood here.

A caveat to the high condo selling prices is the type of properties included in the broad “condominium” term. The NWMLS includes all legally organized condominiums under its condominium classification. Therefore, this includes not only the typical condo unit in a multi-unit building or complex, but also townhomes / rowhouses, accessory dwelling units (ADUs), detached accessory dwelling units (DADUs) and even single residential houses.

The latter are typically larger, newer and higher priced properties than the typical flat-type condo unit. In March, these made up 20.1% of closed sales and shifted the overall median sales price midpoint higher, resulting in the new record high of $587,500. However, if we exclude these, then the median sales price of typical condos was $535,000 last month.

Inventory On The Spring Upswing

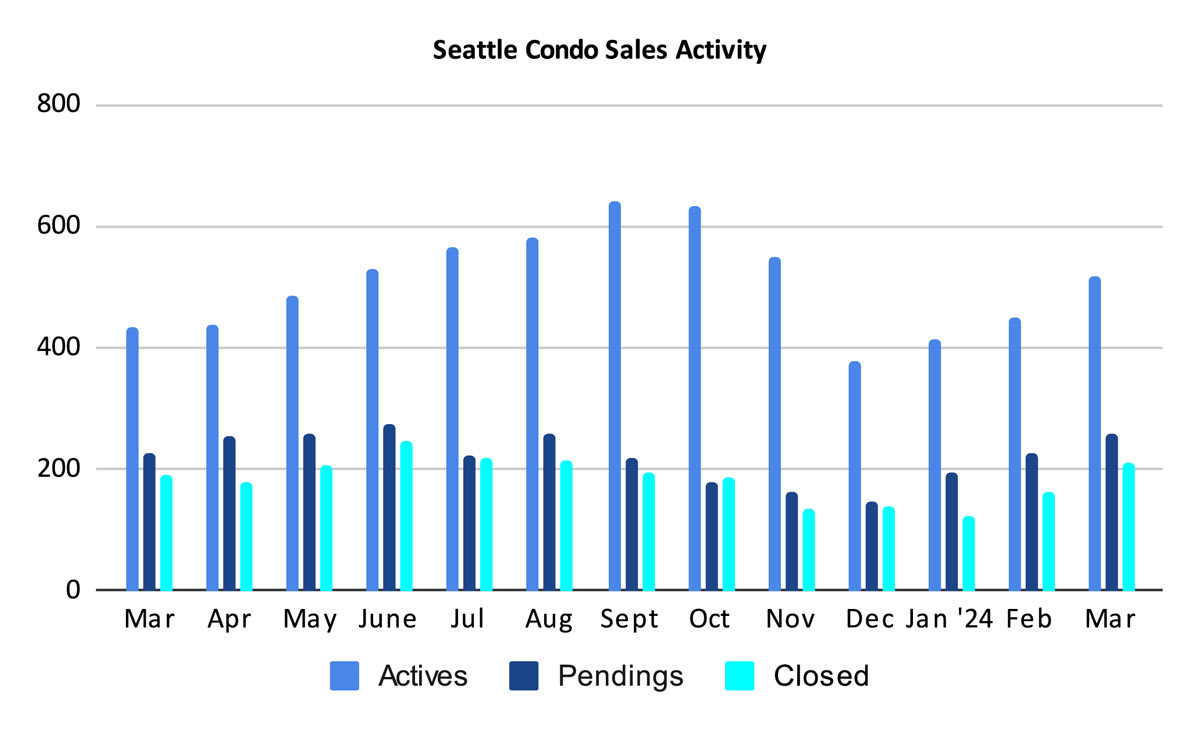

With the arrival of the spring season, sellers have been busy prepping their condos and bringing them to market. We ended March with 516 active condo listings, up 19.2% YOY and 14.4% over the prior month.

There were 374 new condo listings that came on the market in March, which reflected a one-year and one-month increase of 14.4% and 15.4%, respectively.

For March then, we started with month with 451 listings and added 374 for a total of 825. From that, 309 units came off the market through sales or other reasons (e.g. cancelled, expired, rented, etc), leaving 516 listings at month’s end.

While the number of listings increased overall, the inventory supply rate remained unchanged at 2-months of supply, based on robust sales activity for the month. This can also be expressed as the absorption rate, which was 49.8% in March.

The inventory supply rate characterizes the housing market environment. A rate of less than 4-months of supply is considered a seller’s market. A rate between 4 to 7-months is a normal or balanced market. While a rate greater than 7-months of supply would be a buyer’s market.

With a 2-month supply rate, Seattle’s condo market is considered to be in a Seller’s market. However, this varies widely when factoring price points, property types and neighborhoods. For example, a higher priced condo flat on Capitol Hill may experience more of a normal market environment, while an entry level property in West Seattle or a high-end townhome in Ballard may experience a more competitive market.

Condo Sales Pick Up Steam

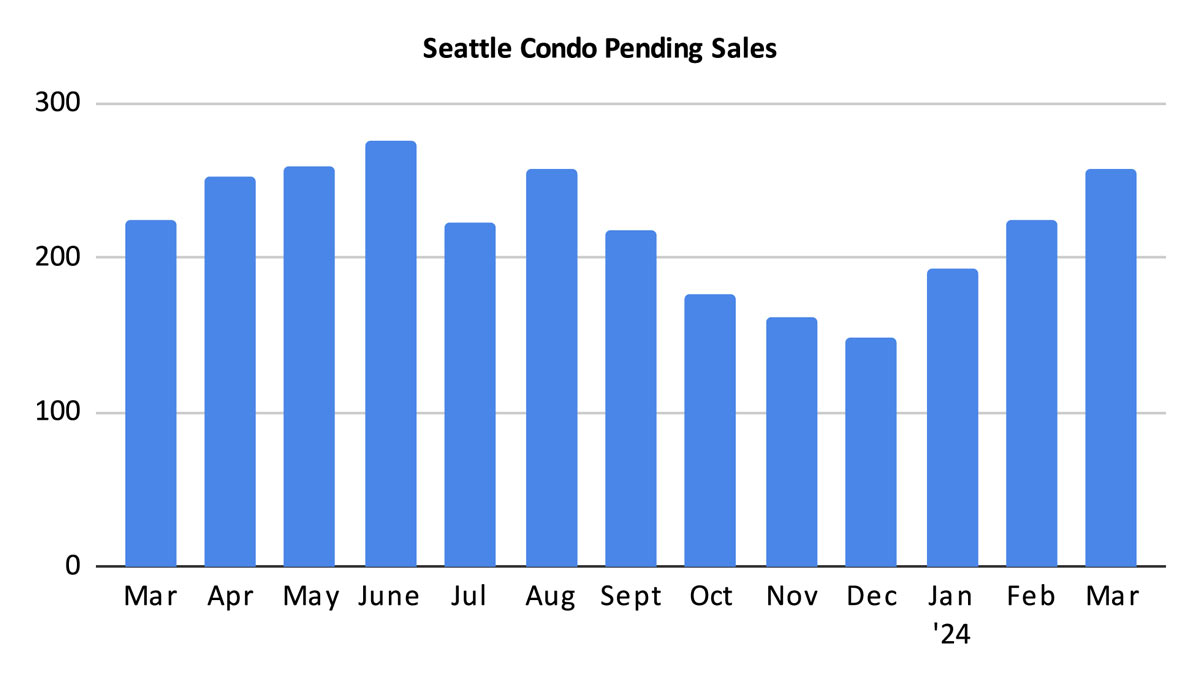

The number of condo sales, or pending transactions, rose to 257 units reflecting an increase of 14.2% both year-over-year and month-over-month.

Condo sales should continue to rise through summer given the cyclical nature of our market.

With strong pending sales activity, the number of closed condo sales increased in March to 210 units. That reflected a one-year improvement of 10% and a one-month jump of 28.8% over February. As with pendings, closings should trend upwards through summer.

In Summary

Spring has sprung in Seattle’s condo market resulting with a greater number of condo listings, more sales and higher selling prices. These improvements were tempered somewhat given the various housing types included in the “condominium” classification, which skewed the stats.

Nevertheless, even excluding these other property types, the market place for traditional condos improved solidly in March. Though, individual buyer and seller experiences will be dependent on micro-market segments such as neighborhood area, price points and property types.

Overall, buyers will benefit from greater supply and more options. Depending on their price point and desired neighborhood they may find themselves in a competitive market place, or they may find a bargain.

Sellers generally will encounter a strong market that remains favorable for them. In fact, we’re now in our 12th year of being in a seller’s market. But, again, location and price points will affect their experience and outcome.

Thinking of buying or selling a condo this year? Drop us a line and let us get you started on your homeownership journey.

Seattle Condo Market Statistics March 2024

Source: Northwest Multiple Listing Service. Some figures were independently compiled by Seattle Condos And Lofts and were not published by the NWMLS.

© SeattleCondosAndLofts.com