Tag: Mortgage Loans

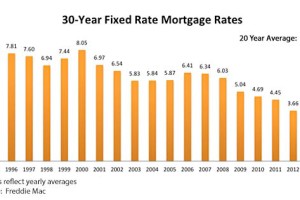

Mortgage Rates Continue to Fluctuate

The U.S. 30-year fixed rate mortgage interest rate continues to trend downward, making it more attractive to buyers and increasing their purchasing power.

3% Down Payment Conventional Condo Loans are Back

Cobalt Mortgage, a local mortgage provider, is now offering a low 3% down payment conventional loan option for condo purchases.

Condos Becoming Elusive for FHA Buyers

The effect of FHA’s 2010 condo approval and recertification changes are leaving condo buyers with fewer options as associations overlook or neglect FHA certification.

Congress Reinstate Higher FHA Loan Limits

On October 1, 2011 the increased loan limit for FHA Loans expired reducing the limit in the Seattle area from $567,500 to $506,000 for FHA back loans, potentially affecting upper-end purchases. Last week, FHA got a reprieve from Congress, which reinstated the higher loan limits in 42 states through 2013. For the Seattle/King County area…

Deadline Ticking for EHLP’s Forgivable Bridge Loan

The deadline for HUD’s Emergency Home Loan Program for at-risk homeowners facing foreclosure is coming up this Friday.

FHA and Conforming Loan Limits Expected to Reduce

The FHA and conforming loan limits are expected to reduce by $61,500 effective October 1, 2011.

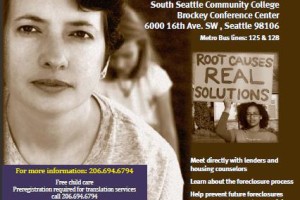

Mortgage Help Day – October 2, 2010

Mortgage Help Day connects homeowners facing foreclosure with their lenders and HUD-certified counselors to help remedy their situation.

FHA Announces New Changes

FHA, today, proposed significant changes to its program in order to reduce its risk, which will increase costs for borrowers.

HUD approves monetizing the $8,000 tax credit

HUD just approved the monetization of the $8,000 first-time home buyers tax credit on FHA loans, making it available to buyers at the time of purchase. Though, a few caveats apply.