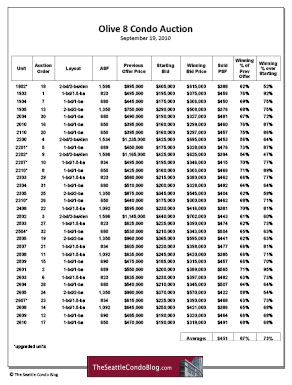

Olive 8 Condo Auction Results

Olive 8 Condominium concluded the auction of 32 units on September 19, 2010. Originally, 34 units were scheduled for auction, though only 28 were listed on the auction day list. After the 28 were auctioned, an additional 4 one-bedrooms were added (part of the original 34). The two units that were not available at the auction were #1901 and #2102, both two-bedroom + den units that were listed over $1 million.

The results were similar the prior auctions, with the winning bids averaging 67% of the last listed prices and averaging 73% over the starting bid prices. The higher priced two-bedroom + den units got the best deals, with winning bids averaging 42% below list prices.

If all auctioned units eventually close, by my estimate, that will bring the sold percentage to approximately 50%, leaving around 100 units remaining in Olive 8. The auction will reset market values within Olive 8 and other downtown buildings, so if you missed out on the auction, you’ll likely be able to negotiate decent deals post-auction. Given the state of the market and the rate of sales at other new condo buildings, it will take a year or more to sell off the remaining Olive 8 units.

View available Olive 8 condos for sale.

See also: Seattle Times write up

they’ll be going for fha approval now eh? didn’t get to go.

Not to nitpick, but… to nitpick, I believe you mean 173% *of* the starting bid prices, not 173% over.

You’re right… it should be of. I changed how I did this table but didn’t correct the verbiage. Thanks for catching that.

NOTE: I’ve changed the table to show the percentage over, rather than percentage of, which also retains consistency with the other auction results.

nice way to comment thomas! nice to see.

Thanks for covering this with such great detail and the added analysis. I was really surprised by the outcome of this auction- the discounts were much higher than I or my wife had anticipated.

It is hard to believe it is almost October of 2010 and we are still feeling reverberation from the O8 financial meltdown. It is sweet that condo prices are now tweeted in real time.

I’ve always been an efficient market sort of guy that gets really frustrated by the secretive selling tactics of condo sales in the 00 decade .

I am still a little baffled at the condo auction platform though. At front9 we sold the last third of our 264 units after 8-08 the traditional way because both the developer and equity partners had the wisdom to lower prices to match the market. The fundamentals of real estate are the same and the largest valve we have to control absorption is price. Sometimes it is simply the only thing that works.

Brett Frosaker

Do we have an results that show the auction prices were above the reserve prices set by the seller? Just because the auction closed doesn’t mean the unit is sold, depending on the reserve price.

@fschwiet That’s unknown at this point as there were no mention of the unpublished reserve price at the auction, so we don’t know if the “winning” bids met the reserve. If it didn’t, the seller will likely counter with a higher price.

Ben:

Great coverage of the auction. Here’s what the Seattle Times said about the developer acceptances of the bids:

“All winning bids were subject to an undisclosed reserve, meaning they could be rejected if they did not meet or exceed a minimum price set by the developer. Thyer said all but four winning bids had been accepted late Sunday.”

I’m guessing the four bids in limbo are on the four largest units — which went for huge discounts.

Your math is off a little Ben. O8 has 229 units. Closing 30 auction sales (best case) and ~70 already sold means they will still have 120+ units to sell. They sold only 17 units in 2010 before this auction, which is less than two per month.

How on earth can they sell 100 units in the next year (8 per month, a 400% increase) without dramatically changing prices? There just aren’t enough buyers, even at the auction prices.

buy 1 get 1 free?

jokes aside, we’ll no doubt take some time to fill olive 8, escala, and wow…cosmo. how many of those units were purchased as flips and just not listed now cause it’s simply pointless? regardless, i’m personally feeling like everybody is going to be just fine. there’s won’t be any ava, insignia, smith tower conversion, or stadium lofts anytime soon, but people are paying a significant amount more per square foot for new construction. i think the most heartbreaking story is all those people who are underwater with an “investment” they really can’t do anything with because the truth is, new construction condominiums downtown are a good value. they’ll sell em. not tomorrow, but they’ll turn into a home for somebody eventually of course. curious where you’re getting the deadline of needing to sell 100 in year tho… maybe from ben’s closing statement in saying it will take a year or more? was a safe thing to say for those not in the loop i think.

BUT, from feb to june, there were over 20 new construction sales each month–one month being 29. that’s well over 100 in 5 months. an option to buy new is certainly becoming less of an option and the only place that really has any comparable inventory is escala. if we just did another 5 months with the same sales we had this year, next year, a year is very possible. idk. i’m just running my fingers to avoid getting to my to do list.

It’ll more than a year (I did say, or more), and that’ll depend on how realistic Hedreen will be with pricing. Their premium pricing model hasn’t worked too well for them so far. Most of the remaining units are in the upper 1/4 of the building so they’ll be at higher price points (than the auctioned units) with a significantly smaller buyer pool.

The deadline of a year to sell is based on Olive 8’s refinancing of their loan one year ago for a two year term.

At what point does a bank pull a 5th and Madison or Escala like move and discount the entire property heavily just to move it?