Seattle Condo Market Recap January 2026

Seattle’s condominium market started 2026 a bit shaky. In January, we saw more listings as expected, along with fewer sales, and a drop in median selling prices compared to last year. Although, January 2025 may have been an anomaly.

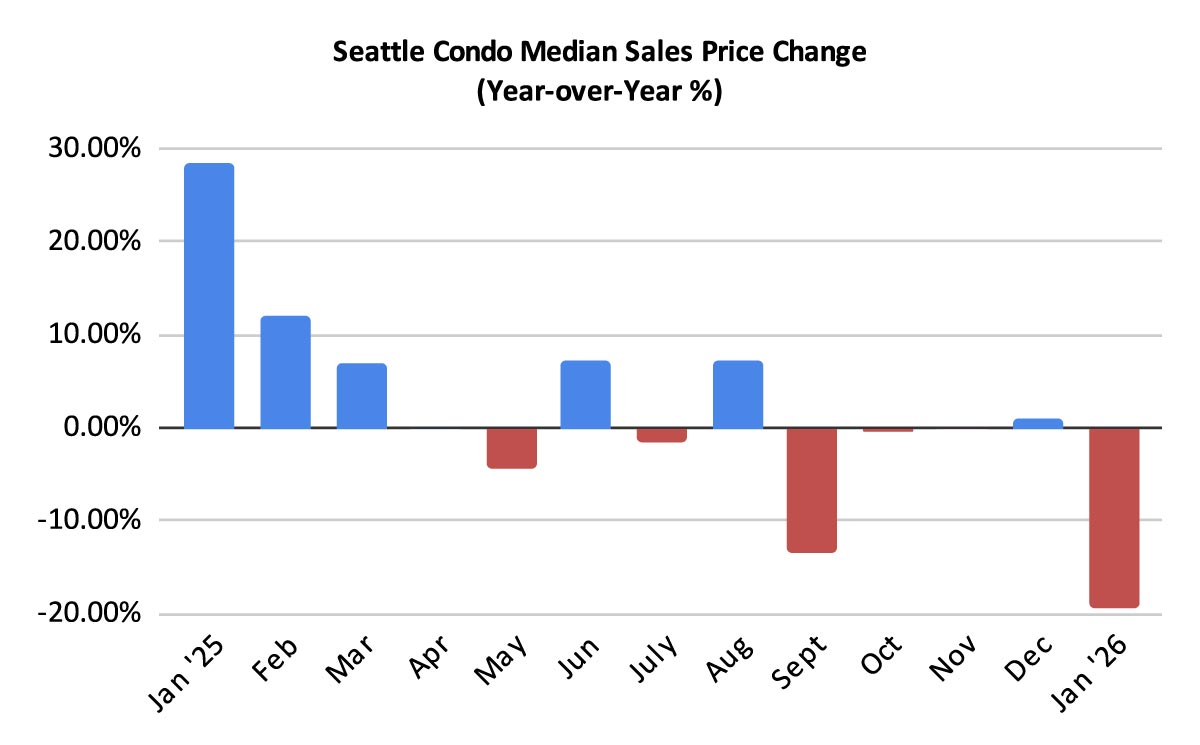

Seattle Condo Selling Prices Unravel

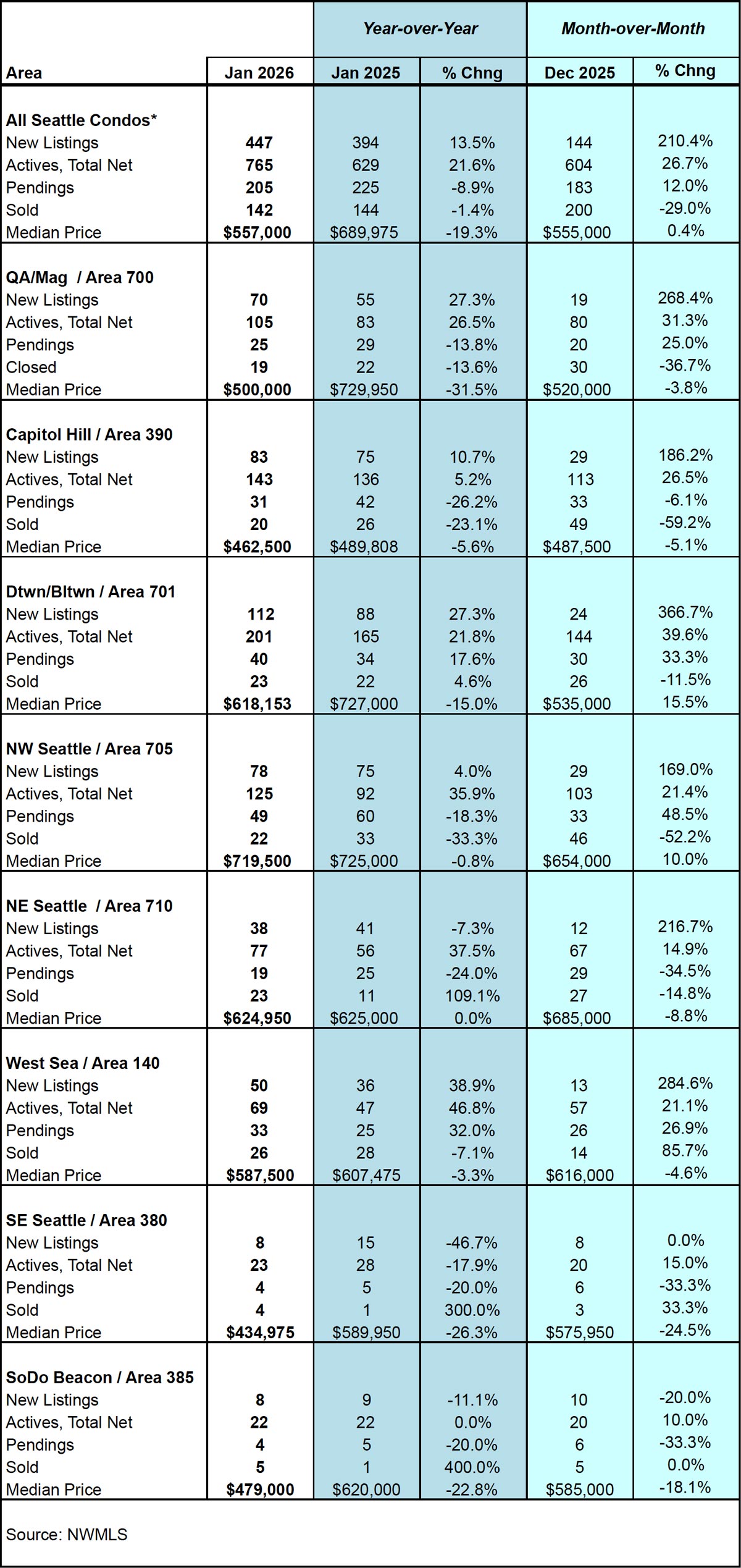

The Seattle citywide median sales price for condos was $577,000 for January. Overall, that was a decrease of 19.3% compared to January 2025, which was the all-time record high for Seattle condos at $689,975. A level we haven’t come remotely close to since. Compared to the prior month, however, the median sales price increased slightly by 0.4%.

Contributing to that was the greater number of high-valued properties that sold last January where 29 units, or 19% of the sales, were over $1,000,000. This January, only 15 units, or 10% of sales, were over $1,000,000. With the roughly the same number of units sold, the greater number of pricier units last year had adjusted the median mid-point upward compared to this year.

Separating the median selling price out between traditional condos and non-traditional condos, both property types still exhibited year-over-year decreases, though not as dramatic as the citywide figure. For traditional condos, the median selling price in January 2026 was $445,000, which represented a 12.9% year-over-year decrease. For non-traditional condos, the median selling price in January 2026 was $775,000, or a 5.8% drop from last January.

The Northwest MLS broadly defines condominiums to include traditional condo flats, as well as non-traditional property types such as townhomes, accessory dwelling units (ADUs), detached accessory dwelling units (DADUs), parking spaces, boat moorage and condoized single family houses. Single family houses are usually “condoized” when an ADU or DADU is built on the property. The original house and new ADU or DADU are set up as a 2 or 3 unit condominium.

Non-traditional properties are typically newer, larger and higher priced than the normal condo unit in a building. They represented 37.1% of all condo sales in January 2026, thus they have a significant impact on median selling prices throughout Seattle.

Listings Blossom

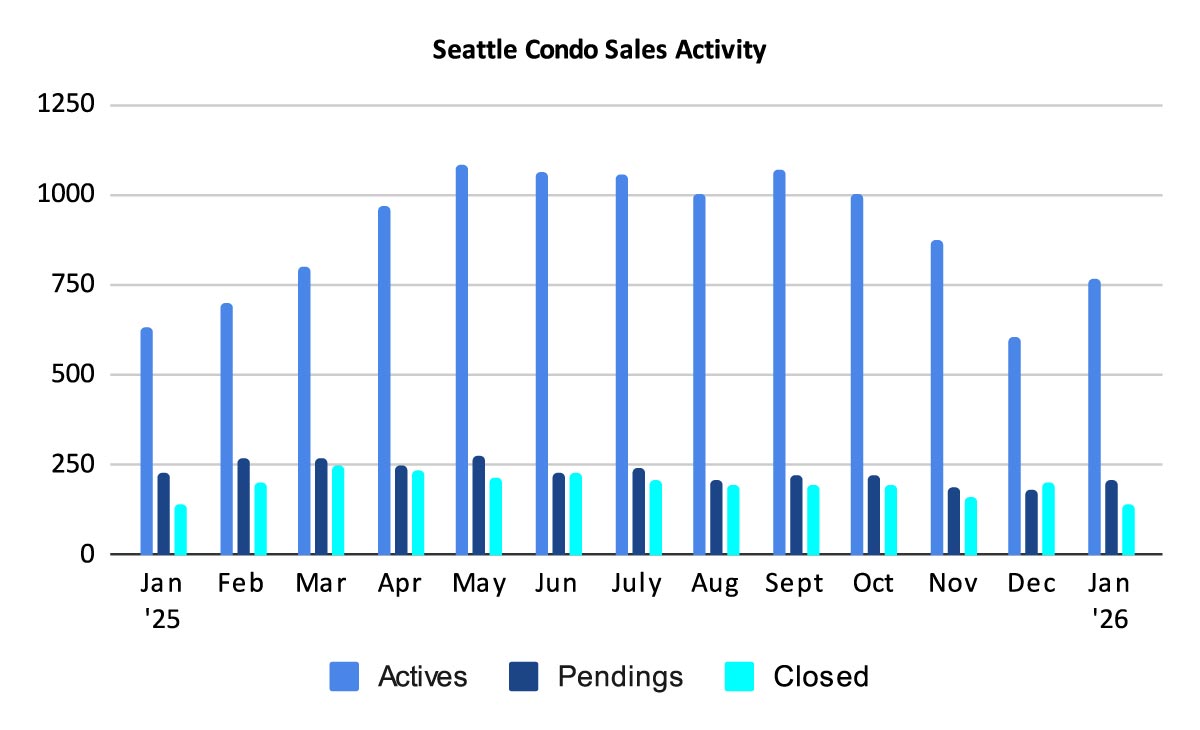

With our cyclical market place, the number of active Seattle condo listings for sale increase with the start of the new year. And, that was evident last month. We ended January with 765 units for sale in the NWMLS, a one-year and one-month increase of 21.6% and 26.7%, respectively. The actual number is a little higher as developers normally limit the number of units they list at any one time.

We started January with 604 listings and sellers added another 447 new listings throughout the month for a total of 1,051 units for sale. Of that number, 286 came off the market — these may have been units sold or in pending status, listings that expired or were cancelled, were rented out or came off the market for other reasons, leaving 765 at month end.

Also of note, there were more new listings this past January (447) compared to last January (394), a 13.5% increase. More sellers are selling so far this year.

As to composition of properties, of the current active listings as of the posting of this article, 77.1% of the listings are traditional and 22.9% are non-traditional.

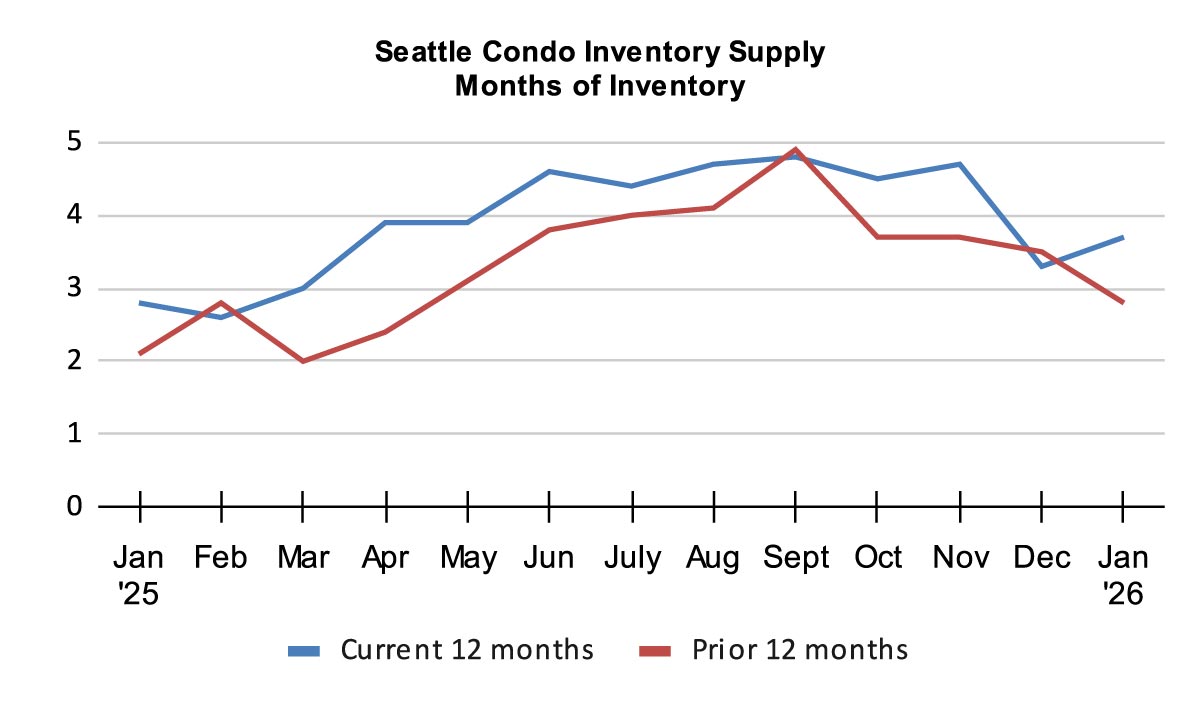

In terms of supply, the inventory supply rate rose to 3.7-months of supply in January, placing Seattle’s condo market on the cusp between a seller’s market and a balanced market environment.

The inventory supply rate is a metric utilized to categorize the current market condition. A rate of less than 4-month of supply is considered a seller’s market. A rate between 4 to 7-months is a normal or balanced market. And, a rate more than 7-months would be a buyer’s market. We use pending transactions when calculating the supply rate, though closed sales is also used.

The market condition and supply can also be expressed as an absorption rate, which was 26.8%. A rate of over 20% is considered a seller’s market, between 10-20% a balanced market and less than 10% would be a buyer’s market.

Condo Sales Lag

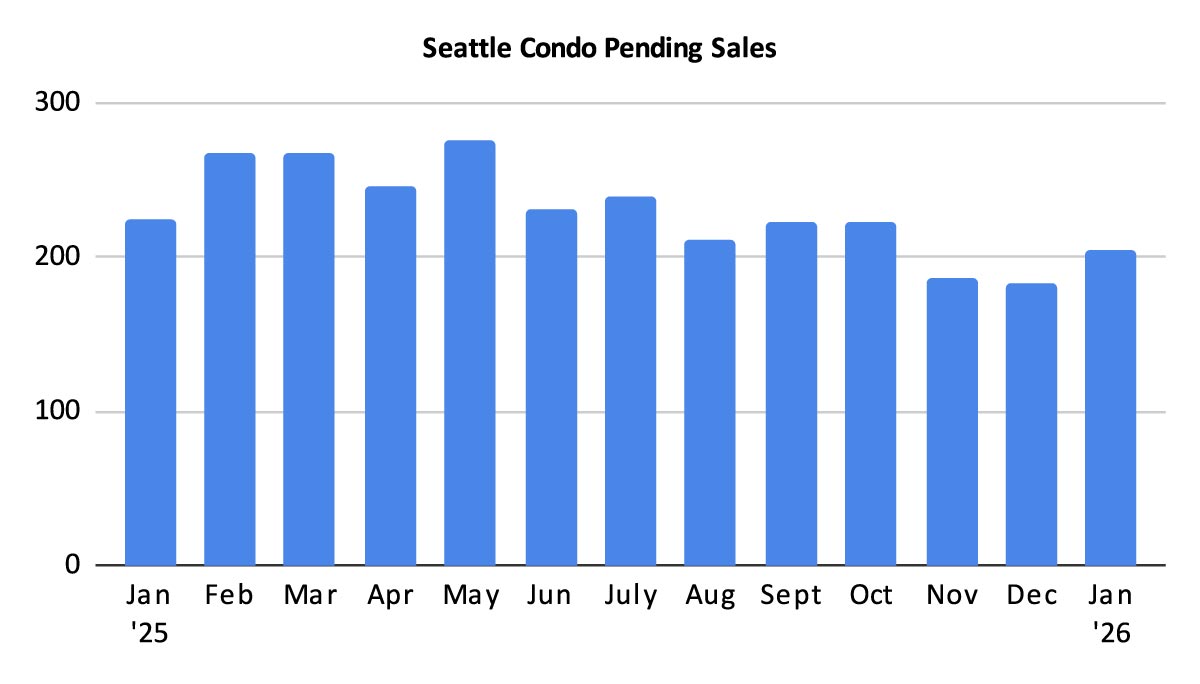

There were 205 units that went into pending status (under contract in escrow) in January. That was 12% more than in December, which is not surprising as December is the slowest month for real estate sales. Unfortunately, that reflected a year-over-year decline of 8.9% from fewer buyers purchasing this January compared to last year. Fewer buyers are buying…so far.

The Spring season is the most active for Seattle’s condo and real estate market, so we should see an improvement in condo sales over the next few months.

Favorable interest rates may help spur more activity. However, the Seattle metro area has been rocked by some unpleasant employment news recently, particularly in the technology sector. Tech employees are the cornerstone of Seattle’s condo market buyers, so there is a potential the tech sector employment instability may impact the condo market.

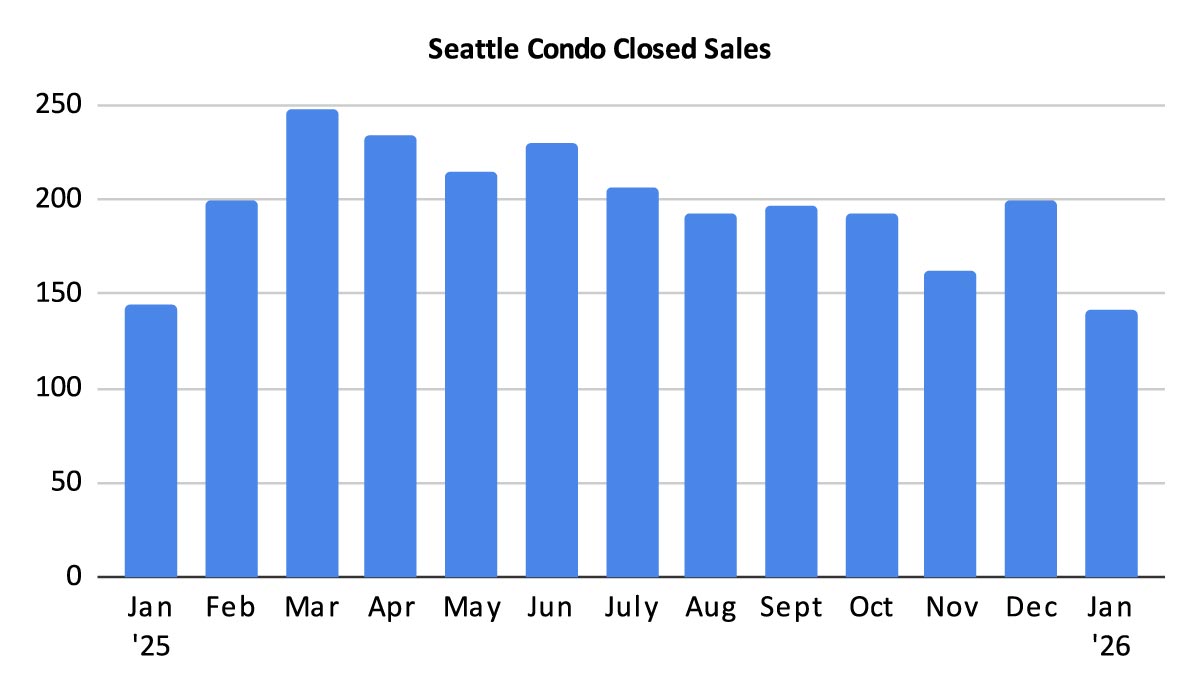

There were 142 condo closings in January, reflecting a 1.4% and 29% decrease year-over-year and month-over-month, respectively. Closings lag pendings by a month, so we should see closings rise in February given the higher number of pendings in January.

In Summary…

Seattle’s condo market started 2026 a bit wobbly with a decrease in median selling prices and unit sales compared to last January.

Seattle’s condo results are skewed by the increasing number of non-traditional condo sales that affect statistics. In January, they represented 1 in every 3 condos sold (and 1 in 4 active listings). As they are usually newer, larger and more expensive, they adjust the median selling price mid-point upwards.

Seattle’s real estate market is cyclical as the seasons change. With the holiday season behind us, and the weather warming with longer daylight, the market starts to pick up with Spring being the most active time for real estate sales.

We will soon see the number of condo listings skyrocket providing buyers more options and potentially better prices and terms. That said, however, well-priced units in desirable locales where inventory is limited, buyers could very well encounter a more competitive environment. Though, the uncertainty with the tech sector employment may damper sales.

On the other hand, for sellers taking advantage of the prime selling season, there will be a plethora of competing properties. That may place downward pressure on pricing and longer market times. Fortunately, rates remain stable and buyers are still buying.

Seattle Condo Market Statistics January 2026

Source: Northwest Multiple Listing Service. Some figures were independently compiled by Seattle Condos And Lofts and were not published by the NWMLS.

© SeattleCondosAndLofts.com