Seattle Condo Market Update – August 2020

In respects to the real estate market, Seattle has been a tale of two cities of late between single family (including townhomes) and condominiums. The single family market has been partying like 2008 never existed, while condominiums have been the wallflower.

Although, with summer wrapping up, condos are starting to make a comeback with higher median sale prices and stable sales velocity.

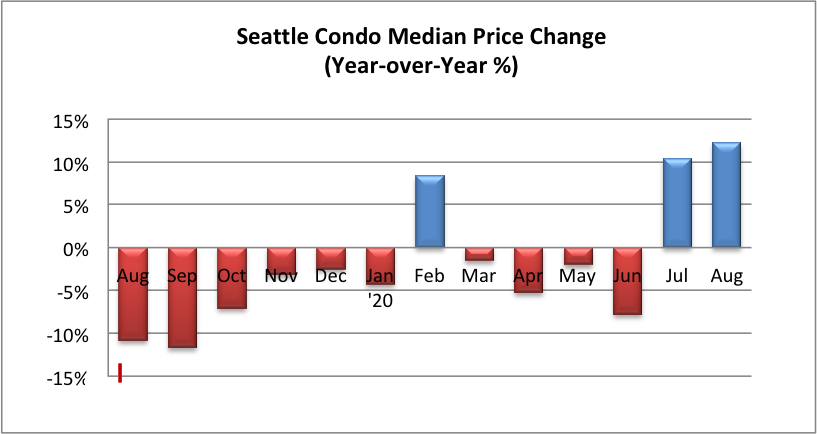

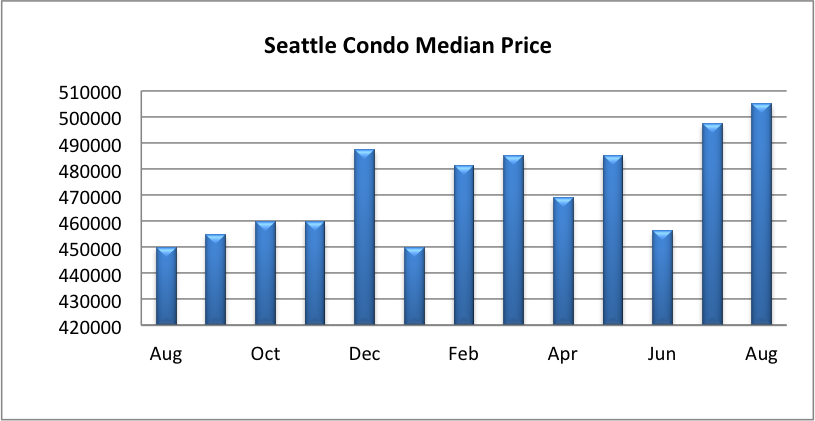

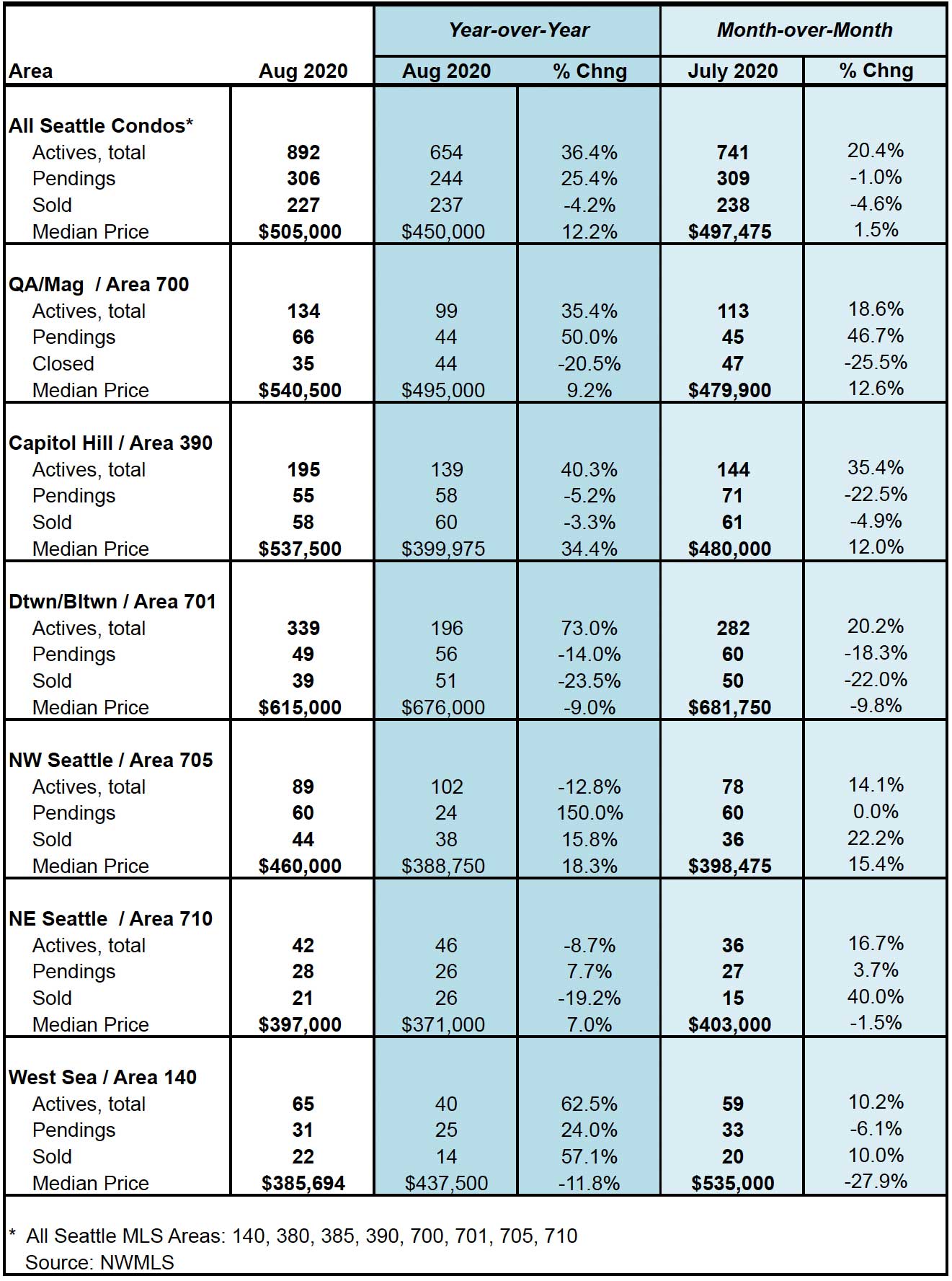

The Seattle citywide median sales price for condos rose 12.22% year-over-year, and 1.5% over the prior month, to $505,000. That’s the highest it has been in two years.

Capitol Hill / Central and Northwest Seattle lead the way with double-digit increases, while downtown and West Seattle declined year-over-year. See table at bottom for more neighborhood results.

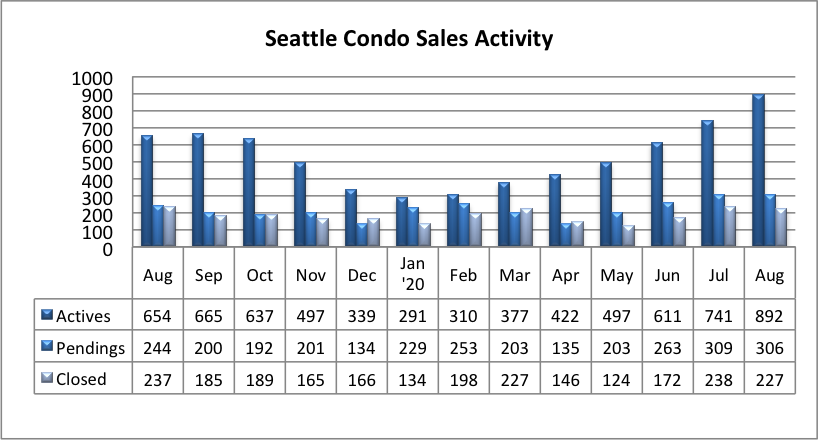

Fortunately, or unfortunately, depending on if you’re a buyer or a seller, Seattle’s condo inventory continued to rise with 892 units for sale in August. That reflected a hefty 36.4% additional condos for sale compared to a year ago and 20.4% more than the prior month. In comparison, the single family house inventory was down 8.2% year-over-year.

This number only reflected Seattle condos listed for sale in the NWMLS, which isn’t the true number the condo inventory. Seattle still has hundreds of under-construction or nearly completed condos that are available for pre-sale purchase but are not included in the NWMLS database.

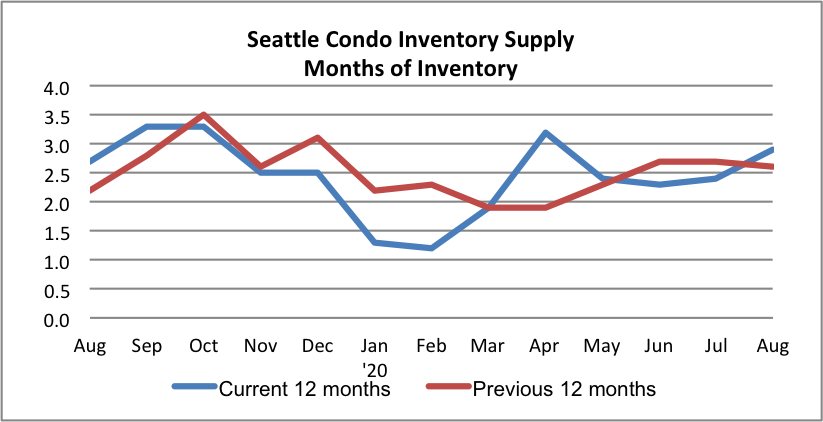

The jump in the condos listings contributed to a rise in the citywide inventory supply rate to 2.9-months of supply, placing Seattle on the cusp between a seller’s market and a balanced/normal market.

But, that’s not necessarily the complete picture since Seattle’s real estate market (and the regional in general) is comprised of micro-markets. Most Seattle neighborhoods are indicative of a still strong seller’s market with inventory supply rate hovering around 2-months of supply.

One neighborhood outlier swayed the citywide average…downtown. With a 6.9-month inventory supply rate, downtown Seattle is markedly in a buyer’s market. And, that’s just NWMLS listed inventory. The downtown market is worse off when contemplating the new condo buildings under construction.

As the downtown market slows, it’s not unforeseeable that we’ll may have a year’s worth of inventory, or more, in the near future as those buildings complete. In fact, one of the new condo buildings recently reduced their prices, and there may be more on the horizon.

Yet, if you’re looking in the Queen Anne / Magnolia or Ballard areas, the market remains in a competitive seller’s market with limited inventory and rising sale prices.

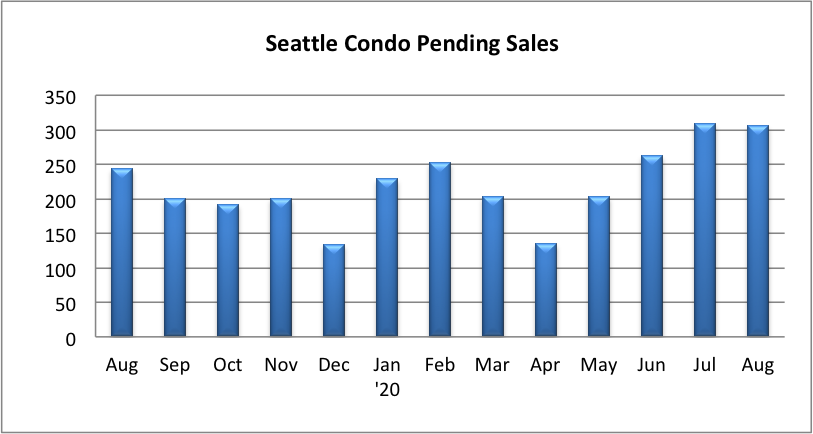

Pending sales transactions (listings with accepted offers) remained steady in August with 306 units in pending status, reflecting a one-year jump of 25.4% and slight one-month dip of 1%.

Seasonally, the end of summer marks a slow down in the region’s real estate market, so we’ll likely see the number of pendings trend downwards for the remainder of the year.

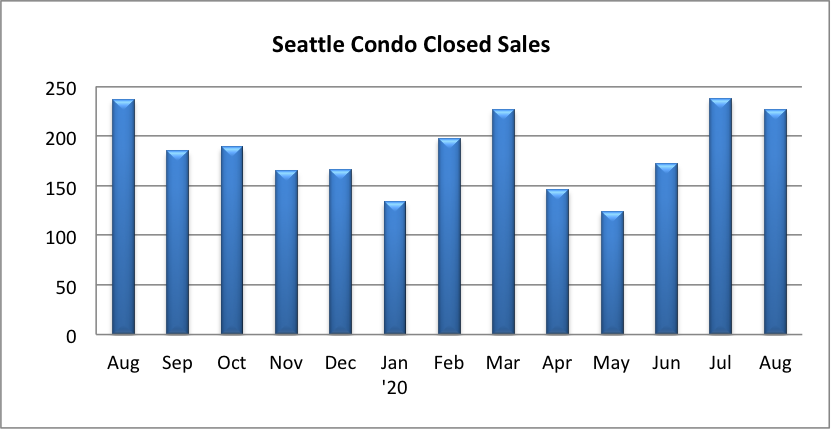

I had expected the number of August condo closings to be higher given the robust sales in July, though the stats indicate closings fell to 227 units for the month. That was 4.2% and 4.6% fewer than a year and a month ago, respectively.

Some of that might be caused by longer closing timelines as there are approximately 30 resale units pending for well over a month.

Moving into September, the market will likely continue on with similar characteristics. The heavily dense downtown condo district will exhibit further softening while surrounding neighborhoods will remain a bit tighter.

Going forward further into the autumn and fall seasons, the Seattle’s cyclical housing market will slow down overall. For buyers, that may be a good thing as competition typically reduces as do selling prices. For sellers, with the exception of downtown, you probably wouldn’t see much difference as the market remains relatively strong, otherwise.

For the core neighborhoods of downtown, Capitol Hill and Queen Anne, inventory has been rising rapidly and with upheaval with the urban tech and business centers during the pandemic, and with work-from-home options, there may be a lessening desire to live in the urban core. Additionally, the recent news of Amazon hiring 10s of thousands outside of its Seattle HQ may have had an impact on the downtown market.

Source: Northwest Multiple Listing Service. Some figures were independently compiled by SeattleCondosAndLofts.com and were not published by the NWMLS.

© SeattleCondosAndLofts.com