FHA to Reduce Annual Mortgage Insurance Premiums

Some good news coming out of Washington, DC on the homeownership front. The Federal Housing Administration (FHA) has announced a reduction to the annual mortgage insurance premiums for FHA backed mortgage loans. This is the first reduction after several increases that followed the housing bubble crash.

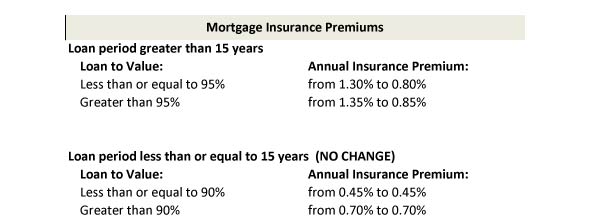

The reduction will apply to FHA loans with case numbers issued on or after January 26, 2015. For the majority of buyers, the rate will reduce from 1.35% of the loan amount to 0.85%, a pretty hefty reduction.

The upfront mortgage insurance premium, however, remains unchanged at 1.75%. For FHA backed mortgage loans, buyers pay both the upfront mortgage insurance premium at closing, plus an annual mortgage insurance premium that is spread out through monthly mortgage payments.

Changes to the FHA annual mortgage insurance premium:

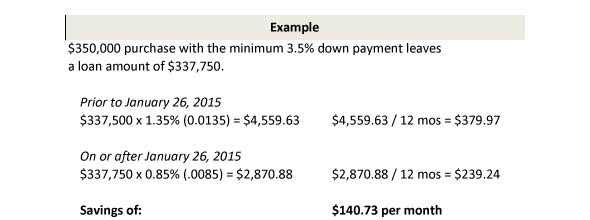

Most FHA buyers will finance a 30-year term with the minimum 3.5% down resulting in a 96.5% loan to value, thus subject to the 0.85% mortgage insurance premium rate.

That’s a significant savings.

Another way to look at it, that $140 per month could afford the buyer more purchasing power. For the same mortgage payment (based on a 5% interest rate), a buyer could purchase up to $370,000 on or after January 26, 2015 vs $350,000.

This reduction is more advantageous to single family residences or townhomes rather than for condo purchases as FHA backed mortgages are only available to approved condo buildings. Unfortunately, with FHA’s recertification process, fewer and fewer Seattle condos have maintained their FHA approval status.

Search for FHA approved condos in Seattle