August 2010 Seattle condo market update

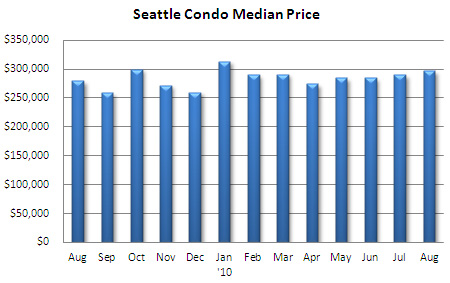

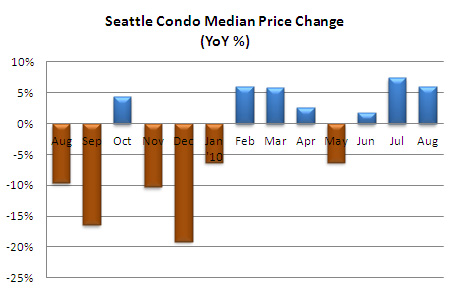

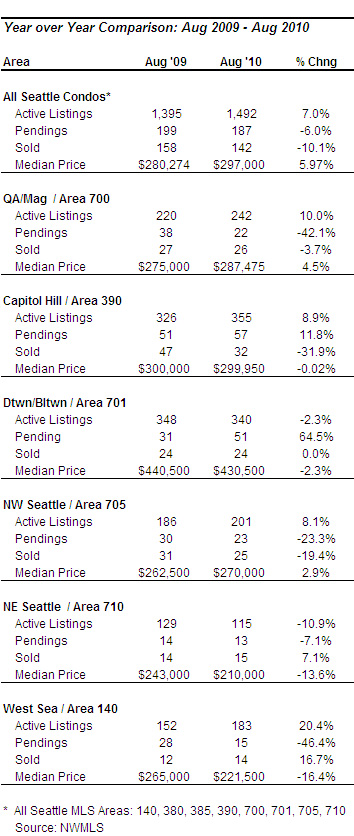

The August condo market results from the Northwest Multiple Listing Service were pleasantly surprising with the median Seattle condo value rising to $297,000; a year-over-year increase of 5.97% and a one-month increase of 2.4% over July.

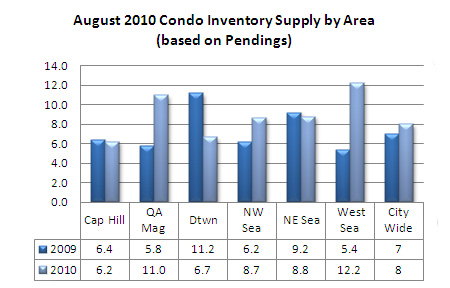

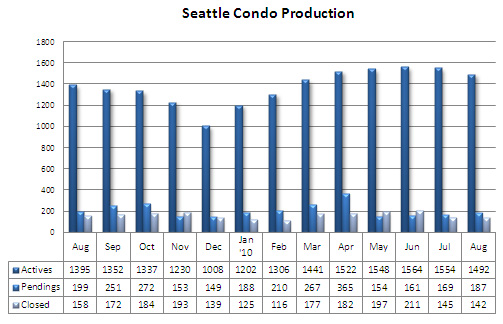

The number of available properties declined 3.9% from July to 1,492 units, though that was still 6.9% more than August of last year. So, there’s still a good number of properties available.

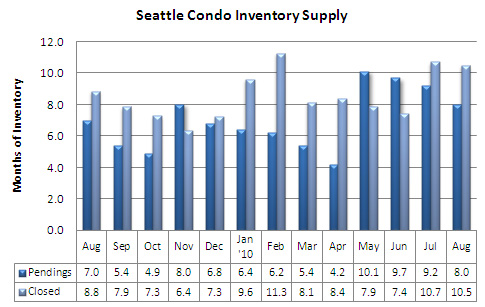

Pending transaction stats have been improving over the past several months with August’s year-over-year pending activity down just 6%, which is great when compared to the -40.8% in May, -30% in June and -20.3% in July (YOY). Further, the number of pending transactions increased 10.6% over July.

However, that trend won’t continue. For the remainder of the year, expect to see the year-over-year figures for pendings to come in well below last year’s activity level, which reflected increased sales volume resulting from rush to meet the November 2009 tax credit deadline.

The number of closed sales dropped 10% compared to last August and was down 2% from July’s closings. Like pendings, there will be fewer closed sales going forward compared to last Fall.

The inventory supply rate dropped to 8 months based on pending, which is good, yet remained at over 10 months based on closed sales. This means we’re still in a relatively stable buyers market, which we’re likely to continue in for the foreseeable future.

I see our average prices going up in New Orleans as the least popular selling condos are the beginning units. Thus moving up the prices on the average. I know however that prices have been somewhat level since 2005 for the better positioned properties.

Nice post, Ben. Your visuals make it really easy to understand the state of the market very quickly. How much are short sales & REOs impacting these numbers?

Hi Mary, short sales and REO’s (bank owned properties) have affected values and compose about 20-25% of the market. For condominiums, they’re impact is felt within individual buildings, such as Cosmopolitan and the 2200 which do have a higher than average ratio of short sales and REOs compared to the market in general. I suspect we’ll see more in the coming year, unfortunately.