Seattle Condo Market April Recap

April’s showers brought a a bit of a sluggish marketplace for Seattle’s condominium sector. The median sale prices remained stable, though sales activity dipped and the number of listings skyrocketed to Covid-era levels.

Prices Hold Steady

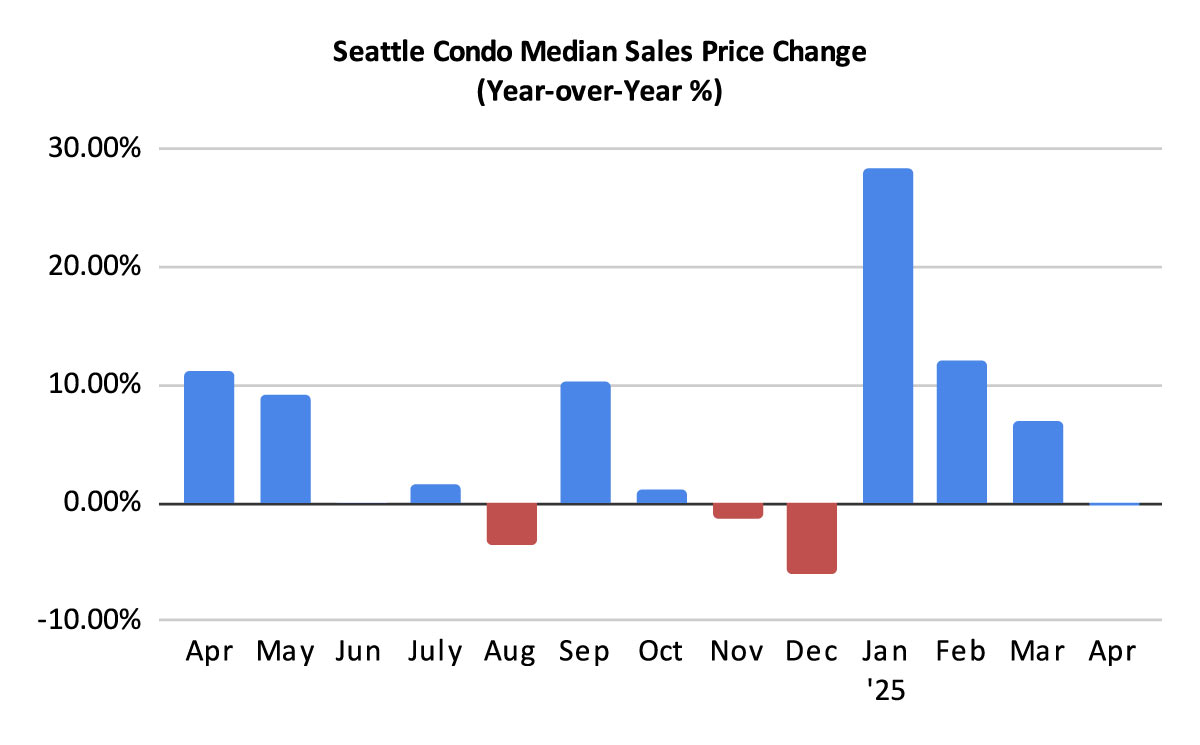

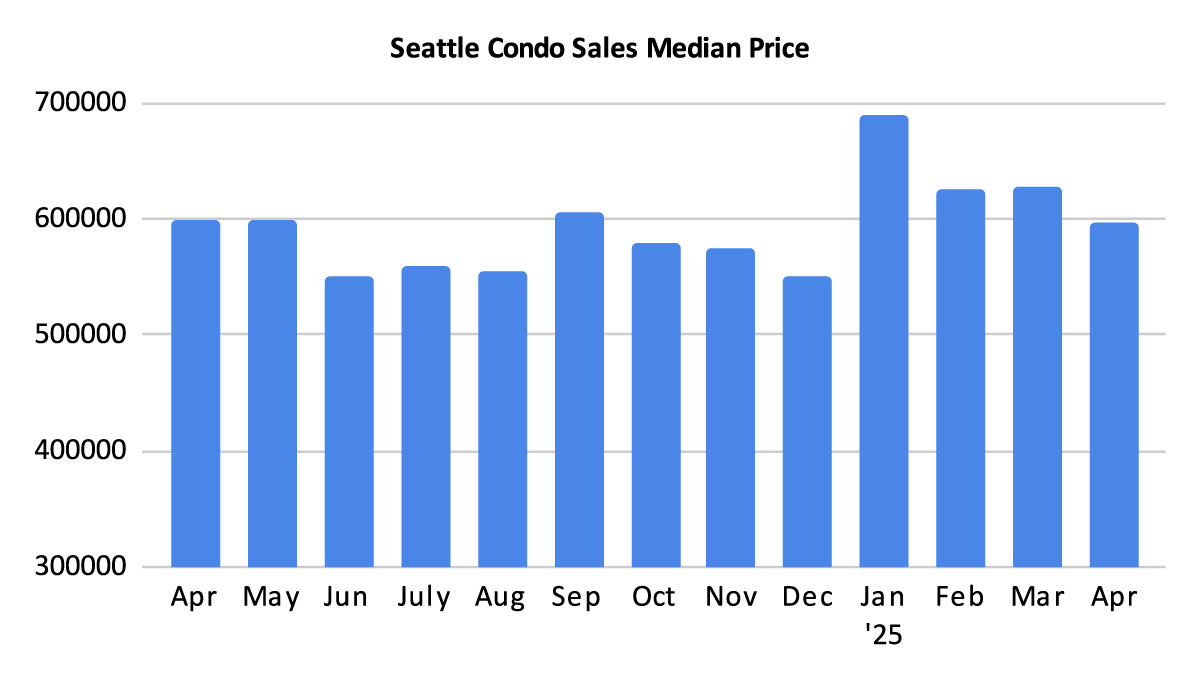

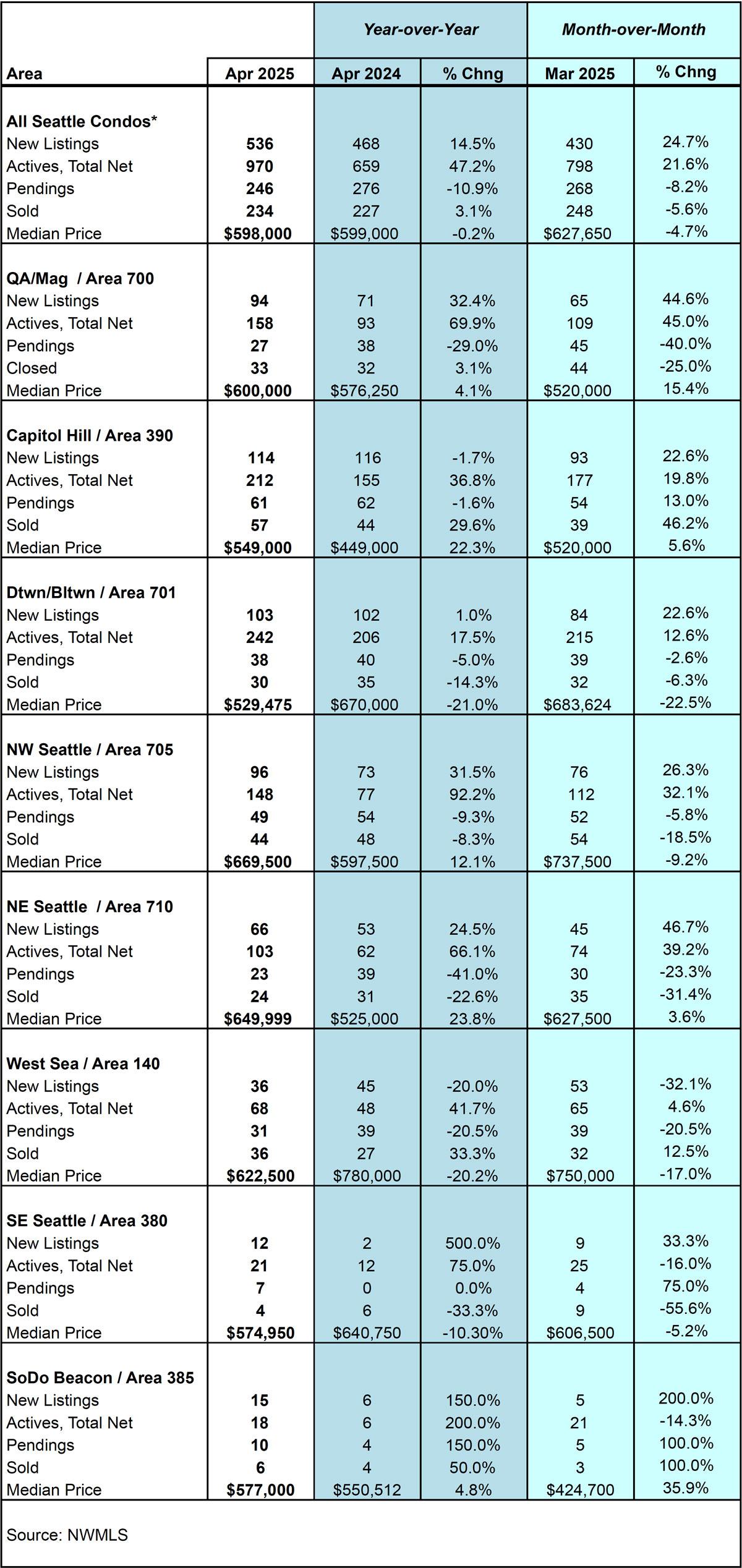

The Seattle citywide median sales price for condos held steady at $598,000 in April, a minuscule dip of 0.2% year-over-year (YOY), though 4.7% less than the prior month. Looking at NWMLS defined neighborhood areas, half the city experienced higher selling prices and the other half was depressed.

Northeast Seattle (+23.8%), Capitol Hill / Central (+22.3%), Northwest Seattle (+12.1%), South Seattle (+4.8%), Queen Anne / Magnolia (+4.1%) all experienced YOY increases to their median selling prices. On the other hand, downtown (-21%), West Seattle (-20.2%) and Southeast Seattle (-10.3%), reflected YOY declines. View full neighborhood area results here.

But, that’s based on the NWMLS published condominium statistics. The NWMLS condominium category includes a number of properties that are not traditionally thought of as condos, such as single family houses that have been condoized, townhome/rowhouses, accessory dwelling units (ADU), detached accessory dwelling units (DADU) and boat moorage slips.

These non-traditional “condos” comprised 27.4% of all condo sales recorded in the NWMLS in April, and were more expensive with a median sales price of $824,000. Excluding these, then the median sales price for traditional condo units (a single unit in a multi-unit building or complex) would have been $542,000 in April.

In fact, the Seattle citywide median sales price for traditional condos increased 8.4% YOY and 11.7% over the prior month.

The condo market was far more robust than the NWMLS’ published “condo” results.

Flood of Listings

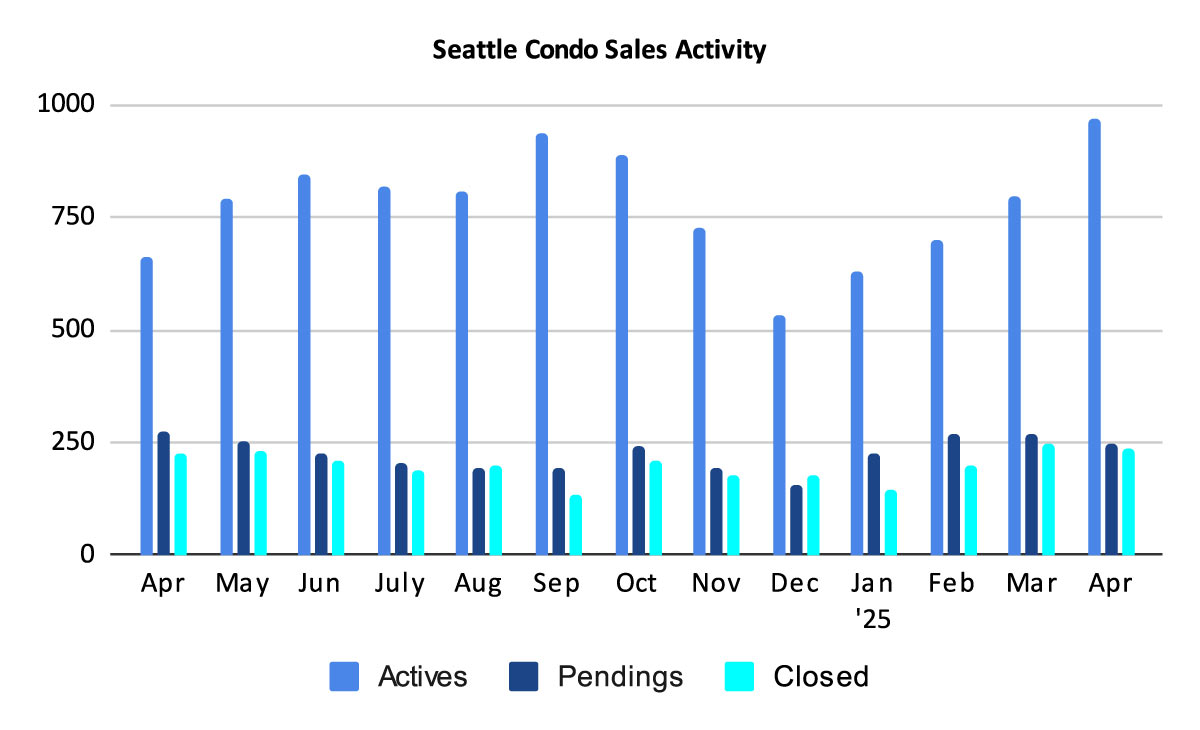

April showered the market with new condo listings with both traditional and non-traditional properties. Overall, we ended the month with 970 condo units listed in the NWMLS for sale. That’s an increase of 47.2% more than we had last April and 21.6% more than we had in March. This is the most we’ve had since September 2020.

In more detail, we started April with 798 listings and sellers added 536 new listings throughout month, for a total of 1,334 properties. From that, 364 listings came off the market for various reasons – pending/sold, being rented instead, expired or cancelled listings, or were temporarily taken off the market – leaving 970 at month end.

The 536 new listings that were added in April represented an increase of 14.5% compared to the same period last year and a 24.7% bump over March.

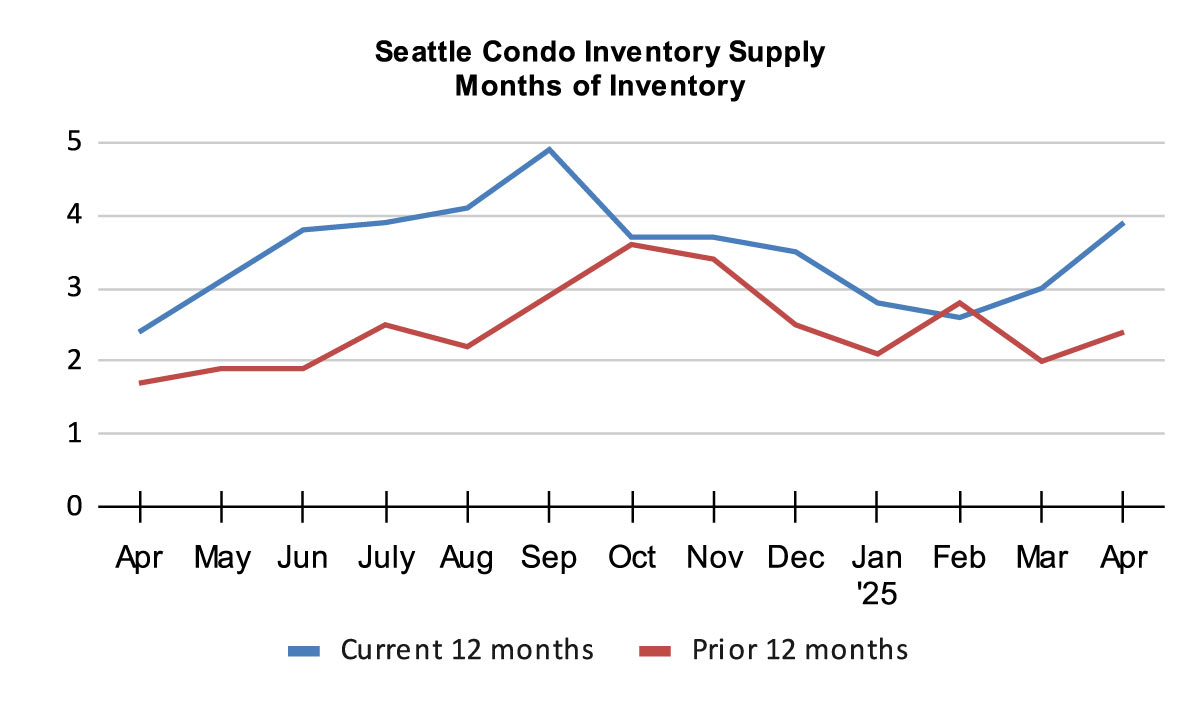

The boost in the number of listings resulted in a significant rise to the inventory supply rate to 3.9-months of supply. That moved Seattle, as a whole, on the cusp of a balanced, normal market.

The supply rate is a metric characterizing market conditions. A rate of less than 4-months of supply is classified as a seller’s market. A rate between 4 to 7-months is a balanced or normal market, while over 7-months is considered a buyer’s market. Seattle has only breached the 4-month supply threshold 3 times over the past 13 years. There’s a strong possibility we’ll see a return to a balanced market.

A Sales Slowdown

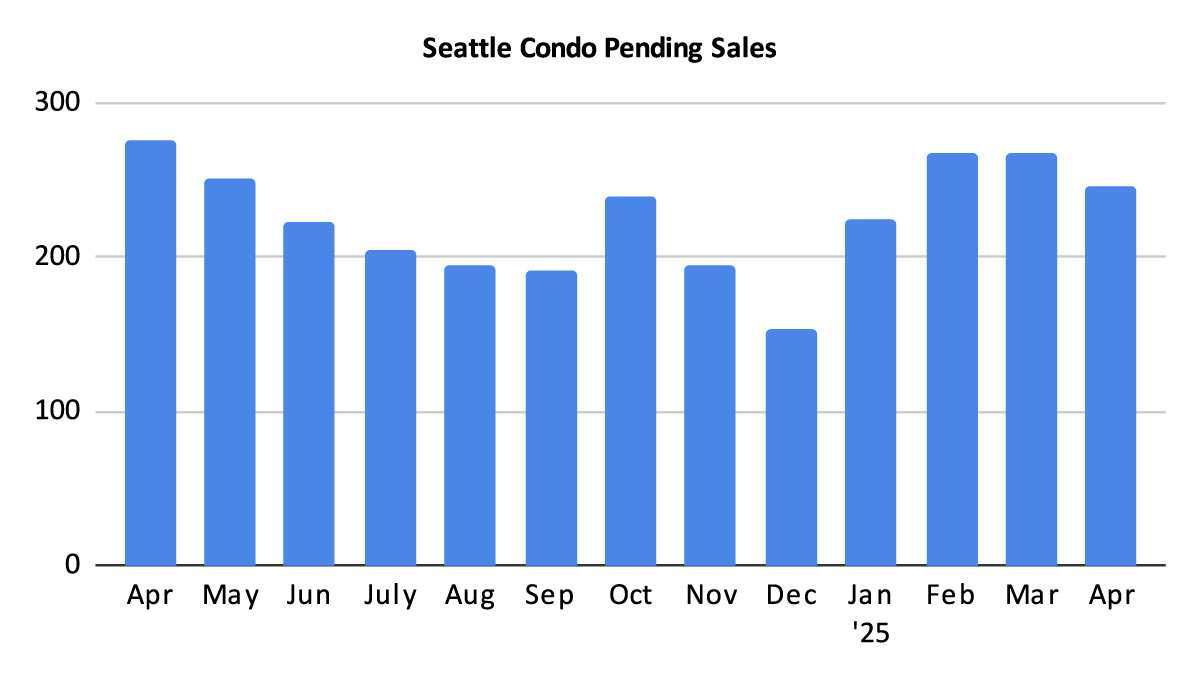

Condo sales slowed a bit in April with only 246 properties going under contract into pending status, exhibiting a one-year drop of 10.9% and a one-month dip of 8.2%.

Having hit the cyclical seasonal peak of sales activity, sales are likely to slow further. Perhaps the abundance of condo options will impact pricing that may be more favorable to buyers, which could draw them back to the market.

There were 234 condo closings in April, reflecting a year-over-year increase of 3.1%, but a one-month dip of 5.6%. Given the number pendings in April, then we expect a drop in closings for May.

In Summary…

April rained new listings onto Seattle’s condominium market, resulting in a 5-year high in the number of listings avialable for sale. Though, to be fair, a good percentage of those were non-traditional condo properties (e.g. houses, townhomes and DADUs) rather than the typical condo unit.

Contemplating all condos, citywide, Seattle’s median sales price remained steady. However, when looking at traditional condo properties, the market experienced solid selling price gains.

That said, condo sales velocity slowed, though not unexpected. Seattle’s real estate market is cyclical and follow the seasons. Spring is the housing market’s peak season, then we usually plateau during the summer before trailing off in the fall. If the cycle holds true, then we’ll see a softening of the market after summer.

Seattle Condo Market Statistics April 2025

Source: Northwest Multiple Listing Service. Some figures were independently compiled by Seattle Condos And Lofts and were not published by the NWMLS.

© SeattleCondosAndLofts.com