July 2020 – Seattle Condo Market Update

It may have taken half a year, but Seattle’s placid condominium market finally got a boost in July. After months of sluggishness, condo sales and inventory supply improved substantially.

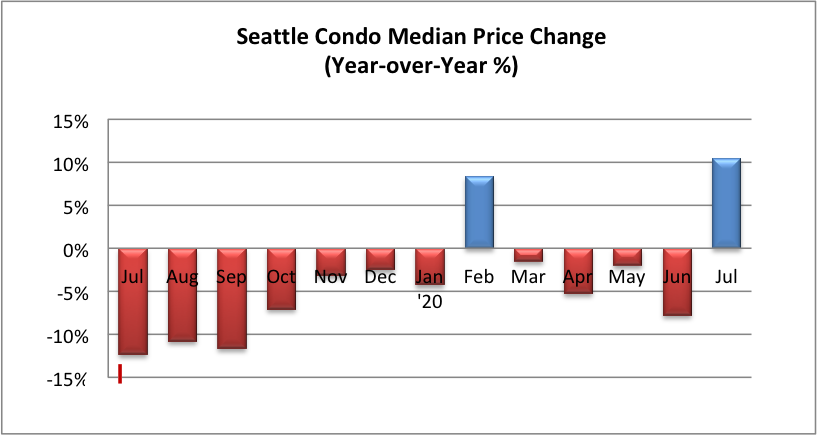

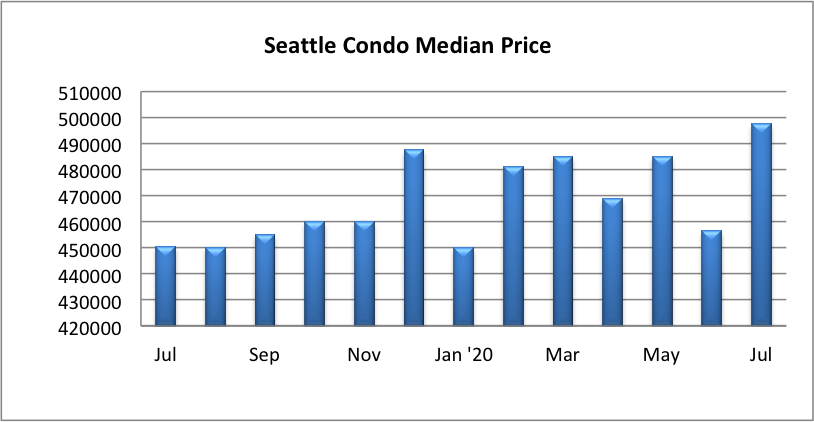

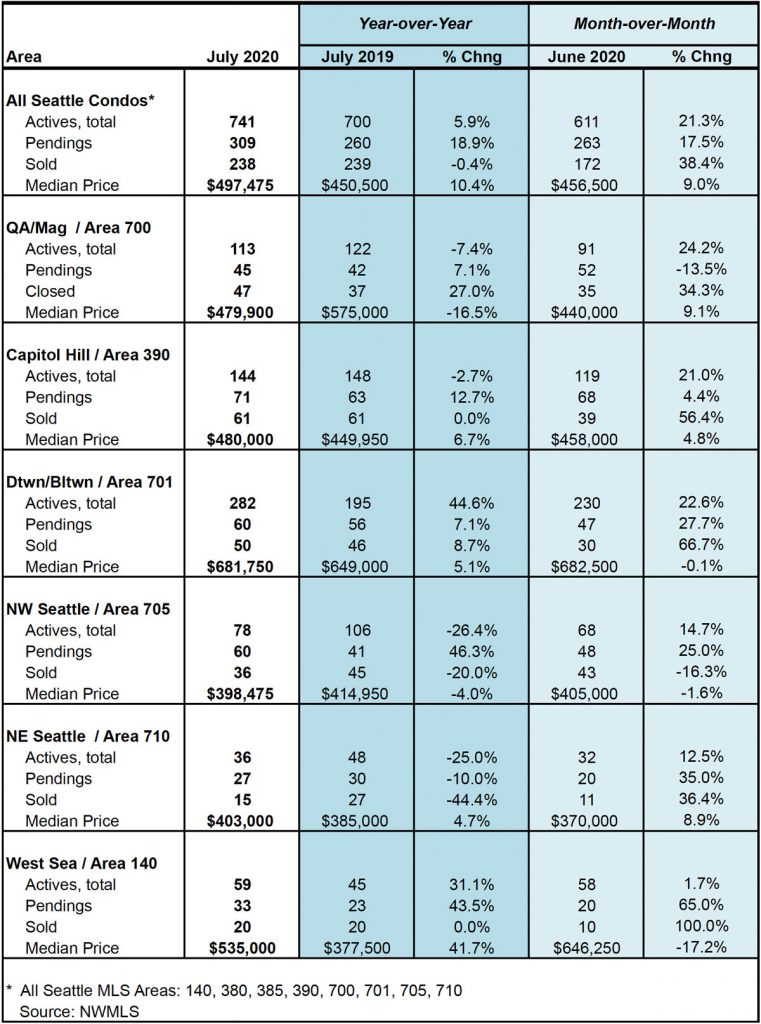

The Seattle citywide condo median sales price rose 10.43% year-over-year to $497,475, reflecting a 19-month high. That’s also 9% greater than a month ago.

By MLS neighborhood areas – downtown/Belltown, Capitol Hill, West Seattle (Alki) and Northeast Seattle realized higher median sale prices compared to last July, while Queen Anne and Northwest Seattle areas experienced a decline in their condo sale prices. See table at bottom of post for full details.

If you listened to news reports and real estate articles you’re sure to have heard that Seattle has been in a phenomenally tight seller’s market with low inventory and multiple offer bidding wars.

For single family homes and townhomes, that’s true. Anecdotally, my non-condo home buyers experienced competing with upwards of 25+ offers that escalated prices more than 30% over the list prices.

For condos buyers and sellers, it’s been opposite. Sales have been slower, particularly in the downtown core where the majority of condos are located. Listings remain on the market longer and currently 35% of all active condo listings in Seattle have taken a price reduction.

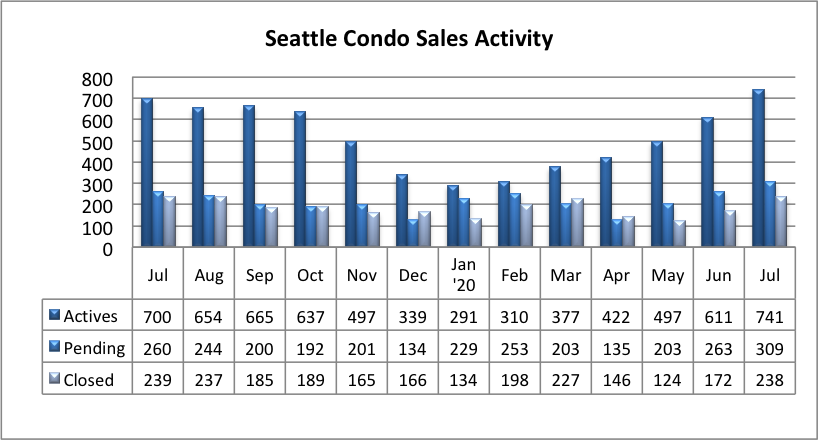

Plus, inventory has steadily risen all year. In July there were 741 Seattle condo listings for sale, which was 5.9% more than the same period last year and 21.3% more than last month. For some perspective, that’s the most listings we’ve had in a single month since November 2011.

And, that’s just the NWMLS listed condo inventory. There are thousands more presently under construction, though not available for immediate purchase.

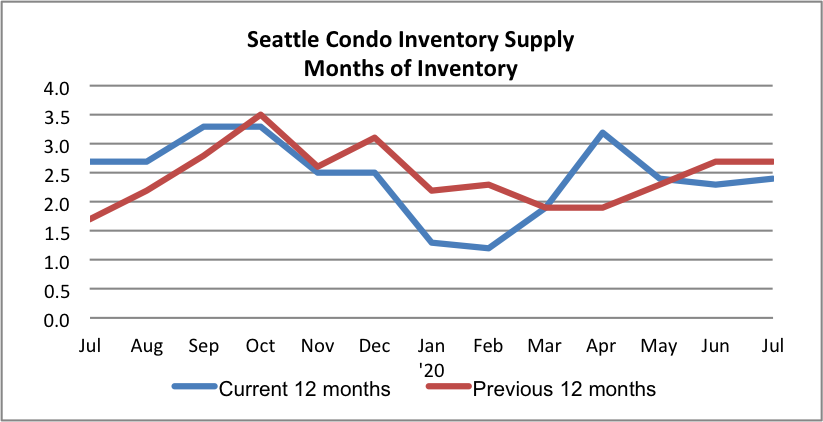

Fortunately, at least for sellers, the inventory supply rate remained unchanged at 2.3-months of supply buoyed by strong sales activity in July.

The months-of-inventory supply rate is an indicator of market status. A rate of less than 3 months is a seller’s market, which Seattle has essentially been in since the condo market bottomed out in February 2012. A supply rate of 3 – 6 months is classified as a normal / balanced market, while more than 6 months would be a buyer’s market.

Pending sales transactions (listings with accepted offers in escrow) continued to rise in July to 309 units, reflecting an improvement of 18.9% year-over-year and 17.5% over the prior month, respectively.

The historic low mortgage interest rates, more unit choices and price corrections have been a boon for condo buyers who are able to take advantage of the current market conditions. Pending sales have been climbing since spring.

With boosted pending sales, the number of closed condo sales also rose to 238 units in July, reflecting a one-month increase of 38.4% over June. Though, the number of closed transactions were on par with last July.

However, since closings lag pendings by a month, we’ll see another significant number of closings in August.

Given how much Seattle’s condo market has underperformed throughout 2020, July was a welcomed respite with higher sale prices, stronger sales velocity and increased inventory.

Both buyers and sellers are benefiting with our current market environment. Sellers are experiencing greater sales volume, while buyers have more choices with pricing stability from a less competitive market.

We’ll likely experience another month or two of similar market characteristics. Then, as is typical of second half of the year, the Seattle market is underscored with downward trend of fewer sales and lower selling prices.

Should inventory continue to rise as it has been throughout the year, then it’s not unrealistic that we may turn the corner towards a balanced market place later this year.

Source: Northwest Multiple Listing Service. Some figures were independently compiled by SeattleCondosAndLofts.com and were not published by the NWMLS.

© SeattleCondosAndLofts.com