2nd Qtr and 1st Half 2009 market stats

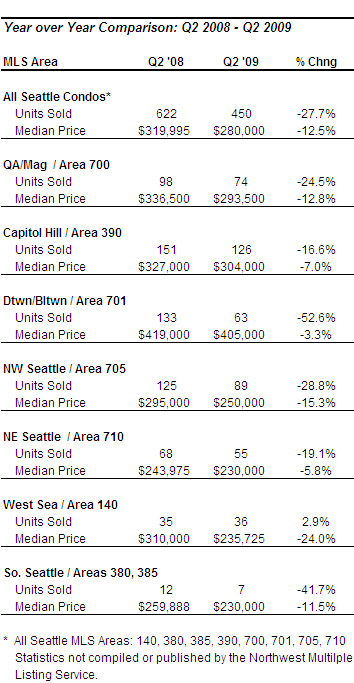

Second Quarter 2009:

The second quarter 2009 market stats exhibited the sluggishness of Seattle’s condo marketplace. The median citywide condo price declined 12.5% from the same period last year to $280,000 while the number of units sold decreased 27.7%. Compared to first quarter 2009, the median price slipped 2.6% though the number of units sold increased 47.1%, partly due to seasonal changes as well as first-time buyer incentives. The best performing market area was Downtown / Belltown which realized the smallest median price decline of 3.3%. West Seattle saw the largest decline of 24%.

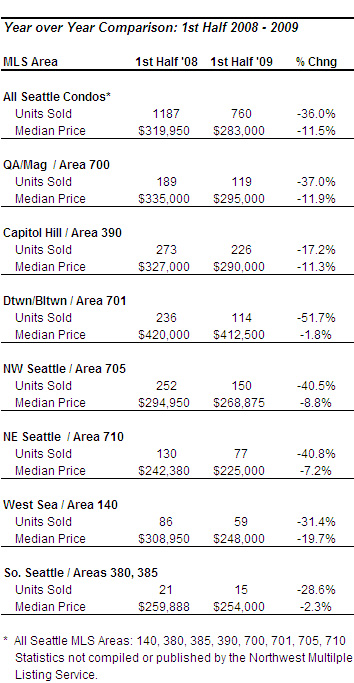

First Half 2009:

The first half 2009 results were not terrible different from the second quarter results with year-over-year citywide median price declining 11.5% to $283,000. Though, the number of units sold decreased 36% compared to the first half of 2008. Similar to second quarter 2009, Downtown / Belltown had the best median price performance, declining just 1.8%, while West Seattle had the largest decline of 19.7% compared to the same period last year.

Ok I know that there is still tons of bad news out there and plenty of reasons to believe it but here are a few things that MIGHT indicate that the real estate market is starting to firm up in Phoenix.

1. A mortgage lender friend of mine says that April will be his best month since 2005.

2. I wrote purchase contracts on two different properties today and received offers on two different listings this weekend. This constitutes the busiest weekend I have had in four years. One of the offers I received was for full price.

3. My wife, an escrow officer, says that April will be her busiest month since 2005. About 50% of the transactions are refinancing of existing mortgages and 50% purchase contracts. Yes, most of the contracts are of lower priced foreclosures but its still promising to see that so many people believe prices now “make sense”.

4. We have received more buyer leads over the last two weeks than we have in four years.

5. We are finding properties priced low enough that one can easily enjoy positive cash flow if they buy and then rent the property out.

I’m not saying that we can now declare that the bust is over and full steam ahead but if things keep going in this direction we very well may be seeing the beginning of a recovery.

“4. We have received more buyer leads over the last two weeks than we have in four years.”

This is consistent with what a number of my colleagues in the States have had to report. Looks like the signs are encouraging over there.