Mortgage

Sale concessions can lead to higher down payment

When negotiating sales concessions on a purchase, be aware that it can affect the down payment amount.

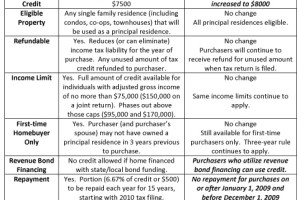

Revised first-time homebuyer tax credit

The $787 billion American Recovery and Reinvestment Act of 2009 revises the first-time homebuyers tax credit.

Condo investors…an endangered species?

New mortgage fees and restrictions may hinder investment condo opportunities.

New mortgage fee for condo purchases

Condo loans may get a little more expensive with a new Fannie Mae fee that’ll go into effect as of April 1st.

Newly constructed FHA approved condos

A number of new condo developments have obtained FHA approval. With FHA approval, buyers can more easily obtain FHA financing for their purchase which provides a low down payment option, more lenient guidelines and higher financial ratios.

Presale Lending

When purchasing a home, whether it’s a presale condo or a resale single-family house, you should be pre-approved for a mortgage. The pre-approval lets the seller or builder know that the buyer can afford the amount and complete the transaction. It will strengthen your offer. For many presale purchases, it’s often a requirement that buyers…