Tag: First Time Home Buyers Tax Credit

Home Buyers Tax Credit: Extended, Expanded

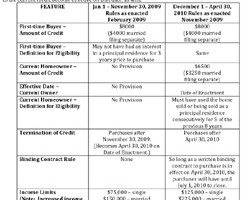

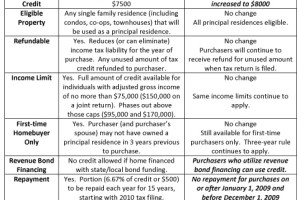

The $8,000 first-time home buyer tax credit has been extend through April 30, 2010; a $6,500 credit is now available to existing home buyers who “move-up”.

HUD approves monetizing the $8,000 tax credit

HUD just approved the monetization of the $8,000 first-time home buyers tax credit on FHA loans, making it available to buyers at the time of purchase. Though, a few caveats apply.

Revised first-time homebuyer tax credit

The $787 billion American Recovery and Reinvestment Act of 2009 revises the first-time homebuyers tax credit.