June 2013 Seattle Condo Market Update – Sizzling Summer Sales

The condo market in Seattle maintained its robust pace in June with another month of solid sales activity and increased prices.

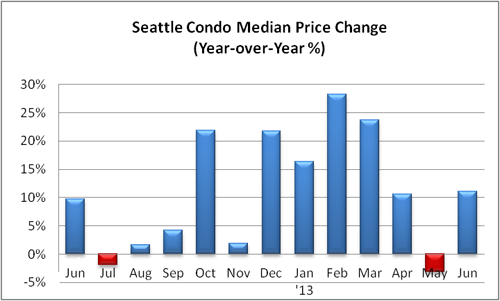

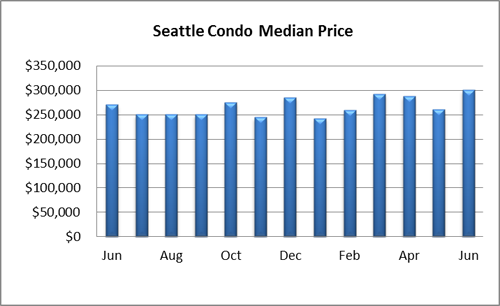

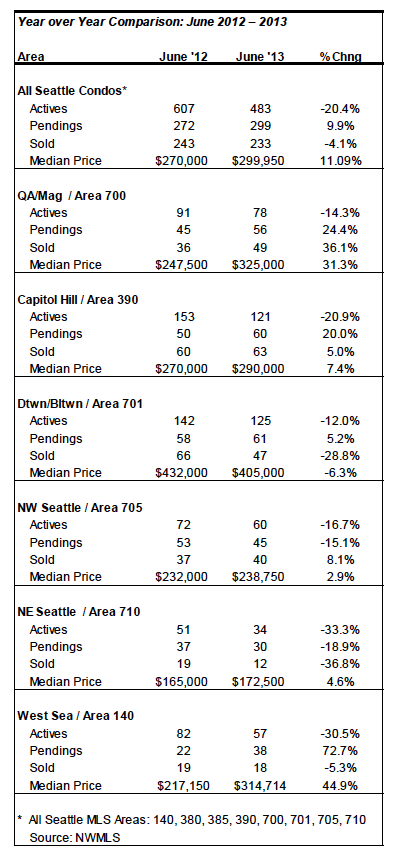

The citywide median sales price rose to its highest level over the past 29-months to $299,950. That’s a 11.09% increase over last year and a 15.4% one-month improvement. Aside from the downtown area, condo sale prices rose throughout the city with the Queen Anne / Magnolia and West Seattle neighborhoods reflecting double digit year-over-year increases (see chart at bottom).

While the NWMLS numbers for downtown, in general, reflected a dip of 6.3% in the median sales price, that is due to fewer higher valued sales (new construction inventory being sold out) rather and a drop in value. For instance, there were 24 sales over $500,000 including 7 properties valued over $1 million in June 2012 compared to only 13 units over $500,000 with just one $1 million+ sale last month, shifting the median point downward.

Excluding new construction sales from downtown (Area 701), the median price for resales reflected an increase of 14.8% ($337,500 in June 2012 vs $387,500 in June 2013).

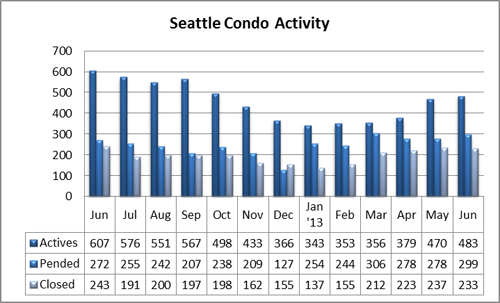

The number of available Seattle condos for sale rose slightly from May to 483 units, yet that is still 20.4% fewer listings from a year ago. Typically, we should see listings plateau and start to decline as we progress through the summer months.

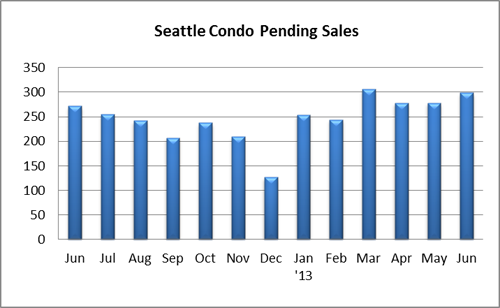

Condo sales increased last month with pending transactions (properties going under contract) up 9.9% from the same period last year and 7.6% from May to 299 units. It was the second highest month of sales over the past 13-month period.

The number of closed Seattle condo sales fell in June to 233 units, down 4.1% from last June and 1.7% from the prior month. As closings trail pendings by about a month (typical closing time frame) it was not unexpected that the number closing dropped considering that pendings were lower last month, and cyclically, sales reduce through the latter half of the year.

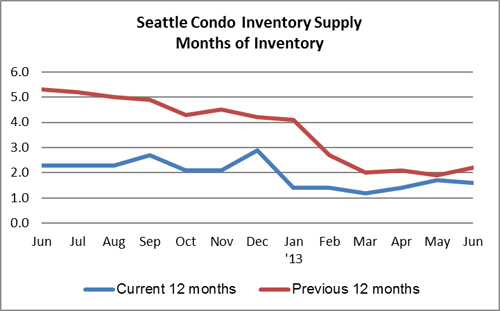

The improvement in the number of pending sale transactions resulted in a slight dip to the inventory supply rate to 1.6-months of supply. A supply rate of less than 3-months is indicative of a seller’s market.

Going forward, we will likely continue with the current market environment for some time. While, typically, sales activity slows during the second half of the year, buyer demand remains high and inventory is not likely to change much as the pipeline remains dry. The only condo development is still a few years out from completion, and I’m doubtful we’ll see apartment-to-condo conversions anytime soon considering Seattle’s strong rental market.

Source: NWMLS. Some figures were independently compiled by SeattleCondosAndLofts.com and were not published by the Northwest Multiple Listing Service.

__________________________

© Seattle Condos And Lofts